the tech buzz

SignalPulse:

SignalPulse:

Weekly Signals, Startups & Deals To Watch Alert

IN PARTNERSHIP WITH

WHAT’S INSIDE

Big Movers: Nvidia backlash, GPT-5.2, Oracle shares fall 13%, & J.P.M's $50M Solana blockchain bond for Galaxy Digital

Open Deals: Skild AI $1B at $14B, WYDE Wyoming Decentralized Exchange $EAT token to end hunger in US

Large Rounds: Saviynt $700M Series B, Unconventional AI $475M seed at $4.5B pmv, Fervo Energy $462M, Harness $200M at $5.5B

Companies Making Waves: Waymo reports 450K weekly paid rides, Phia GatesAI shopping startup, Printerior $10M revenue

Exit Watching: M&A and IPOs like IBM x Confluent, Netflix x Warner Bros, Bending Spoons x Eventbrite, Fervo & Harness IPOs

The Funding Buzz: VC & PE Activity To Watch like Tiger Global, General Catalyst, JAY-Z's MarcyPen Asia, & Kabir Narang's new AI-fund

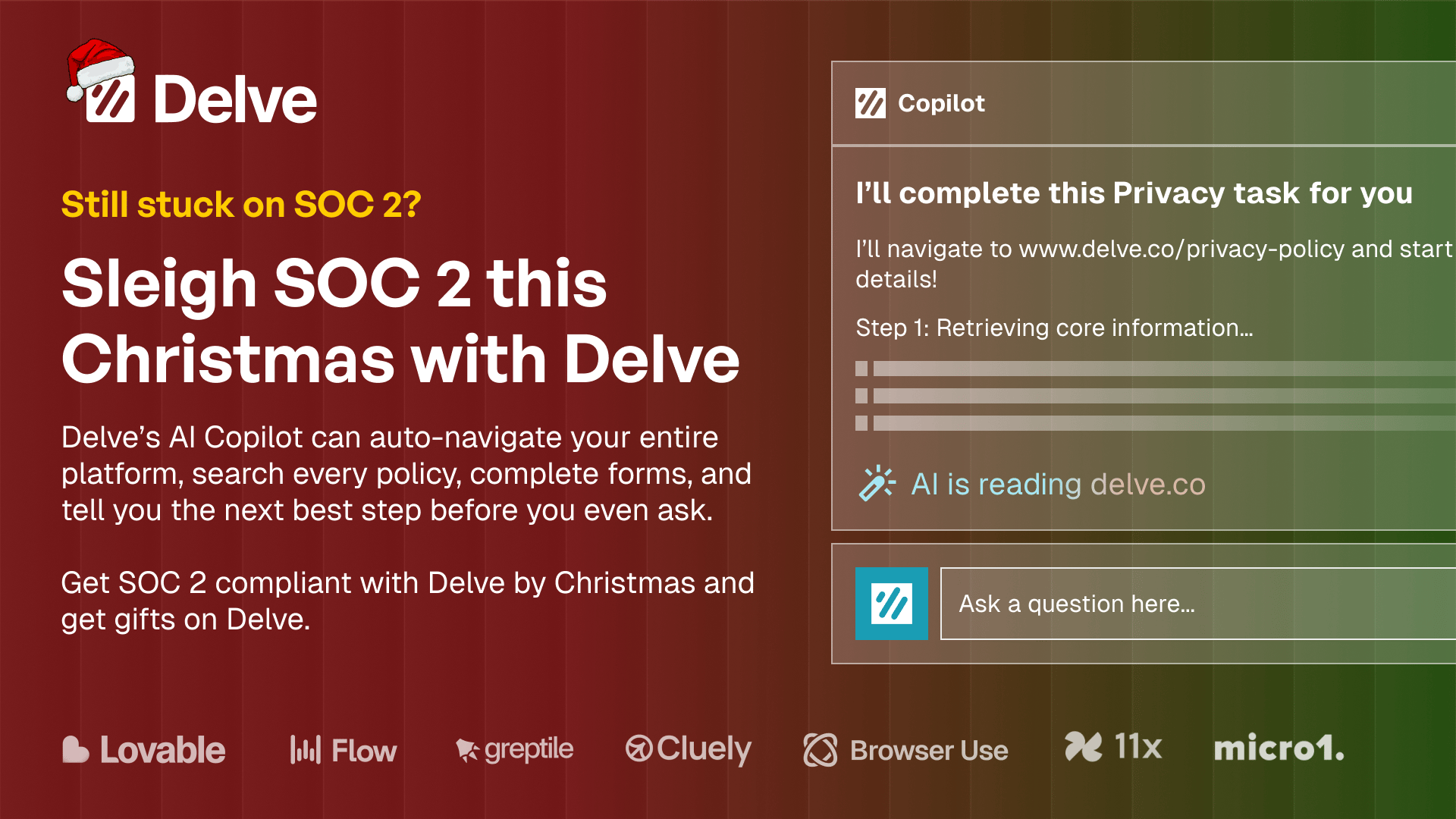

IN PARTNERSHIP WITH DELVE

❄️ SOC 2 have you shivering? Sleigh it with Delve’s AI.

Delve’s Copilot reads your policies, completes privacy tasks, fills SOC 2 evidence, and navigates your workflow from start to finish.

Everything gets done for you automatically, without the manual grind that usually slows teams down.

It extracts the right information, completes the forms you would normally struggle through, and moves each task forward without you lifting a finger. The result is a smoother, faster, and more reliable compliance process that stays on track even during your busiest season.

Teams using Delve are seeing real outcomes.

Lovable achieved SOC 2 in 20 hours.

Wisprflow closed Mercury and Superhuman in one month.

11x unlocked 1.2 million dollars in ARR.

If Santa has elves, you have Copilot working in the background and keeping you confidently compliant.

BIG MOVERS

Big tech moves, movers and trends to watch this week

Google released its Year in Search 2025 film highlighting AI breakthroughs in farming and healthcare, and integrated Gemini AI into Chrome on iOS for seamless mobile browsing. Pledged $5M for computer science education and eye disease,

