the tech buzz

SignalPulse:

SignalPulse:

Weekly Signals, Startups & Deals To Watch Alert

IN PARTNERSHIP WITH

WHAT’S INSIDE

Big Movers: Nvidia denies Burry fraud claim, Alphabet $4T valuation, & Bezos’ Project Prometheus

Large Rounds: X-energy $700M, Physical Intelligence $600M Series B at $5.6B pmv, & Harmonic $120M

Companies Making Waves: Revolut, Public AI-powered brokerage, Clover Security, Joby A x L3Harris, CleanSpark $766.3M Revenue, f, Pony.ai in US, JustiGuide AI law

Open Deals: Startups raising capital Wyoming Decentralized Exchange WYDE Cause Coins Waitlist», DUNA SNAP Funding Nonprofit Associations.

Exit Watching: Mergers & Acquisitions and IPOs like Revolut secondary sale, Paxos acquisition.

The Funding Buzz: VC & PE Activity To Watch like Bending Spoons & Curious, Bitfury $1B emerging tech fund, Firgun Ventures and MrBeast x Rockefeller foundation.

IN PARTNERSHIP WITH DELVE

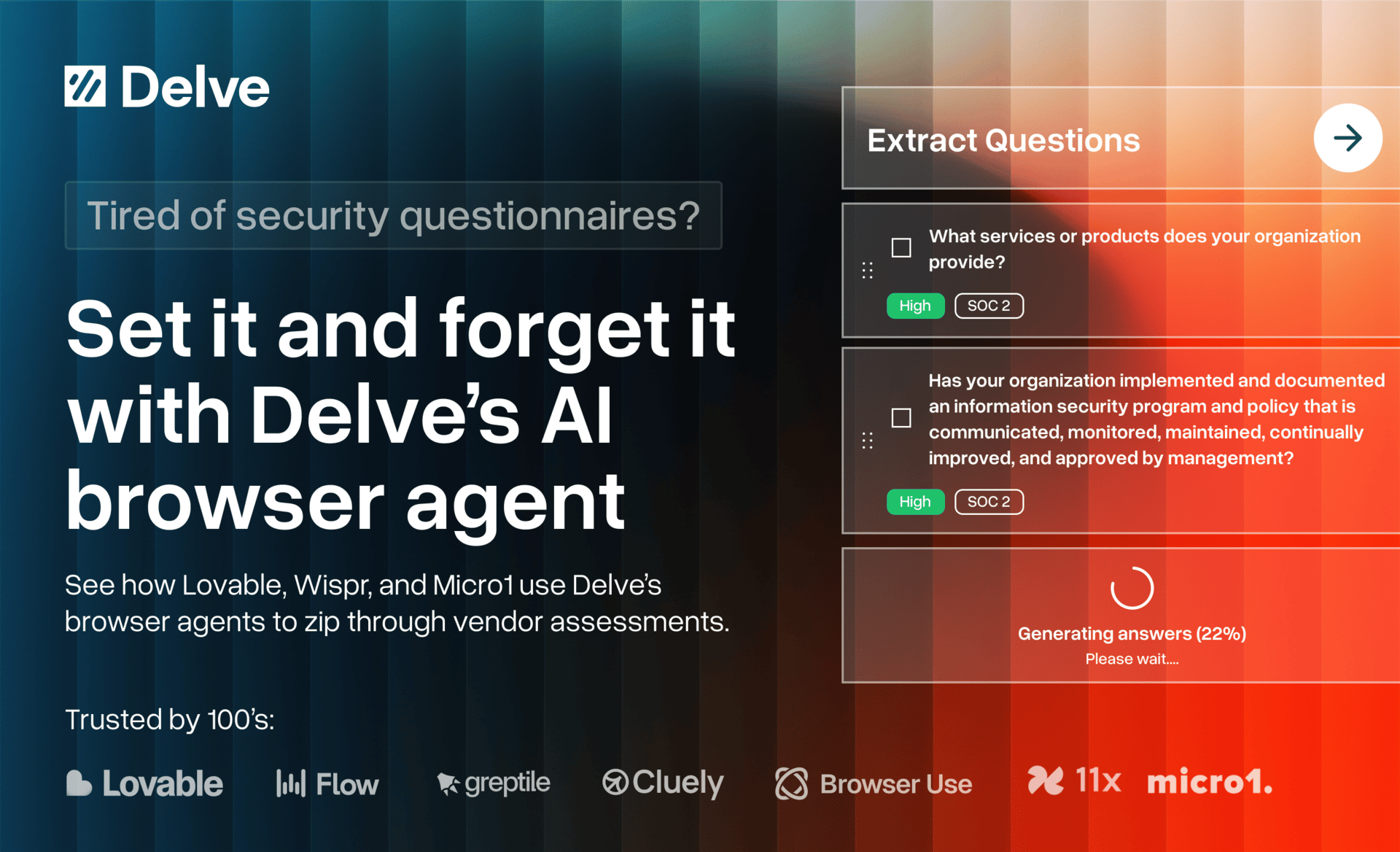

🤖 Set it and forget it with Delve’s AI browser agent

Ever had to fill out a gnarly security questionnaire inside a vendor’s portal and hated your life?

Delve just launched an AI browser agent that does it for you.

It finds answers from your policies, past questionnaires, and docs, then fills everything in while you click next. Hours → minutes.

Switch to Delve for compliance and use this - and every other gamechanging AI features at one simple cost.

If you’re using another platform for compliance, Delve will migrate you over or free.

Piratewire readers get $1,000 off compliance using the link below.

Set it and forget it >>> sweating questionnaires.

BIG MOVERS

Big tech moves, movers and trends to watch this week

Nvidia — Issued a memo denying accounting fraud allegations. Concerns center on complex AI investments that boost chip sales but pose systemic risks, with executives' significant stock sales.

Alphabet — Nears a $4T valuation driven by AI-fueled stock rally and 5% share price increase, with cloud business as major growth area. Stock surged as it challenges Nvidia in AI space, with potential Meta adoption of its TPU chips.

OpenAI — Launched a shopping research tool turning ChatGPT into a personalized buying advisor, competing with Google Shopping and Amazon with ad-free product guides. Unveiled first hardware prototypes with Jony Ive.

