Chinese electric vehicle maker Xpeng is preparing to take its budget-friendly Mona series global in 2026, CEO He Xiaopeng revealed in an exclusive interview. The move positions the $17,000 electric coupe against Tesla and European automakers while the company signals openness to strategic acquisitions amid China's brutal EV price war.

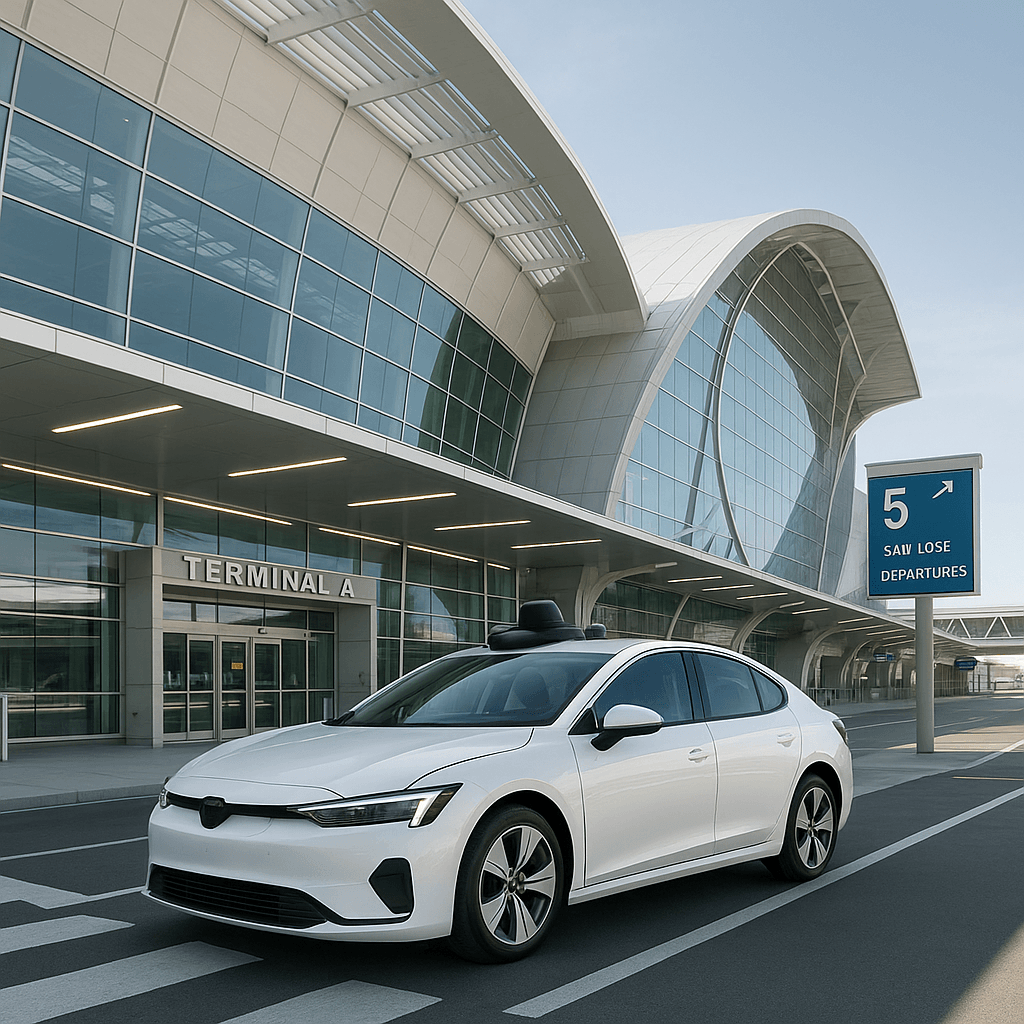

Xpeng just fired the latest salvo in the global EV wars. The Chinese automaker's CEO He Xiaopeng told CNBC the company will launch its mass-market Mona series internationally in 2026, marking the first time this aggressive expansion timeline has been revealed. The announcement came during Tuesday's IAA Mobility auto show in Munich, where Xpeng showcased its upgraded P7 flagship to European audiences. "In 2026 you can expect a variety of Mona products launched into the Chinese and European markets, as well as in rest of the world," He said through translators. "I believe by then, what we launch will be very proven and very excellent vehicles." The global rollout centers around the Mona M03 electric coupe, which launched in China with an aggressive 119,000 yuan ($17,000) starting price. That positions it significantly below Tesla's Model 3 and traditional European offerings from BMW, Mercedes, and Volkswagen. The timing couldn't be more strategic. Tesla continues recording declining European sales, while Chinese rivals like BYD surge with 225% growth in the region. Xpeng's budget-friendly Mona series threatens to intensify pressure on established players already scrambling to compete on price. [embedded images] He revealed that Xpeng has already surpassed its goal of establishing presence in 60 countries by end-2025, accelerating from just 3-5 markets two years ago. The Guangzhou-headquartered company began international expansion in 2020 with Norway and now operates across Germany and France. "Our international expansion is moving faster than I expected," He told reporters at the Munich show. But the global push faces headwinds. EU tariffs on China-made EVs are forcing Chinese manufacturers to consider European production. He acknowledged Xpeng wants to manufacture in Europe but hasn't committed to a timeline, citing ongoing regulatory challenges. [video iframes] The expansion announcement comes as China's domestic EV market undergoes brutal consolidation. He himself has warned that only a handful of Chinese carmakers will survive the current price war, known locally as "neijuan" or involution. Chinese regulators have called for an end to excessive competition as manufacturers slash prices to grab market share. In this environment, He dropped perhaps the most significant revelation: Xpeng is now open to acquisitions for the first time. "I think if we have the opportunity then we want to acquire some companies," he said. "Manufacturing companies, EV companies are always possible." The shift represents a major strategic pivot. Since its 2014 founding, Xpeng has largely grown organically, with its only major acquisition being for $744 million. He suggests the consolidation wave is already underway, creating acquisition opportunities as weaker players struggle. The Mona brand's global launch could prove pivotal for Xpeng's international ambitions. Unlike the company's premium P7 and G6 models, the Mona series targets mainstream buyers with advanced driver assistance systems at mass-market prices. This positions Xpeng to compete directly with Tesla's volume models while undercutting European luxury brands on cost.