TL;DR

- - Nvidia's H20 chips to re-enter China; competitors loom large.

- - AI chip market share predicted to drop to 54% in 2025 (Bernstein report).

- - U.S.-China relations impacting geopolitical and tech strategies.

- - Investing in AI tech requires navigating complex trade dynamics.

Nvidia's H20 chips are poised for a comeback in China following eased export restrictions. However, industry experts forecast a challenging reception due to heightened domestic competition and regulatory oversight. Understanding these dynamics is crucial for strategizing market entry and anticipating geopolitical impacts.

Opening Analysis

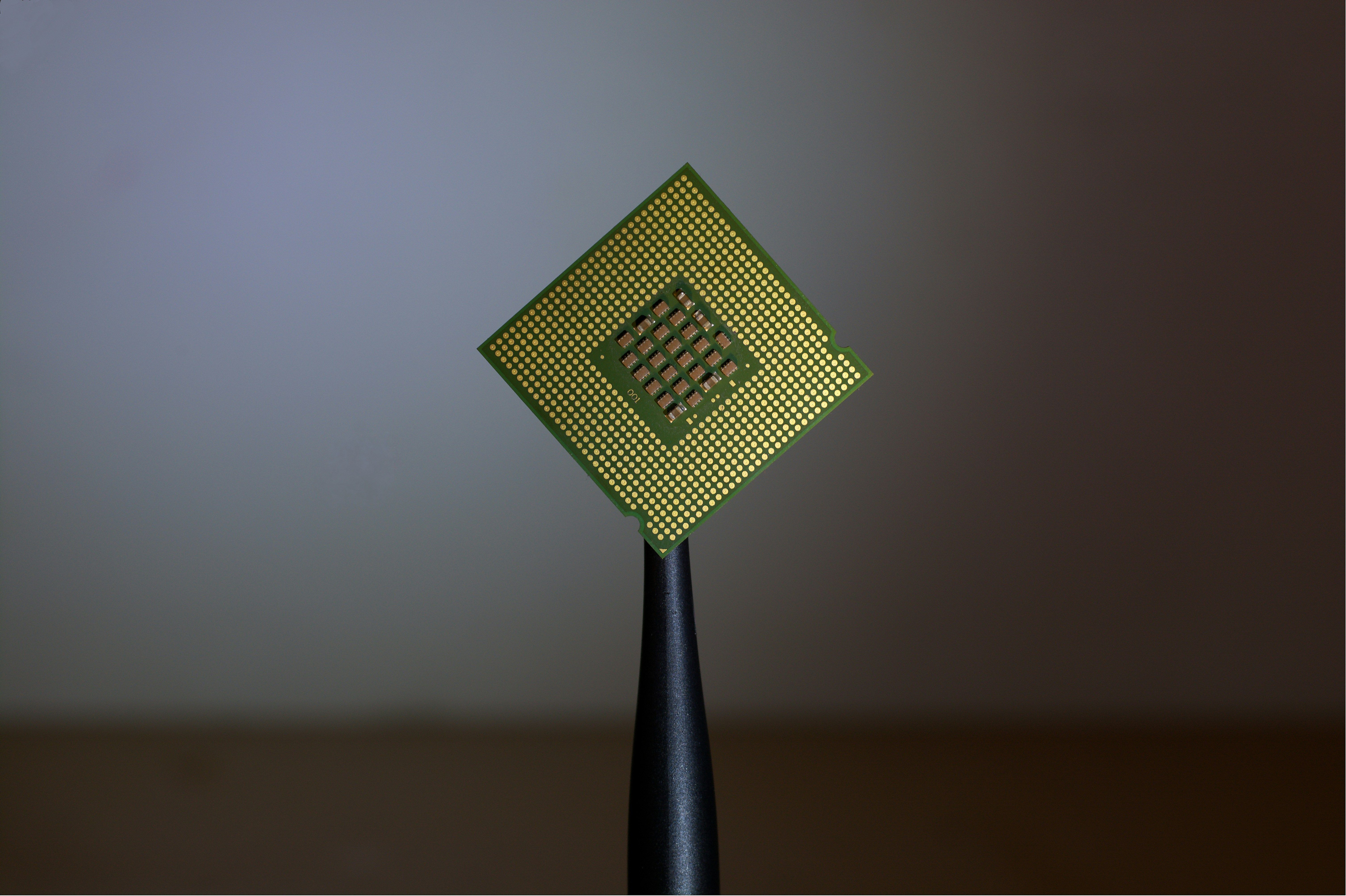

Nvidia is navigating a complex landscape with the anticipated return of its H20 chips to the Chinese market. Although the Trump administration has signaled an easing of restrictions, allowing Nvidia to re-enter this lucrative market, the chips are meeting new competition from local players like Huawei and Cambricon. According to Bernstein, Nvidia's AI chip market share in China is projected to decline from 66% in 2024 to 54% in 2025, marking a significant shift in market dynamics.

Market Dynamics

U.S. export restrictions had inadvertently bolstered domestic Chinese chipmakers, which, unburdened by the need to compete with U.S. firms' latest technologies, have expanded their market presence. The localization of China's AI chip market is expected to soar to 55% by 2027, creating a robust environment for homegrown firms. This shift challenges Nvidia to re-establish its competitive edge amid new regulatory hurdles and an exponentially growing local market.

Technical Innovation

Nvidia announced a "fully compliant" chip tailored for the Chinese market, but skepticism remains due to pervasive trade tensions. Chinese developers have advanced rapidly under these restrictions, posing substantive competition. The broader U.S. stance on chip export policy remains a wildcard, influencing technological leeway for companies like Nvidia.

Financial Analysis

Nvidia flagged potential billions in revenue losses due to the initial ban, but the strategic entry into China is poised to safeguard its financial standing. Yet, as competitors seize market share, Nvidia needs to reassess its market engagement strategies to optimize its revenue projections and maintain growth trajectories.

Strategic Outlook

While Nvidia's comeback may bolster its immediate financial health, longer-term success hinges on navigating geopolitical intricacies and cultivating strategic partnerships. The expected gradual easing of restrictions through potential "sliding scale" import policies could provide a favorable environment, yet this scenario presupposes shifts in U.S. trade policies and ongoing tech innovation to outpace China's burgeoning AI capacities.