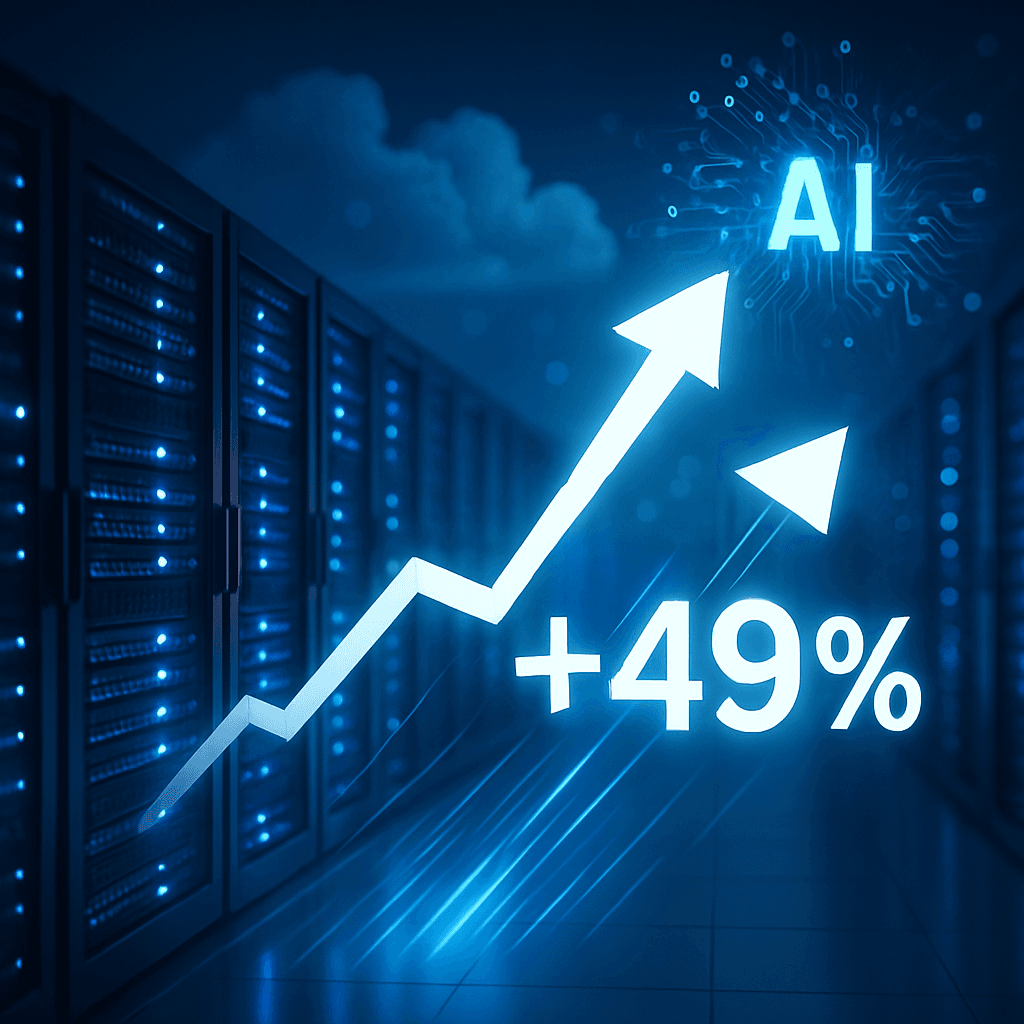

Google Cloud CEO Thomas Kurian just dropped a bombshell at Goldman Sachs' tech conference, revealing the search giant has already generated billions in AI revenue. With a $106 billion backlog growing faster than revenue and over 50% converting within two years, Google's AI monetization playbook is finally paying off in a big way.

Google Cloud CEO Thomas Kurian just confirmed what Wall Street's been waiting to hear: the AI gold rush is real, and Google's cashing in big time. Speaking at the Goldman Sachs Communacopia and Technology Conference in San Francisco, Kurian delivered the kind of concrete revenue validation that's been missing from most AI hype cycles. "We've made billions using AI already," he stated flatly, according to CNBC.

The numbers behind that claim are staggering. Google Cloud's customer backlog has swelled to $106 billion and it's growing faster than the division's actual revenue. More than half of that pipeline will convert to real money within 24 months, Kurian revealed. That's a massive acceleration from where Google stood just two years ago when critics questioned whether the company could translate its AI research dominance into actual dollars.

Google's monetization playbook breaks down into three core strategies that are working better than anyone expected. The consumption model leads the charge, where enterprise customers pay by usage - whether that's GPU time, tensor processing units, or token-based pricing for language model calls. "Whether it's a GPU, TPU or a model, you pay by token — meaning you pay by what you use," Kurian explained. This pay-as-you-go approach removes the traditional barrier of large upfront commitments that slowed enterprise AI adoption.

The subscription play is equally aggressive. Google Workspace users are getting upgraded to AI-powered tiers, while the company's new Google AI Ultra subscription commands $249.99 monthly for premium AI access and 30TB storage. That's a massive jump from the basic $1.99 Google One tier, showing how Google's pricing customers based on AI value rather than simple storage.

But it's the upselling machine that's really driving growth. Once customers taste Google's AI capabilities, they consume more services across the platform. "That leads customers who sign a commitment or contract to spend more than they contracted for, which drives more revenue growth," Kurian noted. It's the classic cloud playbook, but supercharged by AI's stickiness.

The competitive landscape tells the real story. While Microsoft and still dominate overall cloud market share, Google Cloud is growing faster than both. The recent $10 billion, six-year cloud deal with shows enterprise customers are willing to diversify away from AWS and Azure when Google's AI capabilities offer clear advantages.