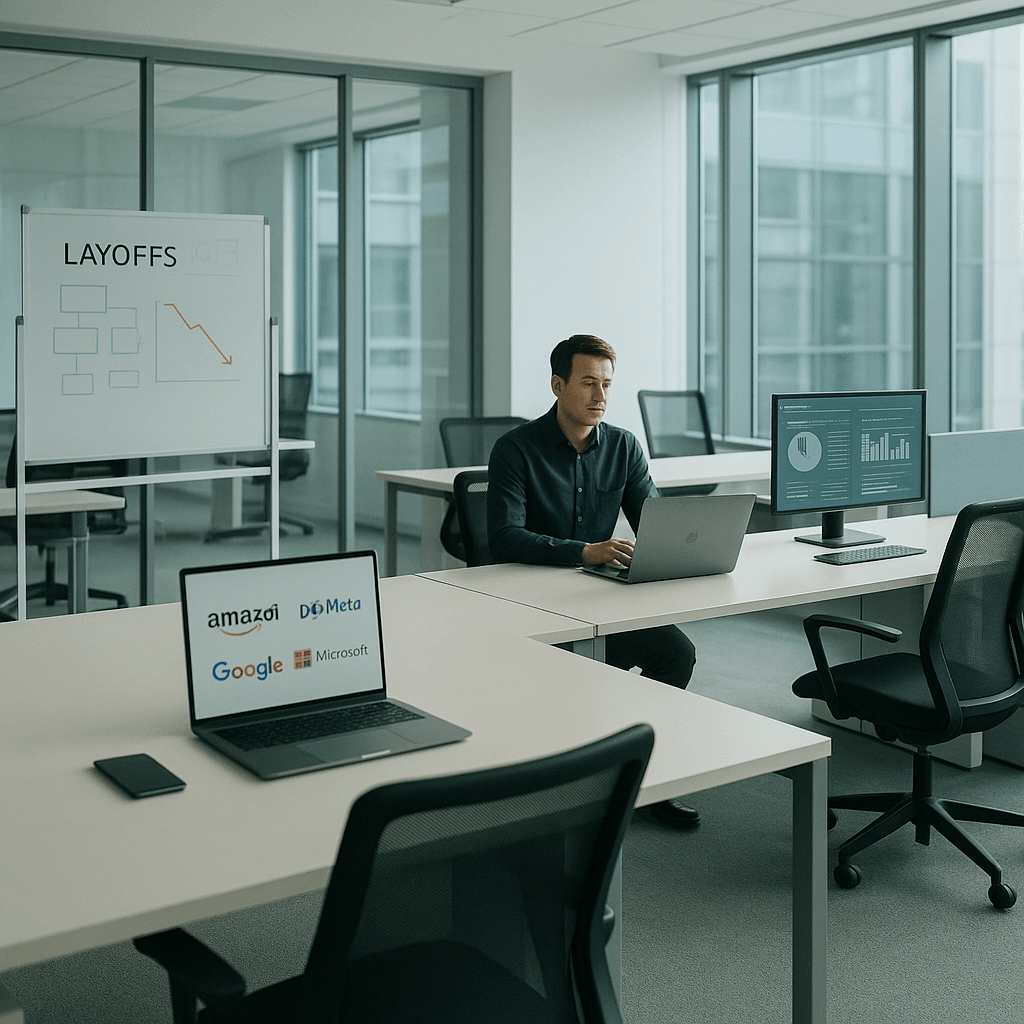

The tech industry's workforce upheaval shows no signs of slowing as 2025 approaches, with TechCrunch launching a comprehensive tracker documenting layoffs across Big Tech companies and startups throughout the year. The ongoing cuts signal a fundamental shift in how tech companies approach headcount after years of aggressive hiring, affecting everything from AI startups to established enterprise software providers.

The tech industry's reckoning with workforce size continues unabated as companies from Meta to emerging AI startups announce fresh rounds of layoffs heading into 2025. TechCrunch's newly launched comprehensive tracker captures the breadth of cuts, revealing a sector still grappling with the aftermath of pandemic-era hiring sprees and economic uncertainty.

Unlike the massive, headline-grabbing cuts of 2022 and 2023, this year's layoffs follow a different pattern - smaller, more targeted reductions that suggest companies are fine-tuning operations rather than panic-cutting. The tracker's month-by-month breakdown shows how these decisions ripple across different tech segments, from established giants reassessing their AI investments to startups extending runway in a challenging funding environment.

The continued workforce reductions highlight a fundamental shift in how tech companies think about growth. Where rapid headcount expansion once signaled success, leaders now emphasize efficiency and sustainable scaling. This recalibration affects not just the companies making cuts, but the broader ecosystem of contractors, vendors, and service providers that depend on tech sector demand.

Big Tech companies continue wrestling with balancing innovation investments against shareholder pressure for profitability. Meanwhile, startups face the dual challenge of extending cash runway while maintaining enough talent to execute on product roadmaps. The result is a more surgical approach to workforce planning that prioritizes core competencies over expansive teams.

The geographic spread of layoffs also tells a story about remote work's lasting impact. Companies can now reduce headcount without closing entire offices, leading to more distributed cuts that affect workers across multiple markets. This geographic flexibility changes how layoffs ripple through local economies, particularly in traditional tech hubs like San Francisco and Seattle.

Investors and industry analysts watch these employment trends closely as indicators of broader tech health. Persistent layoffs could signal ongoing structural challenges, while more targeted cuts might represent healthy optimization. The tracker's comprehensive scope provides crucial data for understanding which interpretation proves accurate.