TL;DR

- Export controls hit AMD hard with a significant revenue impact.

- Revenue grew to $7.69 billion vs. $7.42 billion estimate, reflecting strong market presence.

- AI sector remains challenging with competition and regulatory hurdles.

- Strategic focus on AI chip advancement and regulatory navigation is critical.

Advanced Micro Devices (AMD) recently reported quarterly earnings that fell short of expectations, despite surpassing revenue forecasts. The shortfall, influenced by U.S. export restrictions, raises significant questions about AMD's ability to navigate international sales barriers and maintain growth amid stiff competition from Nvidia, especially in the AI GPU sector.

Opening Analysis

Advanced Micro Devices (AMD) continues its strategic pivot towards artificial intelligence (AI) chip dominance, but export restrictions threaten to derail these plans. In its latest quarterly earnings, AMD disclosed earnings of 48 cents per share, which fell short of the 49 cents anticipated by analysts. Despite this, the company's revenue exceeded expectations at $7.69 billion, surpassing the forecasted $7.42 billion. However, the impact of U.S. export controls has been a major impediment, cutting into AMD's AI business revenue significantly.

Market Dynamics: Competitive Landscape Shifts

AMD is the second-largest player in the rapidly growing AI graphics processing unit (GPU) market, a sector dominated by Nvidia. The competitive landscape is increasingly favorable to AMD as major AI clients like Meta and OpenAI seek alternatives to Nvidia's premium-priced offerings. However, AMD's growth potential is curbed by U.S. export controls to China, which eliminated significant MI308 chip sales, cutting $800 million from expected revenue in the last quarter.

Technical Innovation: Breakthrough Implications

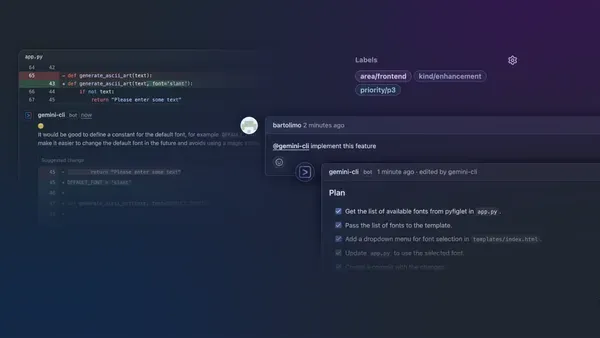

Despite setbacks, AMD continues to innovate with its AI-focused Instinct MI400 series set to launch next year. These advanced chips promise to match Nvidia's offerings in both training and inference applications, a sector critical for AI deployment. Additionally, AMD has secured commitments from major clients such as OpenAI, signaling trust in its technical capabilities.

Financial Analysis: Metrics, Valuations, and Growth Trajectories

In the financial arena, AMD's data center segment, encompassing both CPUs and GPUs, reported a 14% revenue increase annually, driven by expanding demand in AI server workloads. The gaming division also boomed, rising by 73% year-over-year, buoyed by AMD's Ryzen Zen 5 CPUs. Nevertheless, export regulation costs have pinched margins, with adjusted gross margins reported at 43%, down from a potential 54% without these restrictions.