xAI — Developing an 88-acre solar farm near Memphis data center to produce 30MW of power. Elon Musk's AI startup is closing a $15B funding round at $230B pre-money valuation by Dec 19, 2025, to enhance GPUs for LLMs.

Tesla — Aims to lead in AI chip production with plans for new chip design annually. Despite deploying millions of AI chips in vehicles and data centers, analysts highlight challenges in scaling.

Amazon — 40% of U.S. e-commerce sales. The new Leo Ultra antenna offers 1Gbps speeds to enterprise clients with AWS integration. Investing $15B in AI data centers.

Anthropic — Released Claude Opus 4.5 following a valuation surge to $350B. achieved over 80% on SWE-Bench coding tests, integrating with Chrome and Excel to enhance enterprise workflows.

Oracle — Saw a 4% stock increase after bullish analyst reviews, leading a tech stock rally joined by Nvidia and Microsoft.

[OPEN DEALS] RAISING DOLLARS:

Startups, firms or funds raising capital this week

Wyoming Decentralized Exchange — WYDE Cause Coins: Join the Waitlist before this $10T Impact Investing Infrastructure play launches late 2025 ».

DUNA SNAP Funding — DUNAs (Decentralized Uninc. Nonprofit Associations) - a blockchain-based solution to the $6B SNAP funding gap, enabling community-governed, transparent aid for 42M with support from Wyoming's legal framework.

Humans& — Eric Zelikman, former xAI researcher, is raising $1B for his AI startup, targeting a $5B valuation. With early Google employee Georges Harik, the company focuses on AI that collaborates with human preferences, requiring significant compute.

MAKING WAVES

Startups making waves, hot trends and signals to watch in the USA this week:

Project Prometheus — Jeff Bezos' new venture acquired General Agents for $6.2B, enhancing its AI manufacturing base with 'Ace' technology to automate complex tasks at high speed.

Revolut — The neobank completed a secondary share sale, upping its valuation by 66% to $75b. Led by Coatue and Fidelity, this tops several major banks. Plans to acquire a U.S. bank.

Public — Launching an AI-powered brokerage allowing users to create custom investable indexes and manage portfolios. Targets younger investors with plans for an AI wealth manager, competes with Schwab, Fidelity amidst regulatory challenges.

Clover Security — The AI-driven product security startup integrates AI agents into tools like Confluence and GitHub. It raised $36M to enhance security in dev processes, attracting Fortune 500 clients.