OpenAI released GPT-5.2 with a 400K-tcw outperforming Gemini, halted ChatGPT ads amid backlash while facing a $115B burn rate with only 5% of 800M users paying, as user growth slows.

Nvidia — Facing political backlash over a deal to sell H200 AI chips to China. GOP senators argue it risks enhancing China's military AI capabilities, highlighting security.

J.P. Morgan — Arranged a $50M short-term bond for Galaxy Digital Holdings on the Solana blockchain, marking a key step in institutional digital asset adoption.

Oracle — Shares fell 13% due to concerns over AI spending and a $300B OpenAI partnership. Despite plans to boost spending by $15B for fiscal 2026, missed revenue targets prompted price target cuts.

[OPEN DEALS] RAISING DOLLARS:

Startups, firms or funds actively raising capital this week

$EAT — Impact Exchange, WYDE’s first crypto token launched on Dec 10, aims to end hunger in the US through a unique trading fee charity funding share model. 1.5M trading activity and 300+ meals funded in 48 hrs. Expected to hit a $1B market cap.

About WYDE — A Wyoming-HQ decentralized exchange integrating charitable giving into crypto trading. A 1% to 5% trading fee supports nonprofits, token holders shape fund distribution and transparency.

Skild AI — SoftBank and Nvidia are discussing a $1B investment in the robotics startup, valuing it at $14B. Founded by ex-Meta AI researchers, Skild AI develops universal software for robots, enhancing perception and decision-making.

MAKING WAVES

Startups making waves, hot trends and signals to watch in the USA this week:

Waymo — The autonomous vehicle company reports 450,000 weekly paid rides, nearly doubling previous figures, surpassing Tesla in the robotaxi sector. Waymo operates in multiple cities and is deemed "10x safer than human drivers."

Phia — Phoebe Gates, daughter of Bill Gates, raised $30M for her startup, which leverages AI for online shopping. The funding highlights growing interest in tech-driven retail solutions and positions Phia as a key player in AI-powered e-commerce.

