Nvidia CEO Jensen Huang confirmed Friday that the company is actively negotiating with U.S. officials to export a more advanced AI chip to China, even as the chipmaker halts production of its current H20 processors amid mounting Chinese resistance. The potential B30A chip would mark a significant escalation in the delicate semiconductor trade war between Washington and Beijing.

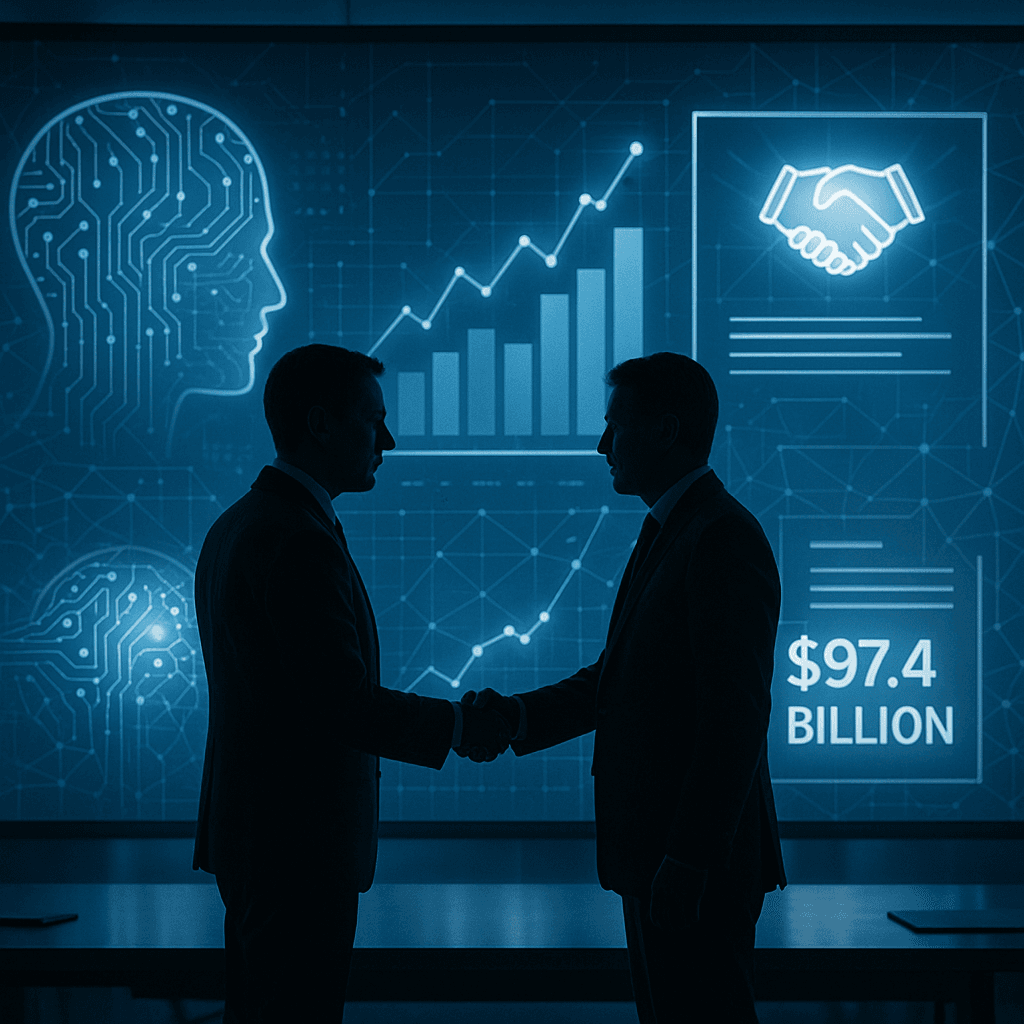

Nvidia just threw a curveball into the already complex U.S.-China chip trade war. CEO Jensen Huang confirmed Friday during a Taiwan visit that his company is in active discussions with Washington about exporting a more powerful AI processor to China, dubbed the B30A, that would surpass the embattled H20 currently allowed for export. "Offering a new product to China for the data center, AI data centers, the follow on to H20, that's not our decision to make," Huang told reporters, according to CNBC. "It's up to of course the United States government. And we are in dialogue with them." The timing couldn't be more precarious. The Information reported Friday that Nvidia has quietly asked component suppliers to halt production of H20 graphics processing units as Chinese resistance mounts. This comes just weeks after the U.S. government approved H20 exports again in July, with Nvidia agreeing to hand over 15% of its China chip sales revenue to Washington in exchange for export licenses. The semiconductor giant's China strategy is unraveling in real-time. Chinese authorities have been actively discouraging domestic companies from purchasing Nvidia chips this month, following what the Financial Times characterized as "insulting" comments from U.S. Commerce Secretary Howard Lutnick. "We don't sell them our best stuff, not our second best stuff, not even our third best," Lutnick told CNBC in July, describing the H20 as fourth-tier technology. Those remarks appear to have backfired spectacularly. Chinese regulators responded by raising security concerns about potential "kill switches and backdoors" in Nvidia processors, forcing the company to publicly deny such capabilities exist. Multiple reports suggest Beijing has since urged local firms to avoid Nvidia chips entirely, creating exactly the scenario Huang has warned against. The Nvidia CEO has consistently argued that blocking chip exports pushes China toward homegrown alternatives, particularly those from . "If the U.S. won't participate in China, ," Huang said in June, positioning American semiconductor leadership as dependent on maintaining Chinese market access. The proposed B30A chip represents Nvidia's attempt to thread an increasingly narrow needle. this week that the processor would outperform the H20 while remaining compliant with U.S. export restrictions designed to prevent advanced chips from powering Chinese military applications. But that balance is proving nearly impossible to maintain. The H20, specifically designed for China with reduced capabilities, has become a symbol of technological condescension rather than compromise. Chinese officials view the chip as evidence of American attempts to maintain AI superiority while offering inferior alternatives to the world's second-largest economy. Nvidia shares fell 1.34% in premarket trading Friday as investors digested the production halt news and uncertain regulatory landscape. The company's China revenue, while not disclosed separately, represents a significant portion of its data center business, which generated $26.3 billion in quarterly revenue. The broader implications extend far beyond Nvidia's balance sheet. The company's China troubles underscore how quickly geopolitical tensions can reshape global technology supply chains. What began as targeted restrictions on the most advanced chips has evolved into a comprehensive decoupling that threatens to split the global AI ecosystem into competing American and Chinese spheres.