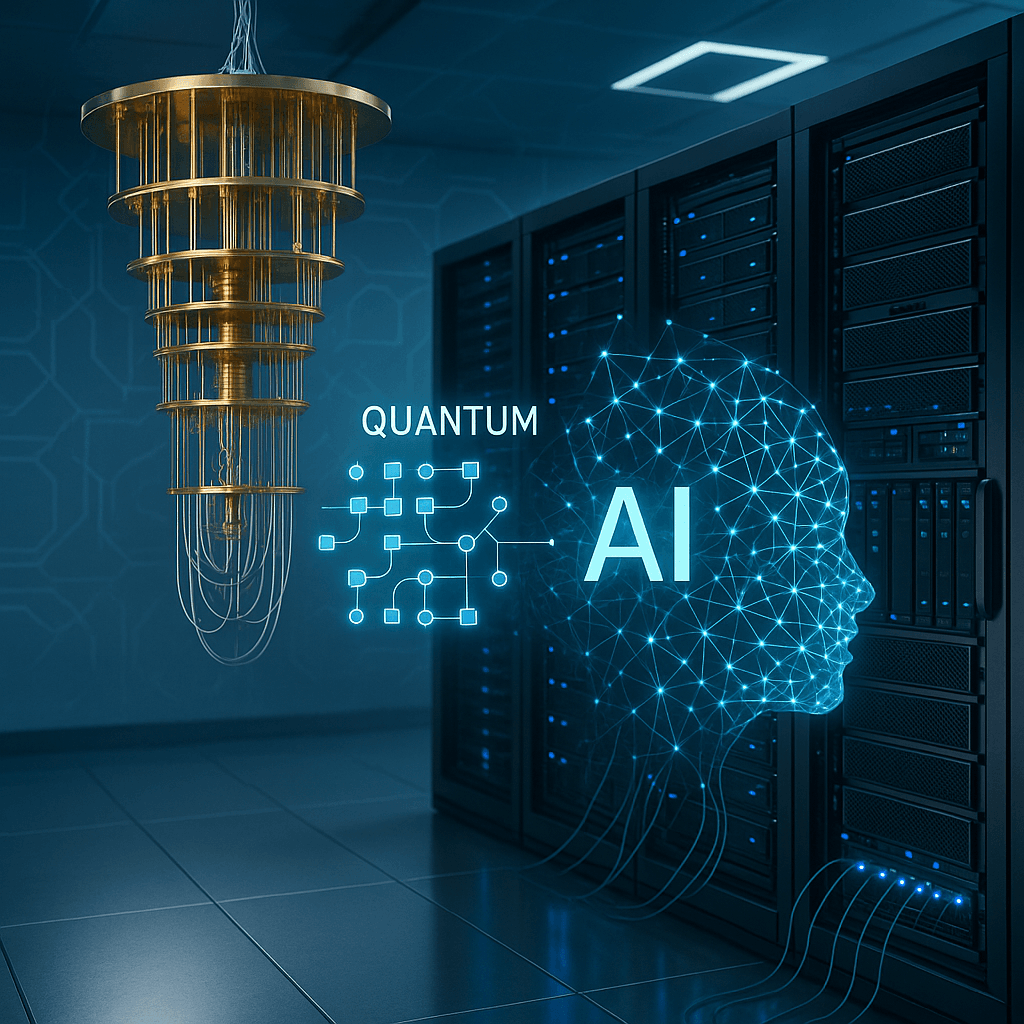

IBM and AMD just announced a strategic partnership to develop hybrid quantum-AI computing architectures, marking a bold attempt to leapfrog Nvidia's dominance by betting on the convergence of two revolutionary technologies. The collaboration could reshape enterprise computing infrastructure as both companies seek to reclaim ground lost during the generative AI boom. (68 words)

IBM and AMD are making their biggest infrastructure bet yet, announcing a partnership that could fundamentally alter the computing landscape. The two tech giants are joining forces to develop hybrid architectures that merge IBM's quantum systems with AMD's AI-specialized chips, creating what they call the next frontier of enterprise computing.

The timing couldn't be more strategic. While Nvidia captured the AI infrastructure market with its GPU dominance, IBM and AMD found themselves watching from the sidelines as enterprise customers poured billions into generative AI deployments. Now they're banking on quantum-AI convergence to leapfrog the competition.

"Quantum computing will simulate the natural world and represent information in an entirely new way," IBM Chairman and CEO Arvind Krishna told reporters in a company statement. "By exploring how quantum computers from IBM and the advanced high-performance compute technologies of AMD can work together, we will build a powerful hybrid model that pushes past the limits of traditional computing."

The partnership targets what both companies see as quantum computing's commercialization moment. Unlike previous quantum initiatives focused on research applications, this collaboration aims to deliver scalable, open-source architectures accessible to enterprise developers. The focus areas include drug discovery, materials science, optimization problems, and logistics – sectors where classical computing hits fundamental limits.

AMD's participation brings critical AI acceleration capabilities to IBM's quantum infrastructure. The chipmaker's EPYC processors and Instinct accelerators will handle the classical computing portions of hybrid workloads, while IBM's quantum systems tackle problems requiring quantum advantage. This division of labor could prove crucial as enterprises seek practical quantum applications.

The move represents a significant strategic pivot for both companies. IBM has invested heavily in quantum research for over two decades but struggled to translate laboratory breakthroughs into commercial revenue. , meanwhile, gained market share against in traditional CPUs but missed the initial AI chip boom that propelled to a $2 trillion valuation.