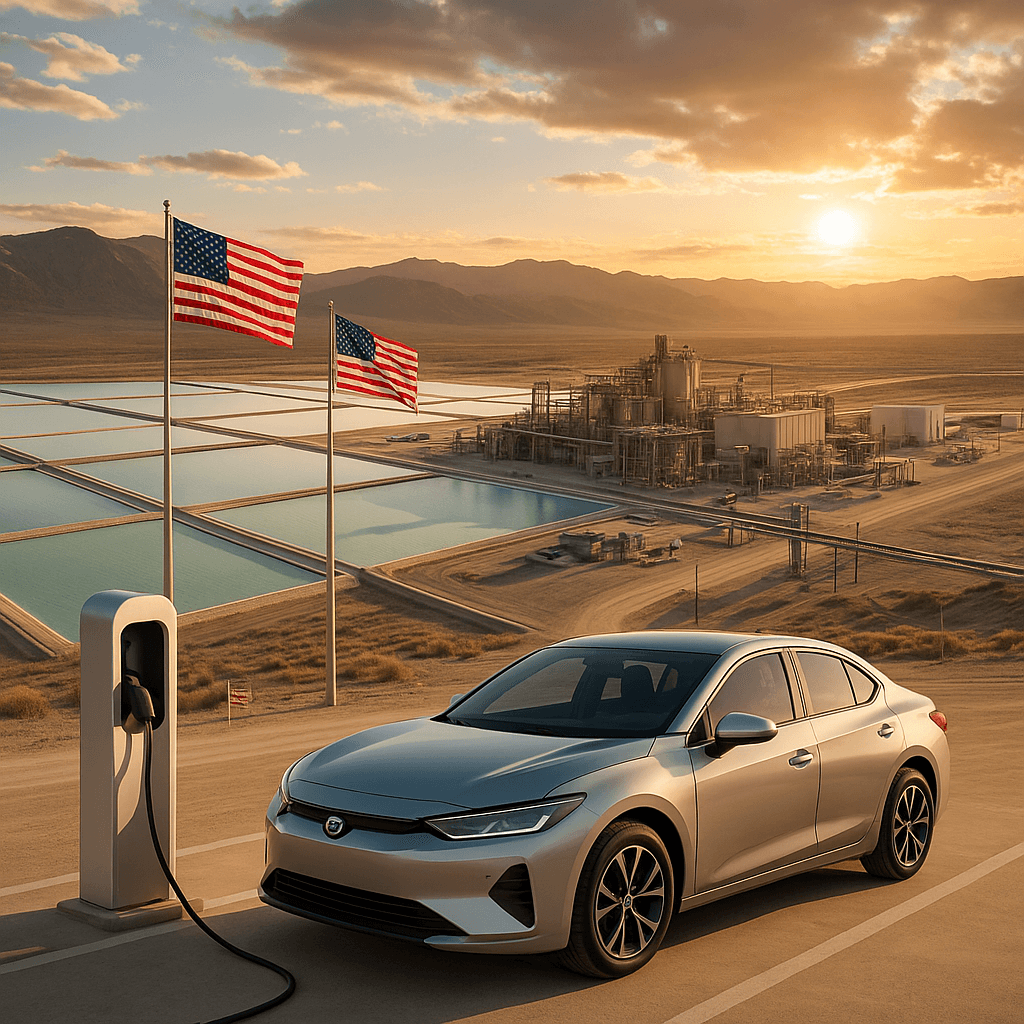

The U.S. Department of Energy just grabbed a 5% equity stake in Lithium Americas and its Nevada mining partnership with General Motors, marking the latest move in the Trump administration's aggressive push to secure American lithium supply chains through direct government ownership.

The U.S. Department of Energy just made its boldest move yet in securing America's critical mineral supply chain, taking dual 5% equity stakes in Lithium Americas and its Nevada mining joint venture with General Motors. The deal, announced Tuesday, restructures a massive $2.26 billion federal loan originally awarded under the Biden administration.

The government will acquire these stakes through no-cost warrants - financial instruments that give the DOE the right to purchase shares at predetermined prices without upfront payment. It's a clever structure that provides the government upside if lithium prices soar while protecting taxpayer dollars through additional loan collateral.

Lithium Americas shares immediately spiked 34% in after-hours trading as investors digested the government backing. The market's responding to what feels like a new era of state-backed industrial policy, where Washington isn't just lending money but taking actual ownership stakes in strategic assets.

"Despite having some of the largest deposits, the United States produces less than 1% of global lithium supply," Energy Secretary Chris Wright said in the DOE's announcement. "Thanks to President Trump's bold leadership, American lithium production is going to skyrocket." The rhetoric signals how critical minerals have become a national security priority rather than just an economic opportunity.

This marks the third major equity play by the Trump administration in strategic industries. The government has already announced plans to take 10% stakes in Intel and MP Materials, the rare earth minerals company. The pattern suggests a systematic approach to securing American control over technologies deemed essential for national competitiveness.

The timing couldn't be more critical for General Motors, which bought its own 38% stake in Lithium Americas last year for $625 million. That deal gave GM exclusive rights to the first phase of production from Nevada's Thacker Pass mine, plus lithium supply for 20 years during the second phase - enough raw material for 1.6 million electric vehicles over two decades.