the tech buzz

Special Edition: What To Watch in Technology in 2026

Special Edition: What To Watch in Technology in 2026

2026 Trends To Watch in Tech, AI, & Consumer Electronics with CES 2026

IN PARTNERSHIP WITH

WHAT’S INSIDE THIS SPECIAL EDITION

Trends and product launches to watch in consumer technology, AI, robotics, wearables and sensors, home tech and extended reality in 2026, including:

Upcoming Platform AI rollouts: Apple Intelligence (iOS), Microsoft Copilot (Windows & Office), and Google Gemini (Android) moving AI into core system layers

On-device silicon upgrades: Apple A-series chips, Qualcomm’s next Snapdragon platforms, and Samsung’s Exynos 2600 (2nm) prioritizing local AI inference

Apple hardware intelligence expansion: Larger Neural Engine capacity enabling continuous, system-level on-device assistance

Next-generation wearables: Smartwatches with improved blood-pressure trends, sleep-apnea indicators, and recovery metrics

Sensor-embedded apparel: Nike and Adidas footwear incorporating gait and impact analysis

Display tech maturation: Mainstream RGB Mini-LED TVs (Samsung, TCL) and next-gen LG OLED panels with better efficiency and longevity

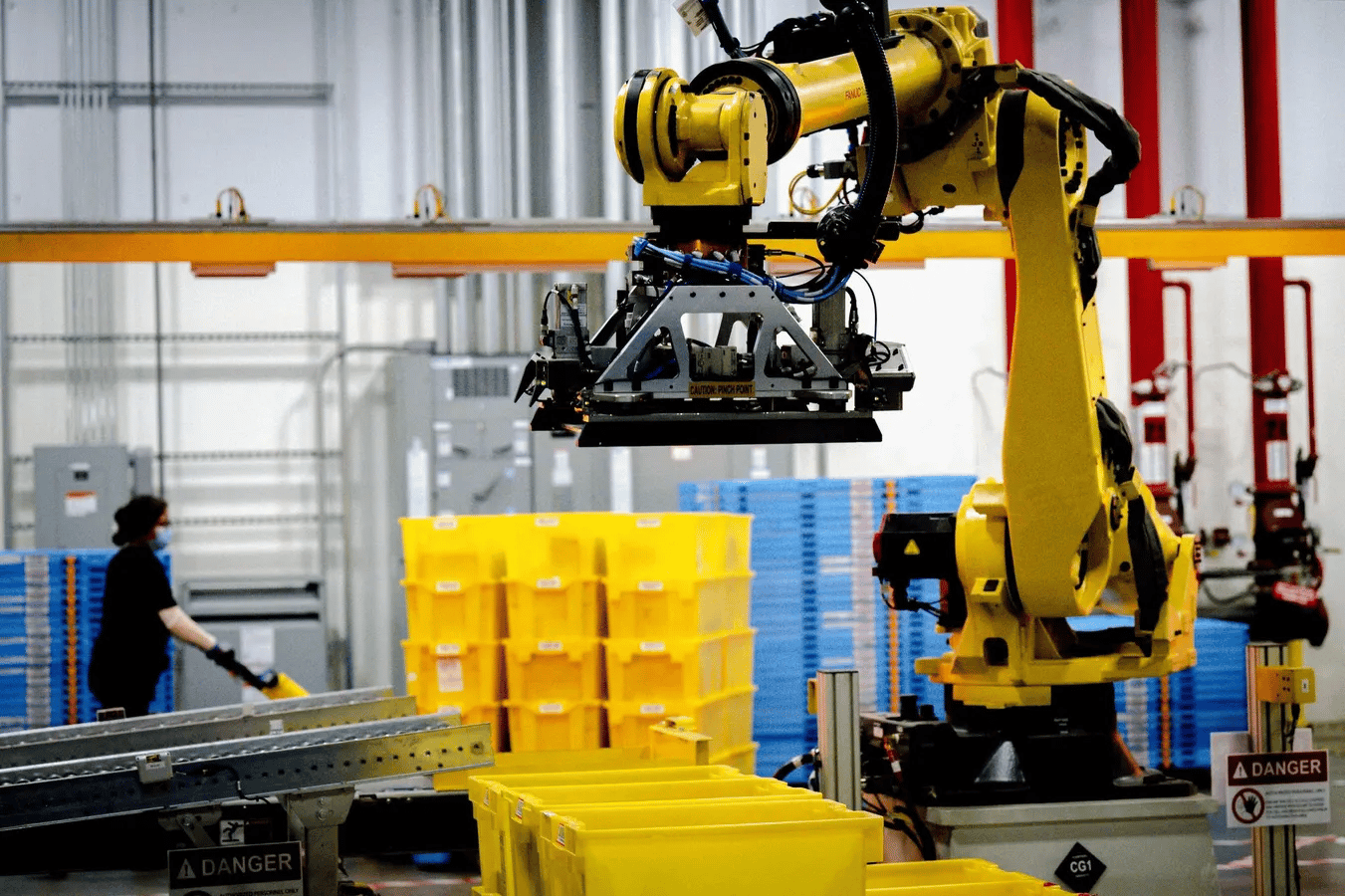

Industrial and service robotics deployments: Vision-based robots in Amazon and Walmart fulfillment centers and logistics robots in hospitals, hotels, and airports

