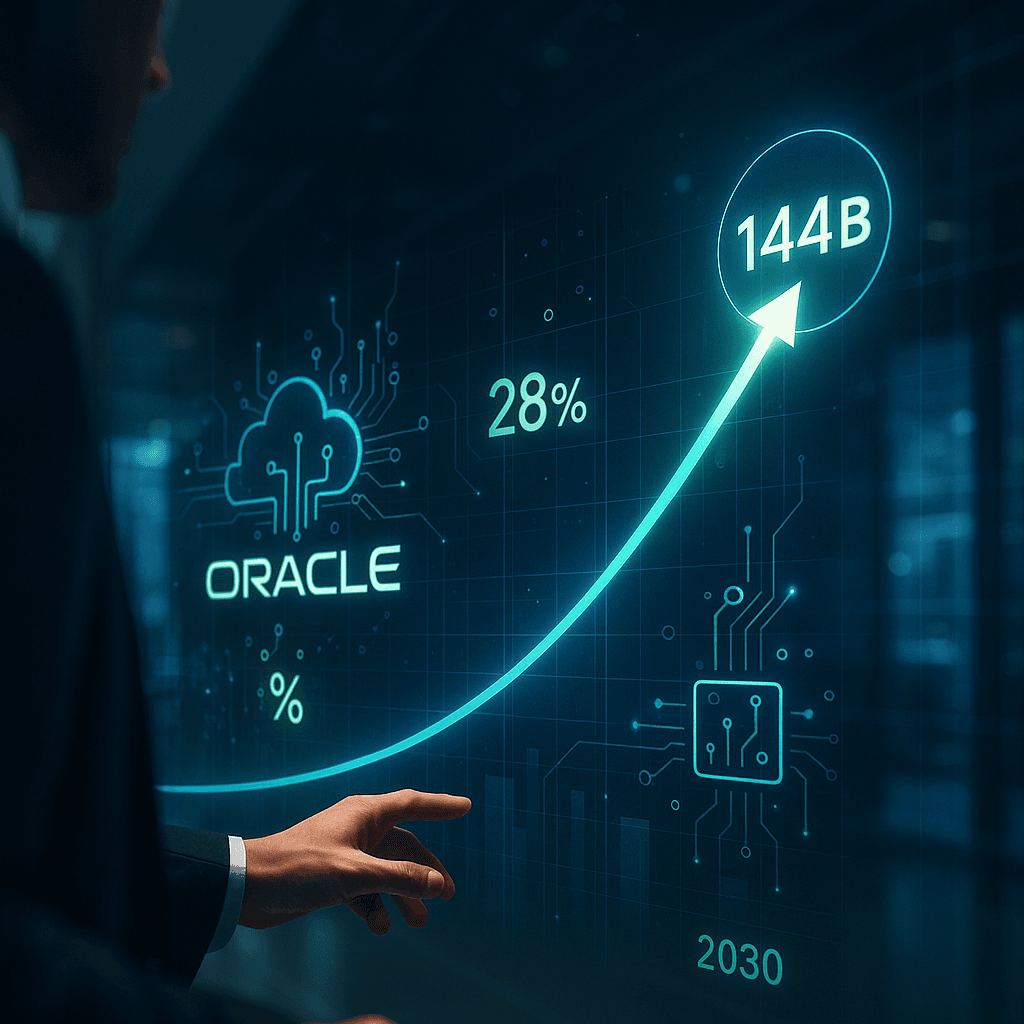

Oracle just delivered the kind of earnings call that makes Wall Street stop and stare. Despite missing on current quarter numbers, the database giant's AI-driven cloud projections sent shares rocketing 28% after hours - potentially the biggest single-day gain since 1999. With a roadmap projecting $144 billion in cloud revenue by 2030, Oracle isn't just competing with the hyperscalers anymore - it's positioning itself as their critical infrastructure partner.

Oracle just rewrote the enterprise infrastructure playbook, and Wall Street can't contain its excitement. The database giant's stock exploded 28% in after-hours trading Tuesday, setting up what could be the biggest single-day rally since the dot-com boom crashed in 1999.

The catalyst wasn't Oracle's actual Q1 results - those came in below expectations. Instead, analysts were transfixed by projections that would transform Oracle from a legacy database company into an AI infrastructure powerhouse rivaling Amazon, Microsoft, and Google.

"We're all kind of in shock, in a very good way," Deutsche Bank's Brad Zelnick told CEO Safra Catz during the earnings call. Guggenheim's John DiFucci said he was "blown away," while TD Cowen's Derrick Wood called it a "momentous quarter."

The numbers behind the analyst euphoria are staggering. Oracle's cloud infrastructure division, currently generating $10 billion annually, is projected to hit $18 billion this fiscal year - a 77% jump. But that's just the beginning. The company outlined a roadmap reaching $32 billion by fiscal 2027, then $73 billion, $114 billion, and ultimately $144 billion by 2030.

"There's no better evidence of a seismic shift happening in computing than these results," Zelnick added, capturing the sentiment that Oracle isn't just riding the AI wave - it's becoming essential infrastructure for it.

The transformation is already showing in Oracle's contract pipeline. The company signed four multibillion-dollar deals with three customers in Q1 alone, including a massive agreement with OpenAI to develop 4.5 gigawatts of US data center capacity. That partnership, announced in July, signals how AI companies are turning to Oracle as hyperscalers struggle with capacity constraints.

Oracle's remaining performance obligations - contracted revenue not yet recognized - jumped 359% year-over-year to $455 billion. That figure represents committed business that will flow through Oracle's books over the coming years, providing unprecedented revenue visibility.