TL;DR

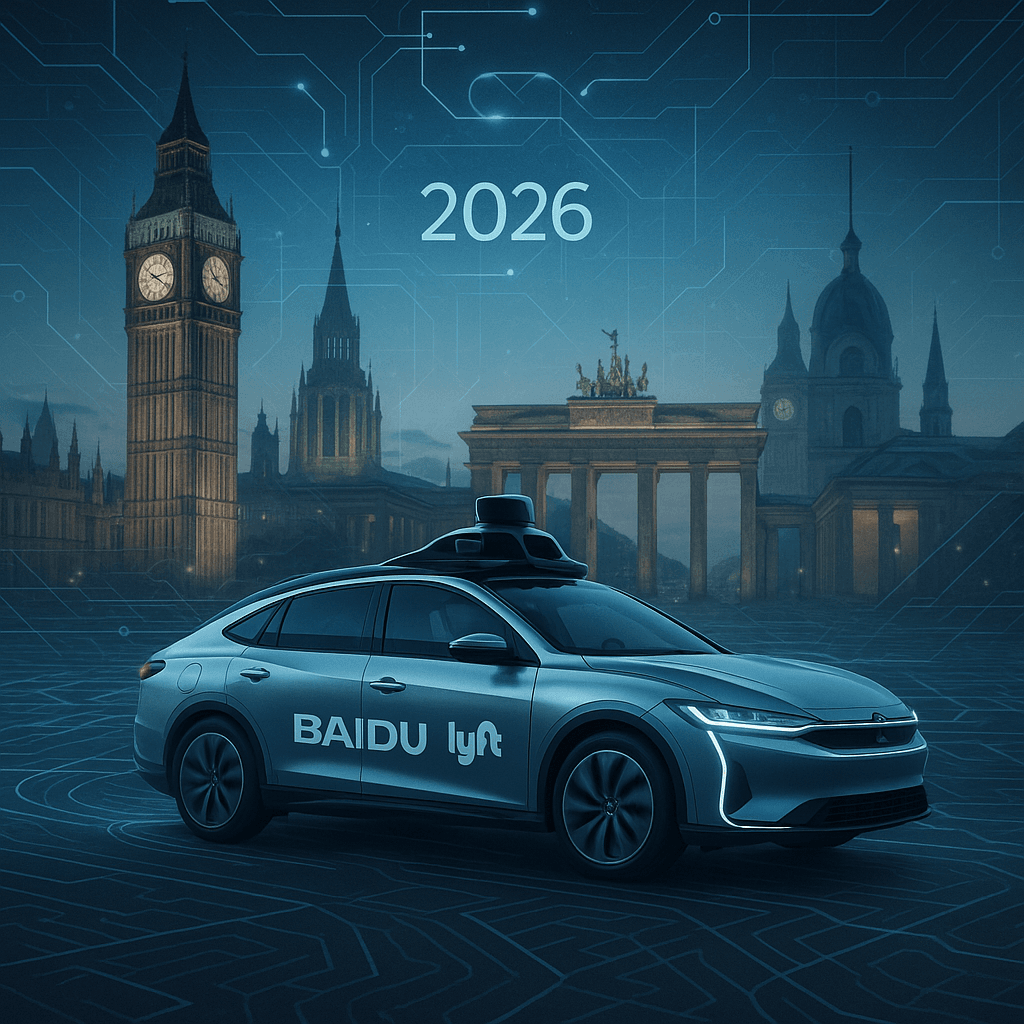

- - Baidu's robotaxis entering Europe via Lyft in 2026

- - Regulatory hurdles remain; potential thousands of vehicles in UK and Germany

- - Integration of AI technologies transforming ride-hailing landscape

- - Strategic move could drive high global market penetration

Did you know that Baidu, China's tech titan, is set to redefine European ride-hailing with its autonomous robotaxis starting in 2026? As the landscape transforms globally, European markets brace for cutting-edge AI integration amid a tech renaissance. This expansion with Lyft symbolizes a bold stride into international markets, unlocking new opportunities and fiercely competing with local players like Uber.

Opening Analysis

Baidu is gearing up to deploy its autonomous robotaxi service in Europe in collaboration with Lyft by 2026. This move is not just a technological feat but a strategic maneuver in an increasingly competitive global ride-hailing market. The collaboration represents a significant shift as Baidu transitions from dominating the Chinese market to challenging giants overseas, expanding its influence with Lyft's newly acquired European subsidiary FreeNow.

Market Dynamics

The current landscape is rife with new opportunities and heightened competition. Lyft's recent acquisition of FreeNow, a major ride-hailing player across Europe, provides Baidu with an established network to roll out its services. As Uber eyes the autonomous vehicle space fervently, Baidu's timely market entry positions it as a formidable foe. European regulatory environments, still evolving to accommodate autonomous vehicles, present obstacles, yet establish Baidu's commitment to navigating these challenges.

Technical Innovation

Baidu's advanced AI and autonomous driving technologies are set to transform the ride-hailing industry in Europe. Their Apollo Go technology, previously tested on Chinese roads, provides a proven foundation for their expansion. This technical capability sets them apart, showcasing potential enhancements in efficiency and safety, crucial selling points for stakeholders and consumers alike.

Financial Analysis

While figures specific to this venture remain undisclosed, Baidu and Lyft’s joint venture suggests a substantial upfront investment with long-term returns anticipated from the European expansion. Lyft’s recent $200 million investment in FreeNow reflects confidence in regional growth, offering a robust launchpad for Baidu’s services. As consumer demand for autonomous options strengthens, revenue streams could widen significantly.