TL;DR:

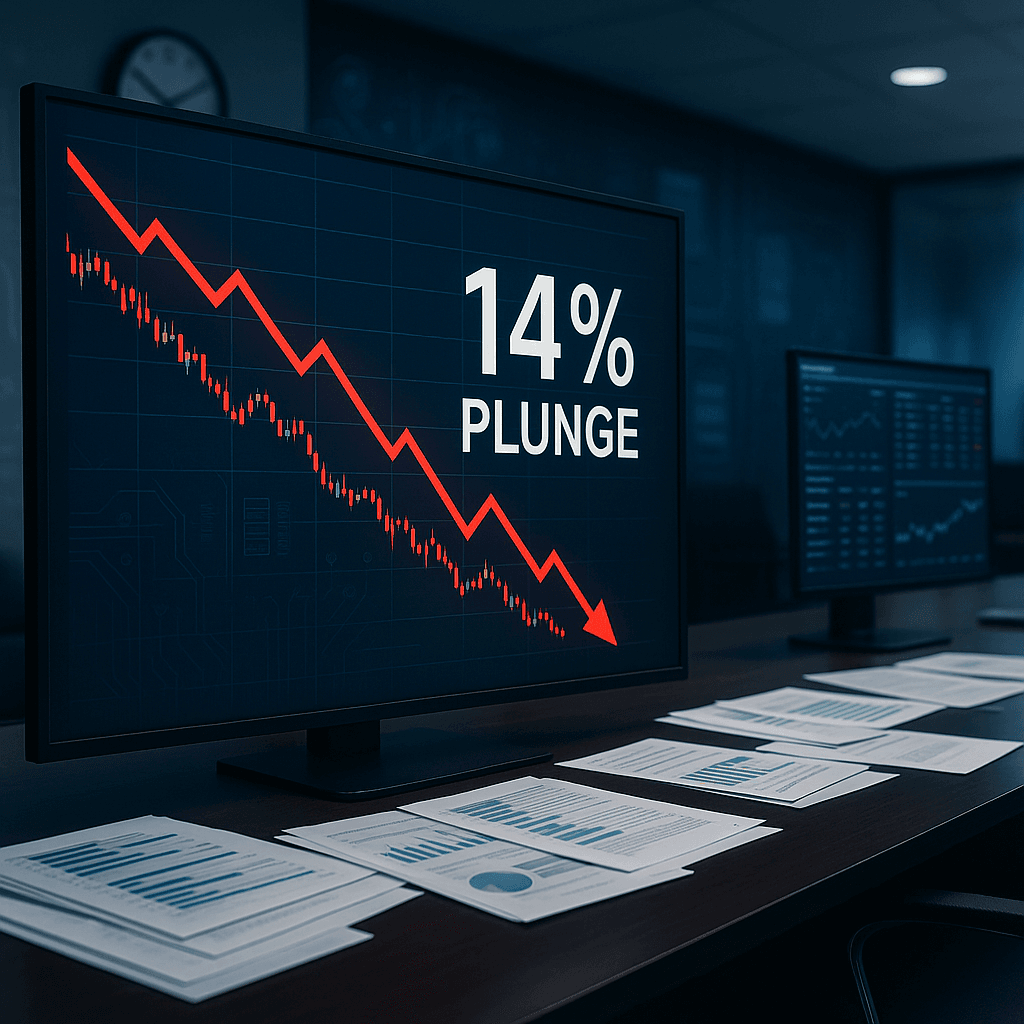

• CoreWeave stock plunges 14% on wider-than-expected Q2 losses

• Company missed EPS estimates by 6 cents despite tripling revenue to $1.21B

• IPO lockup expires Thursday, potentially flooding market with insider shares

• Analysts cite capital expenditure delays and Core Scientific acquisition uncertainty

CoreWeave shares are cratering 14% after the AI infrastructure darling reported a surprise earnings miss just hours before its post-IPO lockup period expires. The timing couldn't be worse for the company that's become synonymous with the AI boom's infrastructure gold rush.

CoreWeave just handed Wall Street a reality check on AI infrastructure valuations. The company's stock is tumbling 14% after reporting an adjusted loss of 27 cents per share, missing analyst expectations by 6 cents in what should have been a triumphant second quarter as a public company.

The timing couldn't be more precarious. CoreWeave's lockup period expires Thursday evening, potentially unleashing a flood of insider selling just as investor confidence wavers. "We remain constructive long term and are encouraged by today's data points, but see near-term upside capped by the potential CORZ related dilution and uncertainty, and the pending lock-up expiration on Thursday," Stifel analysts warned, referencing the company's recent Core Scientific acquisition.

The earnings miss stings particularly because CoreWeave actually delivered spectacular revenue growth, more than tripling year-over-year to $1.21 billion and beating Wall Street's $1.08 billion forecast. Finance chief Nitin Agrawal told analysts that demand still outweighs supply across their AI data center network, which serves marquee clients including OpenAI, Microsoft, and Nvidia.

But investors are fixated on the bottom line deterioration and what it signals about the company's path to profitability. CoreWeave also raised full-year revenue guidance to between $5.15 billion and $5.35 billion, up from previous forecasts, yet the market's focus remains squarely on mounting losses and execution concerns.