Joby Aviation — Its autonomous hybrid S4 VTOL aircraft completed its maiden flight. Developed with L3Harris, it targets the defense sector with a turbine-electric powertrain for extended range.

CleanSpark — A Las Vegas-based AI-driven data center company reported record revenue of $766.3M for FY 2025, doubling from the previous year. With a net income of $364.5M and a $1.15B financing, positioning itself as an AI infrastructure leader.

Pony.ai — The autonomous vehicle company is set to triple its robotaxi fleet to over 3,000 by 2026, despite a $61.6M net loss in Q3. With 72% revenue growth and strategic partnerships like Toyota, it aims to expand into eight countries.

JustiGuide — Dolores AI assistant simplifies US immigration law for 47,000 users in 12 languages. Trained on 40,000 cases, it aids immigrants in form filling and legal options, while connecting them with attorneys and ensuring secure data handling.

TEAMING UP

Startups joining forces via partnerships or joint projects this week:

Pony.ai — The autonomous vehicle company is set to triple its robotaxi fleet to over 3,000 by 2026, despite a $61.6M net loss in Q3. With 72% revenue growth and strategic partnerships like Toyota, it aims to expand into eight countries.

GMI Cloud x Nvidia — Taiwan-based AI data center developer investing $500M to build a center utilizing Nvidia's Blackwell GB300 chips. Expected by March 2026, it will feature 7,000 GPUs and handle 2M tokens/sec.

Toyota in US — Investing $912M in five US factories to boost hybrid vehicle production, focusing on a hybrid-first strategy. This includes $453M for the WV plant and $125M for the first US-built hybrid Corolla.

Ford x Amazon — Launched certified pre-owned vehicle sales on Amazon Autos in LA, Seattle, and Dallas. It enables online browsing and financing, with local dealerships managing deliveries and pricing.

IN THE MONEY

Companies that raised money in the past week and why they matter

Massive Deals

X-energy — The advanced SMR nuclear company closed a $700M oversubscribed Series D led by Jane Street. Funds will expand their supply chain and commercial pipeline for energy projects with Dow, Amazon, and Centrica.

Physical Intelligence — The robot learning company raised $600M in a Series B round led by CapitalG at $5.6Bpmv. The funds will enhance data collection for its universally embodied AI approach.

Harmonic —Robinhood CEO Vlad Tenev raised $120M at $1.45B from Ribbit and others to enhance AI reasoning and reduce "hallucinations." Aristotle, excelled in math at IMO — focus on trust in safety-critical industries.

Circ — Virginia-based recycling startup developed a chemical process for recycling blended fabrics, raising $100M with partners like Zara and H&M to separate polyester and cotton without damage.

Large Deals

Model ML — The UK and NY-based AI automation platform for financial services raised $75M in a Series A round led by FT Partners. The funding will support global expansion and enhance AI capabilities for financial teams.

Range — The AI-based financial planning startup secured a $60M Series C led by Scale Venture Partners, with Gradient Ventures and Cathay Innovation. Since 2023, it has raised over $100M.

Phrontline Biopharma — The biopharma company focused on ADC platforms raised $60M in a Pre-A+ round led by Lapam Investment. The funds will support clinical trials for its lead candidate, TJ101, and expand operations globally.

Upbit — South Korea's largest cryptocurrency exchange suffered a $36.8M hack, resulting in the suspension of withdrawals and deposits. The exchange detected abnormal activities on the Solana network and moved assets to a cold wallet.

Clover Security — The AI-driven security startup has raised $36M to enhance product security by embedding AI agents in tools like Confluence and GitHub. Already used by Fortune 500 companies.

Smaller Deals

Tidalwave — The AI-powered mortgage platform startup raised $22M in Series A funding, led by Permanent Capital with D.R. Horton joining. Will automate mortgage processes, aiming to capture 4% of the U.S. mortgage market.

Cerrion AG — The industrial automation firm based in Europe and the U.S., raised $18M in Series A funding. Utilizing AI and cameras, it minimizes production downtime for major clients like Unilever and Coca-Cola .

Vijil — The NY cybersecurity startup raised $17M in a Series A round, led by BrightMind Partners to enhance its platform for secure AI agent development, focusing on reliability, risk mitigation, and compliance.

Momentic — The AI-based software testing startup raised $15M in a Series A led by Standard Capital. With 2,600 users, including Notion and Webflow, Momentic automates test steps by converting user flows described in plain English.