XR refinement: Apple’s next Vision device repositioned as a professional spatial workstation, alongside Meta’s enterprise-focused XR platforms

IN PARTNERSHIP WITH SMARTASSET

The Top 10 Wealth Management Firms of 2025

Finding the top financial advisor in the United States means choosing between thousands of options. Whether you're looking for help with retirement, wealth management or tax planning, the U.S. is home to thousands of advisors that can potentially meet your specific needs.

SmartAsset ranked the top 10 wealth management firms in the U.S. based on AUM, fees, and more.

Trends To Watch in Technology in 2026

Shirin Unvala For The Tech Buzz

Looking back at 2025, almost every major platform vendor announced some iteration of an AI‑first strategy. Apple rolled out Apple Intelligence across iOS, Microsoft embedded Copilot throughout Windows and Office, Google pushed Gemini deeper into Android, and Samsung reframed its flagship phones around on‑device inference. In practice, however, many of these features shipped with obvious constraints: limited scope, partial reliance on cloud processing, and conservative defaults designed to avoid error. The technology was operational, but often less broadly and less smoothly than early marketing suggested. Users became more discerning, testing the limits of these systems and learning where they truly added value—or where they fell short.

This context is relevant because it frames what lies ahead in 2026. This is set to be a year defined by breakthrough innovations; a consolidation cycle in which technologies hitting the stage or heavily promoted between 2023 and 2025 are refined and delivered at scale. This next phase is perhaps “less flashy,” but certainly still meaningful: fewer ambitious claims, more systems that actually hold up under daily use, and a growing sense that AI is moving from concept to expectation. As Deloitte’s 2026 tech forecast puts it, “the real power of the technology lies in the practical work of making AI useful at scale and achieving the productivity gains that organizations are aiming for.”

AI At The Center

Artificial intelligence sits at the center of that transition. The most important AI developments heading into 2026 are architectural. Over the course of the year, Apple steadily moved more inference onto devices, lessening latency and privacy tradeoffs. Microsoft stopped positioning Copilot as a destination and instead treated it as a layer embedded directly into file systems, email, spreadsheets, and operating system workflows. Salesforce, Adobe, and ServiceNow followed in a similar vein, tying AI features directly to existing enterprise actions rather than abstract assistants. These changes reflect a subtle but crucial shift: intelligence is no longer something you summon; it quietly underpins the tools you already use.

In 2026, that phenomenon escalates. On Apple hardware, expanded neural engine capacity and higher baseline memory enable more persistent system‑level intelligence. Tasks like sorting notifications, organizing files, summarizing long‑running message threads, and surfacing contextually relevant information happen locally and continuously, without the user explicitly prompting for assistance. On Windows, Copilot increasingly maintains task continuity across sessions, tracking projects over days or weeks rather than responding to isolated, one‑off prompts. For enterprise users, AI becomes something that quietly monitors workflows, flags anomalies, and prepares drafts rather than something employees “talk to.” The emphasis is on subtle augmentation rather than overt spectacle.

Reliability Over Autonomy

What’s significant is actually what does not happen. There is no meaningful move toward fully autonomous systems operating without oversight. Instead, vendors double down on reliability, bounded behavior, and integration with systems companies vest trust in. The ambition narrows, but the utility increases. As industry experts observe, 2026 is increasingly the year when AI moves beyond proof‑of‑concept pilots into sustained operational value—supporting managers, analysts, and engineers in everyday work rather than dazzling them with novelty.

That same delivery‑first mindset carries into consumer hardware. By 2026, new smartphone form factors are no longer a primary industry focus. Instead, the competition centers on performance per watt, sustained processing under AI workloads, and battery resistance. Samsung’s Exynos 2600, expected to debut in select Galaxy models built on a 2‑nanometer process, is emblematic of this shift. The benefit is not mere speed, but the ability to run increasingly complex local inference without the side effect of draining power or overheating.

Qualcomm’s next Snapdragon platforms follow a similar logic, prioritizing sustained on‑device intelligence over peak benchmark results. Apple’s own A‑series chips continue along that trajectory, with better image processing, language understanding, and contextual analysis happening entirely offline. The result is not a radically different phone, but one that feels more responsive and capable in daily use. The changes are incremental, but cumulative, creating a quieter revolution in how users experience their devices day‑to‑day.