Printerior — A University of Missouri startup, focusing on additive manufacturing from recycled plastic, aims for $10M revenue by 2026 by expanding and automating production and R&D.

TEAMING UP

Startups joining forces via partnerships or joint projects this week:

Disney & OpenAI — Disney has partnered with OpenAI to enable Sora to produce AI-generated videos featuring Disney characters. This collaboration, effective marks a significant step in using AI for creative content in entertainment.

IN THE MONEY

Companies that raised money in the past week and why they matter

Massive Deals

Saviynt — The identity security company raised $700M in Series B at a $3B valuation led by KKR to enhance its AI-driven platform focusing on identity governance for AI adoption, serving over 600 global enterprises.

Unconventional AI — Ex-Databricks AI head Naveen Rao, raised $475M seed at a $4.5B pmv, co-led by Andreessen Horowitz and Lightspeed, to develop energy-efficient AI computers. Potential total raise of $1B.

Fervo Energy — The U.S.-based geothermal energy company secured $462M led by B Capital with Google backing to develop projects like the 500-megawatt Cape Station in Utah. IPO rumors.

Boom Supersonic — The Colorado-based company raised $300M to commercialize its Superpower stationary turbine, with deliveries starting in 2027.

K2 Space — The U.S.-based satellite manufacturer founded in 2022 raised $250M in Series C at a $3B valuation, plans to scale to 100 high-power satellites annually.

Harness — The AI-powered software delivery platform hit a $5.5B valuation following a $200M funding round led by Goldman Sachs, with over $250M in ARR and growth at 50%+. Planning an IPO.

Fal — The New York-based AI infrastructure provider serving clients like Adobe and Shopify raised $140M in Series D led by Sequoia, tripling its valuation to $4.5B, with ARR surpassing $200M.

Large Deals

Steelhead Technologies — The U.S.-based ERP software provider for metal finishers and fabricators secured $84M from Mainsail Partners to expand AI-driven tools. 17% annual growth since 2021.

Blue Current — The silicon solid-state batteries company secured over $80M Series D extension led by Amazon to advance its silicon composite battery platform.

Serval — The IT automation company raised $75M in Series B at a $1B valuation led by Sequoia, Automates over 50% of IT tickets and plans to enhance AI capabilities.

OnCorps AI — The Boston-based AI platform for fund operations raised $55M led by Long Ridge Equity to support product innovation, expand marketing teams, and scale infrastructure for automating reconciliation and financial report reviews

Medra — The AI-driven lab automation platform raised $52M in Series A to revolutionize drug discovery with its Physical AI Scientist platform, automating experiments and integrating AI for enhanced pharma R&D efficiency.

Esusu — The New York-based fintech platform raised $50M Series C at $1.2B valuation to expand services and introduce Pay, helping renters build credit scores.

Solve Intelligence — The AI-driven patent preparation company secured $40M Series B led by Visionaries to launch 'Charts' litigation product, serves 400+ IP teams globally.

Bobyard — The San Francisco-based AI platform for construction takeoffs and estimates raised $35M Series A led by 8VC to enhance AI models and expand trades.

Ritten — The Philadelphia-based AI-powered behavioral health management platform raised $35M Series B led by Five Elms Capital to boost AI workflows, customer support.

Smaller Deals

Prime Security — The cybersecurity firm focusing on autonomous AI agents for product security raised $20M Series A led by Scale Venture Partners, with clients like PayPal and Bumble, total funding $26M.

Resemble AI — The CA-based AI startup raised $13M in strategic funding. Specializing in AI detection of deepfakes with its DETECT-3B Omni model, backed by Sony Ventures and Comcast.

AnySignal — The radio technology company for space and defense raised $24M Series A, planning to expand from 40 to 100+ employees and scale production to 1,000-2,000 radios p/a.

SuperCircle — The U.S.-based AI-driven textile waste management platform raised over $24M led by Foundry Group, having diverted over 6 million textiles from landfills, targeting 1B by 2030.

RelationalAI — The New York-based decision intelligence company raised $22.5M from Snowflake Ventures and AT&T Ventures to enhance its GenAI-native system with specialized LLMs.