CoPlane — The AI-native software company, based in New York, raised $14M in seed funding to revolutionize back-office operations for large enterprises. Co-founder Chris Sperandio aims to replace outdated ERP systems.

Momentic — The AI testing startup secured $15M in a Series A round led by Standard Capital, with Dropbox Ventures participating. Based in New York, Momentic automates software testing for 2,600 users, including Notion and Xero.

Cordance Medical — The ultrasound system startup raised over $8M in seed funding, led by Sonder Capital. Investors include the Sontag Foundation. The funds will support trials for their FDA breakthrough device.

Palo — A NY startup aiding content creators with ideation and analytics. Founded by former MrBeast strategist Jay Neo, it raised $3.8M to offer AI-powered planning, analytics, and community interaction tools for creators with 100k followers.

EXIT WATCHING

Mergers & Acquisitions and IPOs

Revolut — the neobank completed a secondary share sale, upping its valuation by 66% to $75b. Led by Coatue and Fidelity, this tops several major banks. Plans to obtain a full UK license and expand into credit, mortgages, acquire a U.S. bank.

Paxos — Paxos acquires Fordefi, a New York-based crypto wallet startup, for over $100M. This strategic move into decentralized finance (DeFi) aims to provide clients with enhanced DeFi access. Fordefi, valued at $83M, it will remain independent.

IPO Watch

Open or upcoming IPOs to watch:

Kraken — The crypto exchange based in the U.S. has confidentially filed for an IPO following an $800M funding round, valuing it at $20B. This move aims to expand internationally and develop payment services.

Ledger — The French hardware wallet for crypto security company is considering an IPO or fundraising in 2025 due to rising demand, with $100B in secured bitcoin. Expanding in NYC amid increased crypto investment and security challenges.

Grayscale Investments Inc. — The crypto asset manager filed for IPO with $203.3M net income on $318.7M revenue for first nine months of 2025, down from prior year's $223.7M and $397.9M.

THE FUNDING BUZZ

VC & PE Activity To Watch

DoubleLine — The investment firm warns about the surge in tech bond sales funding AI expansion, with analysts forecasting AI data center bonds could reach $1.5T in five years, potentially impacting the $9 trillion U.S. corporate bond market.

Bending Spoons & Curious — Pioneering the "hold forever" strategy by acquiring stagnating tech companies with $1M-$5M in ARR, focusing on profitability through cost-cutting and price increases rather than traditional VC growth models.

Bitfury — Transitioning from a bitcoin miner to an investment firm, the company launched a $1 billion initiative to support ethical emerging technologies, investing in mission-driven innovators backed by its previous operations and investor networks.

Firgun Ventures — The Qatar Investment Authority-backed firm launched a $250M VC fund with an initial $70M close, targeting early growth-stage quantum technology companies in healthcare, finance, and cybersecurity.

Baobab Ventures — A London-based deep-tech VC fund raised $15M to invest in global pre-seed and seed stage startups in AI, robotics, and defense. Founded by Carles Reina, it plans to invest $300K-$350K per startup.

MrBeast Philanthropy — MrBeast's philanthropic organization partners with the Rockefeller Foundation to address global issues, focusing on child labor in the cocoa industry. The collaboration aims to inspire youth through MrBeast's influence.

TECH BUZZ DIRECTORY

Featured Products*

SEO Bot — A fully autonomous "SEO Robot" with AI agents for busy founders.

Memelord — Meme Software for marketing memes, tech memes, & sales memes.

Otonomos — Incorporate your Delaware C-corp or tax advantaged foundation and get 5% OFF.

FOR INVESTORS

Open Deals

Investors– request an intro to startups - invest@techbuzz.ai.

Before we restart our placements of raising startups, we’re sharing an open call to send in your own company. Just shoot us an email with a deck and we may feature you in this bulletin.

For detailed pitch materials, please email invest@techbuzz.ai with your deck.

🔥 — hot deal!

⏰ — leaving soon.

FOR EMPLOYERS

Job Candidates

Employers– request an intro to candidates - jobs@techbuzz.ai

*Note: Some products above have affiliate links which we earn a percentage from qualifying sales.

The Tech Buzz

| Get the daily newsletter that helps you understand the tech ecosystem sent to your inbox.

By submitting your email, you agree to our Terms and Privacy Notice.

More Newsletter Posts

Newsletter