The Wearables and Sensor Tech Upgrade

Wearables evolve in much the same way. Rather than chasing speculative health features, companies focus on improving the accuracy and consistency of existing metrics. By 2026, leading smartwatches are expected to offer more reliable blood pressure trend readings, refined sleep apnea indicators, and better correlation between activity, recovery, and cardiovascular signals. These are not diagnostic tools, but they move wearables closer to being trusted early‑warning systems rather than lifestyle accessories.

That expansion extends beyond what you can wear on your wrist. Athletic brands such as Nike and Adidas continue toying with sensor‑sensitive footwear, using gait analysis and impact data to generate injury prevention and performance optimization. The broader implication is that health monitoring becomes disseminated across devices people already wear, so that readings are collected on a passive basis as the user goes on with their daily routine. The ecosystem of connected devices begins to form a web of contextual intelligence, informing users in ways that feel seamless rather than disruptive.

Home Entertainment Goes Physical

In home entertainment, the focus shifts decisively away from resolution and toward physical performance limits. By 2026, RGB Mini‑LED televisions from Samsung, TCL, and others reach mainstream price tiers, offering improved coloration and brightness without the burn‑in risks associated with OLED. LG’s next‑generation OLED panels, meanwhile, improve efficiency and longevity, addressing long‑standing worries about durability as processing demands increase. The result is a premium TV market that finally feels mature, with fewer tradeoffs and more consistency across viewing conditions.

A Robotics Industrial Revolution

Robotics follows a different but equally pragmatic trajectory forward. The most significant deployments in 2026 are not consumer‑facing. Walmart and Amazon continue putting into use robotic picking and sorting systems across fulfillment centers, not to erase human labor, but to reduce bottlenecks and improve production. Vision‑based robots capable of handling irregular objects become more common, quietly reshaping logistics economics behind the scenes. In service environments such as hospitals, hotels, and airports, robots increasingly handle narrow logistical tasks like deliveries, cleaning, and inventory transport. These systems succeed precisely because they are constrained. Meanwhile, humanoid robots remain limited to pilot programs in controlled industrial settings, performing repetitive tasks under supervision. Their importance lies more in long‑term research than immediate disruption.

Extended Reality Levels Up

Extended reality, long saddled with inflated expectations, finally finds a sustainable identity. Apple’s next Vision device iteration is positioned less as a consumer lifestyle product and more as a professional spatial workstation. Improvements in weight, comfort, and software support make it more usable for designers, engineers, and content creators who already rely on multi‑monitor setups. Meta, for its part, continues pushing XR into training, fitness, and enterprise collaboration, where clear use cases justify the hardware. What’s changed is not the technology itself, but the framing. XR in 2026 is not about replacing phones or laptops. It is about solving specific problems better than existing tools, and adoption reflects that narrower ambition.

The Financial Picture

In finance, the story is even quieter. By 2026, blockchain’s speculative phase is largely behind it, replaced by infrastructure‑level deployment. Tokenized treasury instruments gain broader institutional adoption, while blockchain‑based settlement systems reduce reconciliation times in cross‑border transactions. Digital identity and audit tools quietly replace legacy systems in logistics, supply chains, and compliance workflows. For end users, much of this is invisible, which is precisely why it succeeds.

Health Technology

Health technology rounds out the landscape. Wearables and remote monitoring platforms shift from passive tracking toward pre‑emptive detection and contextual insight. Continuous temperature, heart rate variability, and metabolic indicators are increasingly analyzed for change over time rather than absolute values. In clinical settings, AI tools aid with imaging triage and workflow prioritization, supporting clinicians rather than replacing them. Progress here is cautious, shaped as much by regulation as by technology, but the incremental improvements steadily build a more reliable health ecosystem.

The Takeaway

Taken together, these developments converge into a single theme: There will be no defining gadget or standout breakthrough that encapsulates 2026. Instead, the year will be remembered by pragmatic AI-powered and physical technology-enabled applications in real‑world settings that quietly, but materially, improve how people live and work through increased reliability. AI is entering a crucial trust-building phase in which it still has a lot to do to prove to consumers and business that it can reliable form a deeper part of their lives moving forward. The hype of the initial boom may be subsiding this year to be replaced by a more measured and cautious stage of testing, and innovation as companies consolidate and focus on finding elusive product-market-fit and niches where they are seen as trusted service providers.

Follow Us On Social Media

Instagram: https://www.instagram.com/thetechbuzz.ig/

The Tech Buzz

| Get the daily newsletter that helps you understand the tech ecosystem sent to your inbox.

By submitting your email, you agree to our Terms and Privacy Notice.

More Newsletter Posts

Newsletter