TL;DR:

• CoreWeave beats Q2 revenue estimates by $130M with $1.21B vs $1.08B expected

• Revenue tripled 206% year-over-year but operating margin collapsed from 20% to 2%

• Expanded OpenAI partnership and added Goldman Sachs, Morgan Stanley as customers

• Raised 2025 guidance to $5.15-5.35B, implying 174% growth rate

CoreWeave shares tumbled 11% in after-hours trading Tuesday despite the AI infrastructure provider delivering blockbuster Q2 results that crushed Wall Street expectations. The company's revenue more than tripled to $1.21 billion, beating estimates by $130 million, while expanding its crucial partnership with OpenAI and landing Goldman Sachs and Morgan Stanley as new customers.

CoreWeave just delivered the kind of explosive growth that defines the AI infrastructure gold rush, yet investors sent shares plummeting 11% after hours. The paradox illuminates the complex dynamics tearing through the AI chip rental market, where demand outstrips supply but margins are getting crushed by competition and costs.

The New Jersey-based company's revenue more than tripled to $1.21 billion, obliterating Wall Street's $1.08 billion estimate. But the victory dance was short-lived as investors zeroed in on a troubling trend: operating margins collapsed from 20% a year ago to just 2%, primarily due to $145 million in stock-based compensation costs that signal aggressive talent acquisition in the red-hot AI space.

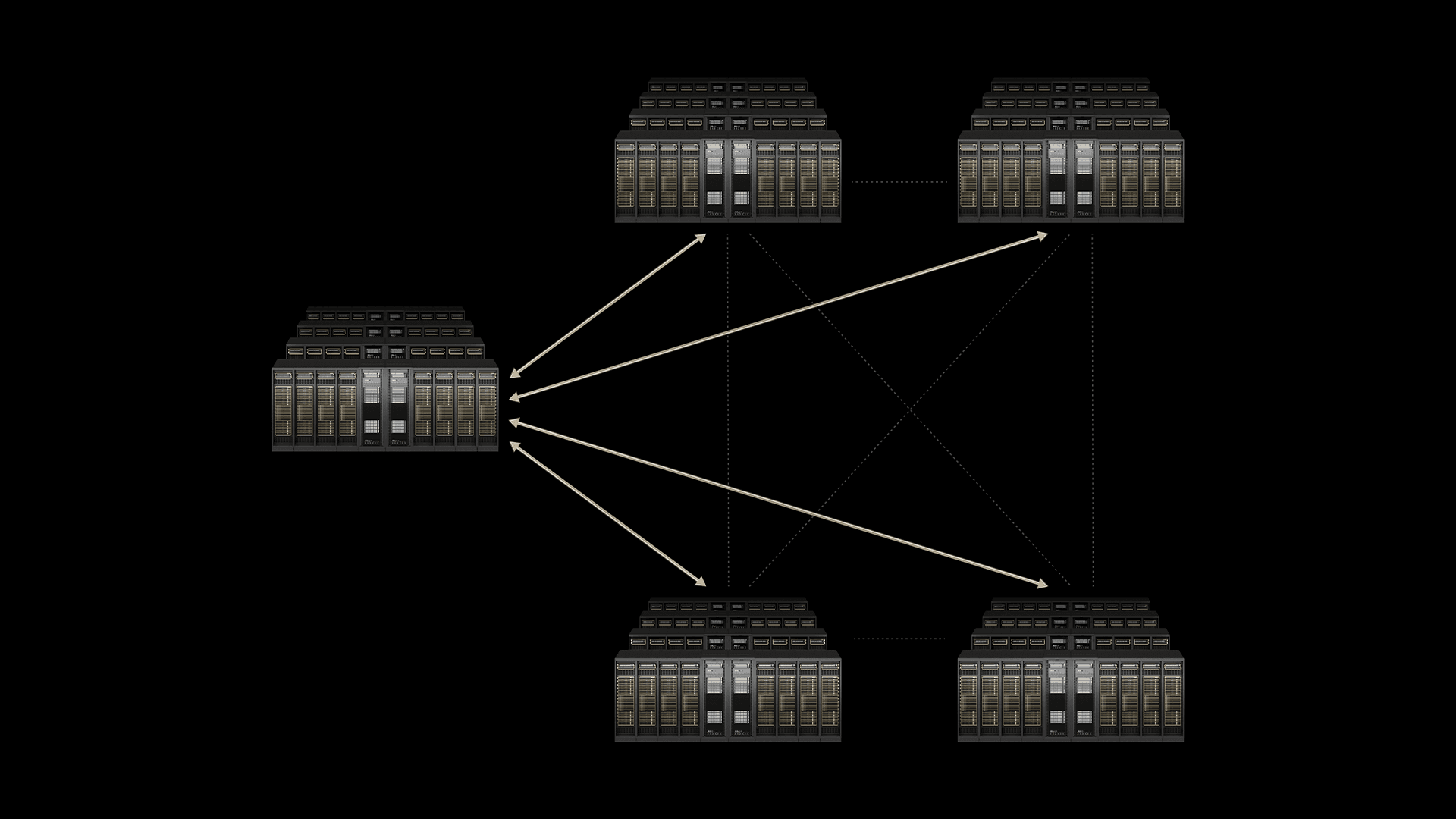

"Revenue growth continues to be capacity constrained, with demand outstripping supply," CFO Nitin Agrawal told analysts during Tuesday's earnings call, according to CNBC's coverage. The admission reveals both the opportunity and the operational nightmare facing CoreWeave as it races to build data centers fast enough to meet surging demand for Nvidia chips.

The quarter's biggest strategic win came from deeper integration with OpenAI, already a major client and investor. CEO Mike Intrator disclosed an expansion of the partnership without providing specifics, but the timing coincides with OpenAI's own infrastructure buildout for its next-generation models. The relationship gives CoreWeave a front-row seat to the AI arms race while providing crucial revenue stability.

Perhaps more intriguing is CoreWeave's success landing and as customers. Both Wall Street giants served as underwriters for the company's March IPO, and their conversion to clients signals how traditional finance is embracing AI infrastructure beyond just investment thesis. The deals suggest is successfully diversifying beyond pure-play AI companies into enterprise adoption.