TL;DR:

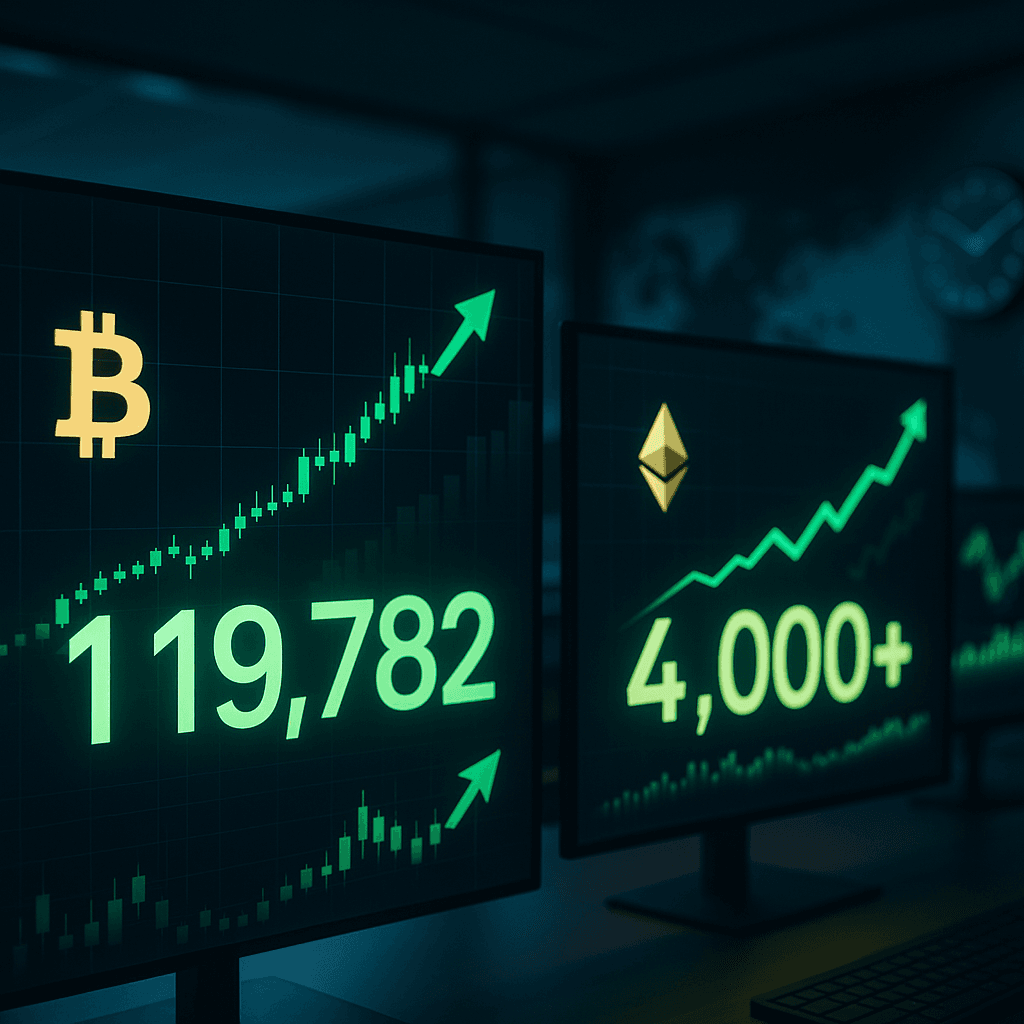

• Bitcoin hits $119,782, approaching record highs on overnight Asian buying

• Ethereum breaks $4,000 barrier, reaching levels not seen since December 2021

• Crypto stocks surge: Coinbase up 3%, miners rallying 3%+

• ETF inflows favor Ethereum over Bitcoin for first time in weeks

Cryptocurrency markets are surging overnight, with Bitcoin climbing to $119,782—just stones throw from its all-time high—while Ethereum smashed through the psychologically crucial $4,000 level for the first time since December 2021. The rally is sending crypto-related stocks soaring in premarket trading.

Bitcoin just delivered the kind of overnight surge that reminds everyone why crypto never sleeps. The world's largest cryptocurrency rocketed to $119,782 according to Coin Metrics, putting it tantalizingly close to setting new all-time records. But the real story might be Ethereum, which bulldozed through the $4,000 level that's tormented traders for years, hitting $4,181 before pulling back slightly.

The moves are already reverberating through traditional markets. Coinbase shares jumped over 3% in premarket trading, while Galaxy Digital climbed 3% alongside it. Bitcoin proxy MicroStrategy advanced more than 2%, and the mining sector went into full rally mode—Marathon Holdings, Riot Platforms, and Iris Energy all gained over 3%.

The catalyst appears to be Asian trading sessions, where buyers have been aggressively accumulating amid what Markus Thielen, CEO of 10x Research, calls "the fastest U.S. debt expansion in history." He points to a telling correlation: Bitcoin's breakout from its July consolidation pattern coincided almost exactly with President Trump's signing of the Big Beautiful Bill, which included a staggering $5 trillion debt ceiling increase.

"Bitcoin's breakout isn't random, it's being fueled by the fastest U.S. debt expansion in history and that momentum isn't slowing down," Thielen told . "Whether the economy stays strong or dips into recession, the flood of new debt is a tailwind for hard assets like bitcoin and gold."