Robomart just fired the first shot in what could reshape the $150 billion delivery wars. The LA startup's new RM5 autonomous robot promises $3 flat-fee deliveries—no surge pricing, no service fees, no tips—directly challenging the fee-heavy models that have made DoorDash and Uber Eats profitable but left consumers frustrated with mounting costs.

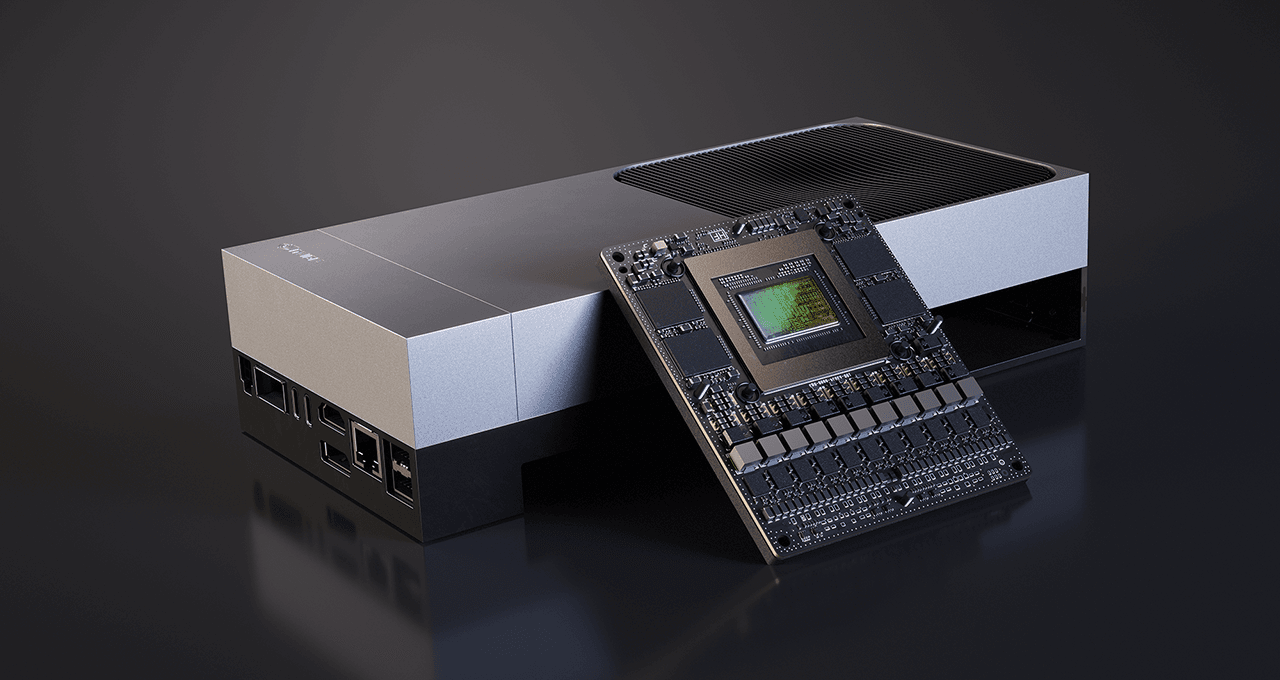

Robomart just threw down the gauntlet against the delivery giants. The Los Angeles startup announced its patented RM5 autonomous delivery robot Monday, promising to crack the code that has eluded the industry for years: profitable on-demand delivery at consumer-friendly prices. The level-four autonomous vehicle can haul 500 pounds across 10 individual lockers, designed for batch ordering that lets one robot handle multiple deliveries simultaneously—a critical efficiency play that could reshape delivery economics. "We see this as building our own autonomous marketplace," CEO Ali Ahmed told TechCrunch. "That is something that is pretty unique in this space, an autonomous marketplace for on-demand delivery using self-driving robots." The timing couldn't be more strategic. While DoorDash reported $8.6 billion in revenue last quarter, customer complaints about delivery fees, service charges, and surge pricing have reached a fever pitch. Robomart's $3 flat fee model eliminates the fee stacking that can double order costs on traditional platforms. Ahmed knows the delivery pain points intimately. Before founding Robomart in 2017, he ran Dispatch Messenger, a UK delivery platform that collapsed under the weight of human driver costs. "If you are paying a driver $18 an hour, your cost, just for that driver, is $9 to $10 an hour," Ahmed explained to TechCrunch. "Our robots bring the cost of a delivery down by up to 70%." That economic transformation could finally make autonomous delivery more than a Silicon Valley fever dream. The numbers show why traditional platforms struggle with profitability—Uber Eats posted losses through 2023 despite massive scale, while DoorDash achieved profitability only by raising fees and reducing driver pay. Robomart's approach mirrors the company's evolution from its original "store on wheels" concept. Since 2020, the startup has operated mobile autonomous stores delivering pharmacy items and ice cream directly to customers. The pivot to on-demand delivery represents natural progression, Ahmed says, but with a twist: retailers partner with to open storefronts on the platform, similar to or , but served entirely by robots. The financial backing tells its own story. has raised just $4 million from , , and —a fraction of the billions and have burned pursuing delivery dominance. "I'm proud of our team, and it's a testament to how much we have been able to achieve," Ahmed told . Austin, Texas becomes the proving ground later this year as begins onboarding retailers. The choice reflects Texas's robot-friendly regulations and Austin's tech-savvy consumer base—ideal conditions for testing whether Americans will embrace robot deliveries at scale. The competitive implications extend beyond delivery fees. has tested delivery robots through its Scout program, while operates thousands of robots on college campuses. But none have attempted to build a full marketplace challenging the - duopoly directly.