TL;DR

- Enables Tesla to operate without human safety drivers statewide

- Permit until August 2026 opens significant market opportunities

- Risk of federal scrutiny due to past traffic incidents

- Strategic thesis: Tesla bets heavily on autonomous tech to capture market share

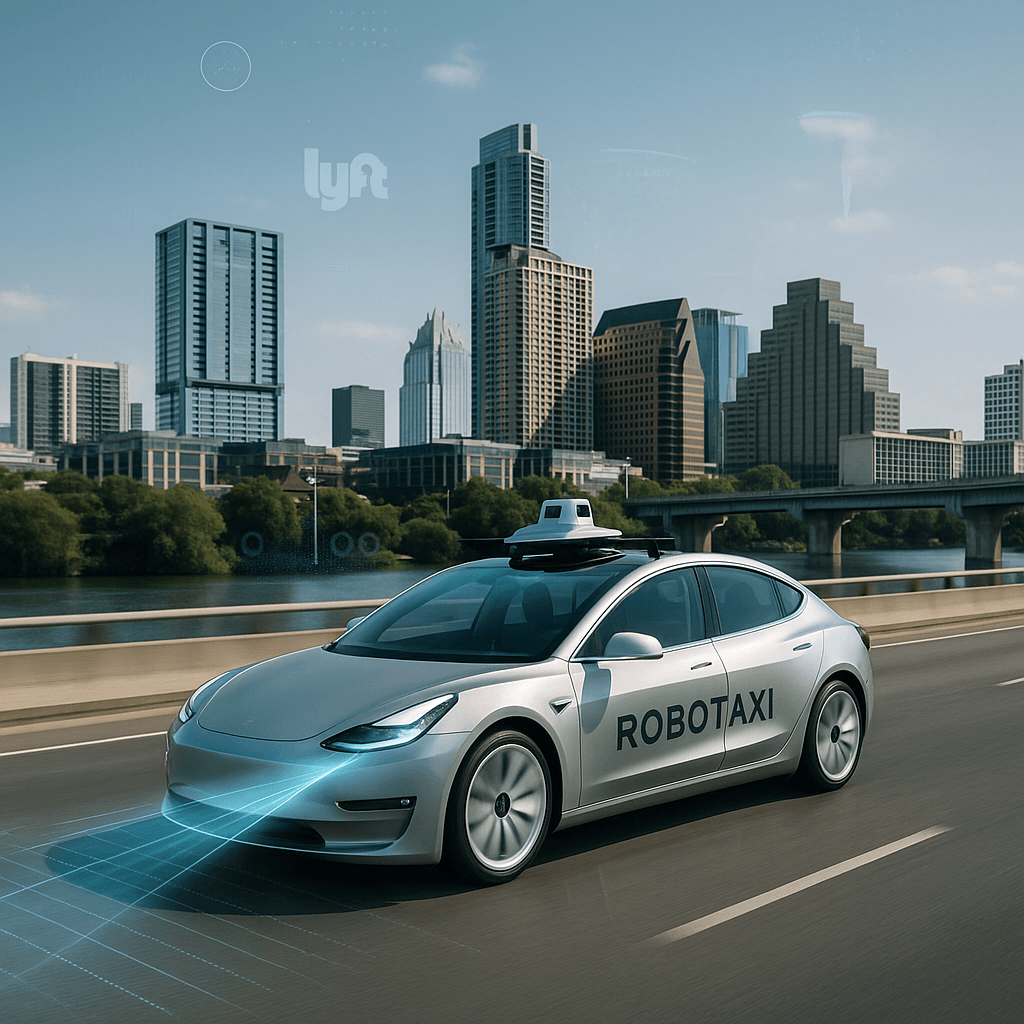

Tesla has been granted a pivotal permit to operate a ride-hailing business in Texas, enabling it to challenge incumbents Uber and Lyft. This landmark decision positions Tesla's robotaxi service at the frontier of autonomous ride-hailing in one of the U.S.'s most permissive states for AV testing. With aspirations to serve half the U.S. by 2025, what can investors and industry leaders glean from this strategic move?

Opening Analysis

Tesla recently secured a permit from the Texas Department of Licensing and Regulation to run a ride-hailing service throughout the state. This development places Tesla head-to-head with established players like Uber and Lyft, leveraging its autonomous vehicle technology. Particularly, this permit underscores Texas’s supportive regulatory stance towards autonomous vehicles, allowing Tesla to operate vehicles without human drivers.

Market Dynamics

The ride-hailing market in Texas is fiercely competitive, dominated by Uber and Lyft. Tesla's entry introduces a significant shift, potentially driving innovation and lowering costs through self-driving efficiencies. With Texas generally more permissive towards AV testing, Tesla's strategy to capitalize on this climate may catalyze industry-wide advancements.

Technical Innovation

Tesla's integration of autonomous technology within the Model Y fleet marks a pivotal step in the automation of transportation services. By eliminating the need for human drivers, Tesla aims to reduce operational costs significantly. However, the technology's maturity is under scrutiny, as incidents of rule violations have caught federal attention.

Financial Analysis

The opportunity for Tesla to expand its ride-hailing service across Texas provides a new revenue stream outside its conventional automotive sales. Tesla's aggressive move into autonomy aligns with its broader strategy to dominate mobility solutions, potentially boosting its market valuation. Yet, Tesla shares are down 18% this year, pointing to investor caution regarding execution risks.

Strategic Outlook

Strategically, this expansion pits Tesla directly against incumbents in a lucrative market forecasted for high growth. Nevertheless, mitigating operational risks and federal compliance will be critical for sustained deployment. In the 6-12 month outlook, Tesla's progress in Texas could set a precedent that other states may follow, leading to a broader acceptance of autonomous ride-hailing services. Longer-term, in 1-2 years, should Tesla overcome current challenges, it may emerge as a formidable player in the global autonomous vehicle market.