- - Joby Aviation buys Blade's ride-share business for $125 million

- - Blade's existing network provides Joby with strategic infrastructure

- - This sets the stage for Joby's entry into the air mobility market

- - Long-term growth hinges on integration of air taxi technology

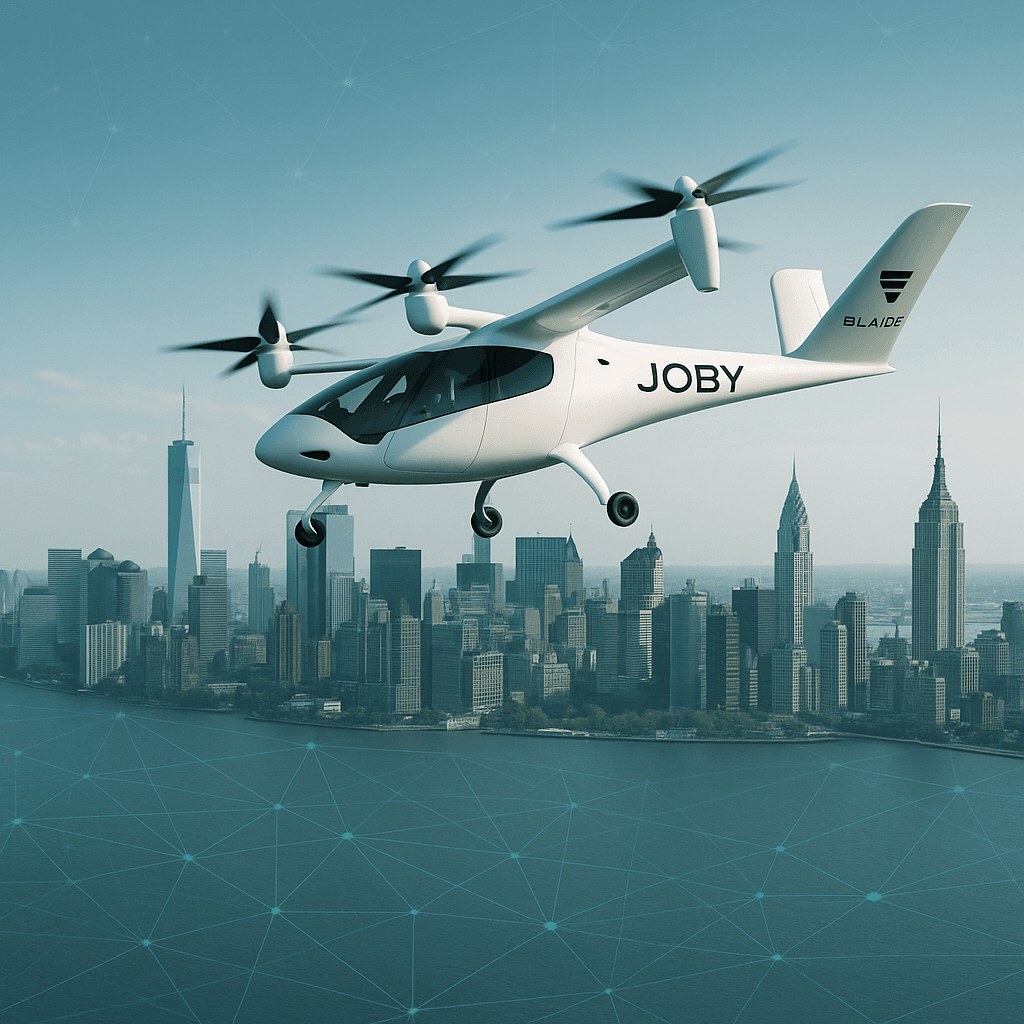

In a pivotal move, Joby Aviation is set to acquire Blade Air Mobility’s ride-share operations for up to $125 million. This acquisition aims to propel Joby into the air mobility sector with an established network across key geographic markets. Understanding the implications of this deal is crucial for stakeholders eyeing growth opportunities in urban air transport.

Opening Analysis

Joby Aviation has announced its acquisition of Blade Air Mobility's ride-share operations for as much as $125 million. The purchase includes Blade's established brand, operational foothold in the U.S. and Europe, and an extensive digital network that connects passengers to helicopter rides. Although Blade does not own any helicopters, its asset-light model and terminal access in strategic locations such as New York City offer immediate value to Joby's expansion plans.

Market Dynamics

The acquisition marks a significant shift in the air mobility market, as Joby aims to transition Blade’s existing helicopter services to electric vertical takeoff and landing (eVTOL) operations. Blade's network already flies over 50,000 passengers annually, providing Joby with a substantial customer base and urban transport terminals in high-traffic regions like JFK and Newark airports. By absorbing Blade’s logistics and passenger base, Joby strengthens its competitive posture in the burgeoning urban air transport sector.

Technical Innovation

Exploiting Blade’s software and established user base, Joby intends to replace traditional helicopters with electric air taxis. This transition will reduce operating costs and allow for more sustainable travel options. Joby's eVTOL design, which has been in development for over a decade, positions the company as a frontrunner in the air mobility race. The integration of such technology is vital for Joby to achieve operational efficiency and meet future urban transport demands.

Financial Analysis

This acquisition is pivotal financially as well. Joby's strategy to hold back $35 million of the $125 million purchase price, contingent on performance milestones, highlights a calculated risk approach. This ensures Blade meets certain operational benchmarks, securing returns on Joby's investment. Joby's public listing via a SPAC merger in 2021 has positioned the company well to execute such scale investments, backed by substantial capital inflow and strategic investor confidence.