The fusion energy sector has attracted a staggering $7.1 billion in private investment, with just 13 companies capturing the lion's share of funding as they race to commercialize the same nuclear reaction that powers the sun. Commonwealth Fusion Systems alone has raised nearly $3 billion, while breakthrough achievements at government labs have validated the underlying science and triggered an investment gold rush.

The fusion energy revolution is no longer a distant dream — it's a $7.1 billion reality reshaping the global energy landscape. What was once dismissed as perpetually "20 years away" has transformed into a competitive race among well-funded startups, each pursuing different approaches to harness the same nuclear reaction that powers the sun.

The investment surge follows a watershed moment in December 2022, when the U.S. Department of Energy's National Ignition Facility achieved scientific breakeven — producing more energy from a controlled fusion reaction than the lasers delivered to ignite it. This breakthrough validated decades of scientific theory and unleashed a wave of private capital.

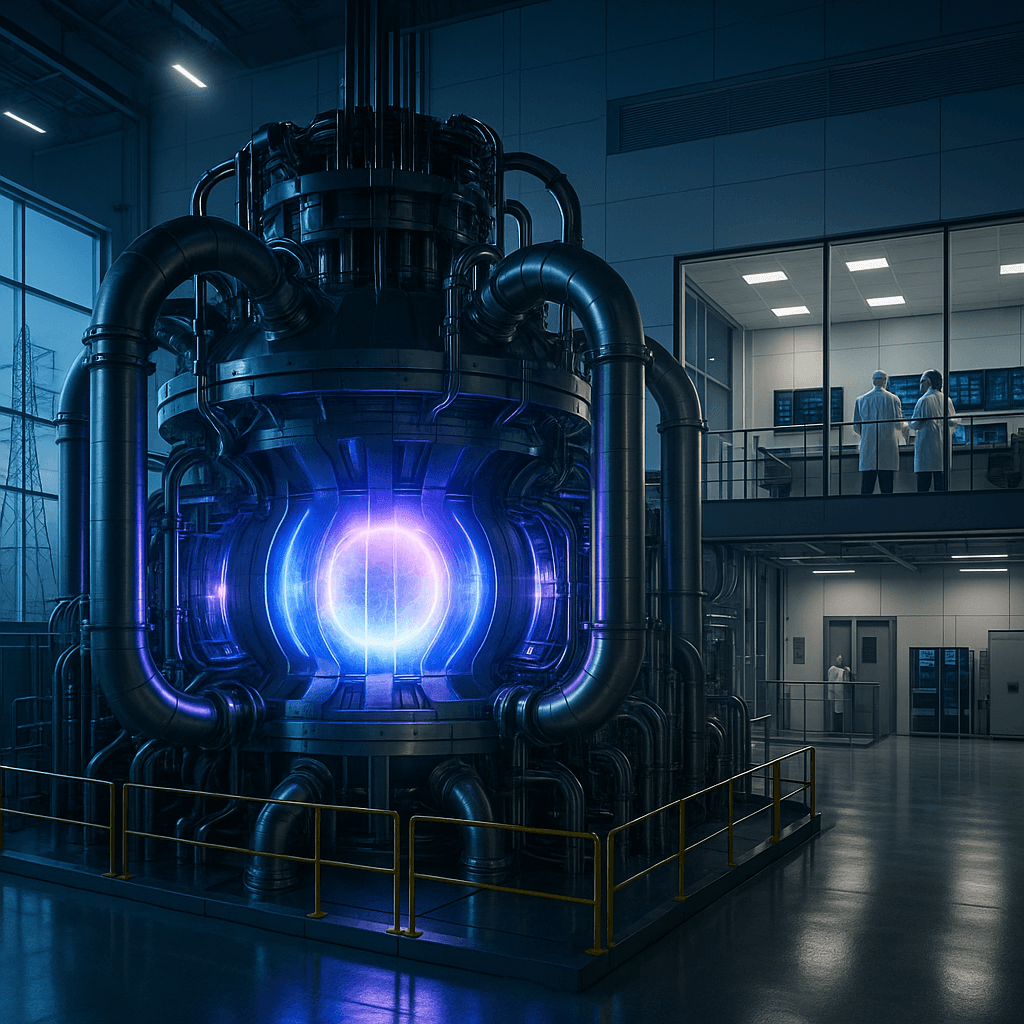

Commonwealth Fusion Systems dominates the funding landscape, having raised nearly $3 billion including an $863 million Series B2 that closed in August. The Massachusetts-based company, co-founded by MIT researcher Bob Mumgaard, expects its Sparc demonstration reactor to be operational by late 2026. "We're not just building a power plant — we're building the future of energy," Mumgaard told investors during the funding announcement.

The company's tokamak design resembles a doughnut wrapped in high-temperature superconducting tape that generates powerful magnetic fields to contain superheated plasma. Google has already agreed to purchase half the output from CFS's first commercial facility, Arc, which will produce 400 megawatts near Richmond, Virginia.

TAE Technologies, formerly Tri Alpha Energy, follows with $1.79 billion raised since its 1998 founding. The company uses a field-reversed configuration where plasma shots collide and are stabilized by particle beams. Google contributed to TAE's $150 million funding round in June, marking the search giant's second major fusion bet.

Helion Energy has set the most aggressive timeline, promising to deliver electricity to Microsoft by 2028. The Everett, Washington-based company raised $425 million in January and uses a field-reversed configuration that directly harvests electricity from the plasma's magnetic field. CEO David Kirtley turned on the company's Polaris prototype reactor as investors watched, demonstrating progress toward their Microsoft deadline.