Quilt — The Redwood City-based customizable heat pumps startup raised $20M Series B led by Energy Impact Partners and Galvanize, with nearly 1,000 units across 16 U.S. states.

Allonnia — The Boston-based bio-ingenuity company secured over $20M Series A extension, totaling over $100M, to rollout D-Solve for mineral recovery and PFAS treatment.

EXIT WATCHING

Mergers & Acquisitions and IPOs

IBM — Acquiring Confluent for $11B to boost cloud computing amid rising AI demand; deal includes Confluent's CEO joining IBM, aligning with IBM's cloud strategy.

Netflix — Acquiring Warner Bros. for $82.7B to enhance user choice and optimize operations; backed by $59B in bank financing, includes a $5.8B breakup fee.

OpenAI — Acquiring Neptune, a startup focused on AI model training tools, to integrate monitoring and debugging capabilities into OpenAI's training processes.

Meta — Acquiring Limitless, an AI wearable startup known for its AI-powered pendant that records conversations, to advance personal superintelligence.

Anthropic — Acquired Bun, a fast JavaScript runtime, to enhance Claude Code with AI software development. CC recently reached $1B in run-rate revenue.

Bending Spoons — Acquired ticketing giant Eventbrite for $500M, well below its $1.76B IPO valuation, at $4.50 p/share premium, aligns with its turn-around strategy.

Metronome — Stripe acquired Metronome, a leading monetization solutions provider, to leverage Stripe's infrastructure to enhance Metronome's product offerings.

IPO Watch

Open or upcoming IPOs to watch:

Fervo Energy — The U.S.-based geothermal energy company secured $462M led by B Capital with Google backing to develop projects. IPO rumors are circulating.

Harness — The San Fran-based AI DevOps company reached a $5.5B valuation after a $240M Series E led by Goldman Sachs, with plans to expand R&D and international presence toward an eventual IPO.

THE FUNDING BUZZ

VC & PE Activity To Watch

Tiger Global — The NYC-based VC firm is raising a $2.2B fund, PIP 17, with a cautious strategy amid high AI valuations. This follows successes from PIP 16, including investments in OpenAI and Waymo.

General Catalyst — Developed a $1.5B AI roll-up engine targeting low-margin service industries for automation. By combining AI talent with private equity expertise, it aims to transform a $16T market.

MarcyPen Capital Partners — JAY-Z's firm and Hanwha AM have launched a $500M JV fund named MarcyPen Asia. Targeting high-growth Korean consumer and culture companies.

Factorial Capital — Closed a $25M Fund II to invest in frontier AI startups, building on its initial $10M Fund I, founded by Matt Hartman with a portfolio including Modal valued at $1B.

Kabir Narang — Former B Capital partner Kabir Narang has left to create a new AI-focused investment platform to ride the AI boom, though B Capital will continue its Asia strategy.

BlackRock — Ben Powell highlights the beginning of an AI infrastructure spending boom, with hyperscalers set to boost capital investments.

TECH BUZZ DIRECTORY

Featured Products*

SEO Bot — A fully autonomous "SEO Robot" with AI agents for busy founders.

Memelord — Meme Software for marketing memes, tech memes, & sales memes.

Otonomos — Incorporate your Delaware C-corp or tax advantaged foundation and get 5% OFF.

FOR INVESTORS

Open Deals

Investors– request an intro to startups - invest@techbuzz.ai.

Before we restart our placements of raising startups, we’re sharing an open call to send in your own company. Just shoot us an email with a deck and we may feature you in this bulletin.

For detailed pitch materials, please email invest@techbuzz.ai with your deck.

🔥 — hot deal!

⏰ — leaving soon.

FOR EMPLOYERS

Job Candidates

Employers– request an intro to candidates - jobs@techbuzz.ai

*Note: Some products above have affiliate links which we earn a percentage from qualifying sales.

The Tech Buzz

| Get the daily newsletter that helps you understand the tech ecosystem sent to your inbox.

By submitting your email, you agree to our Terms and Privacy Notice.

More Newsletter Posts