TL;DR

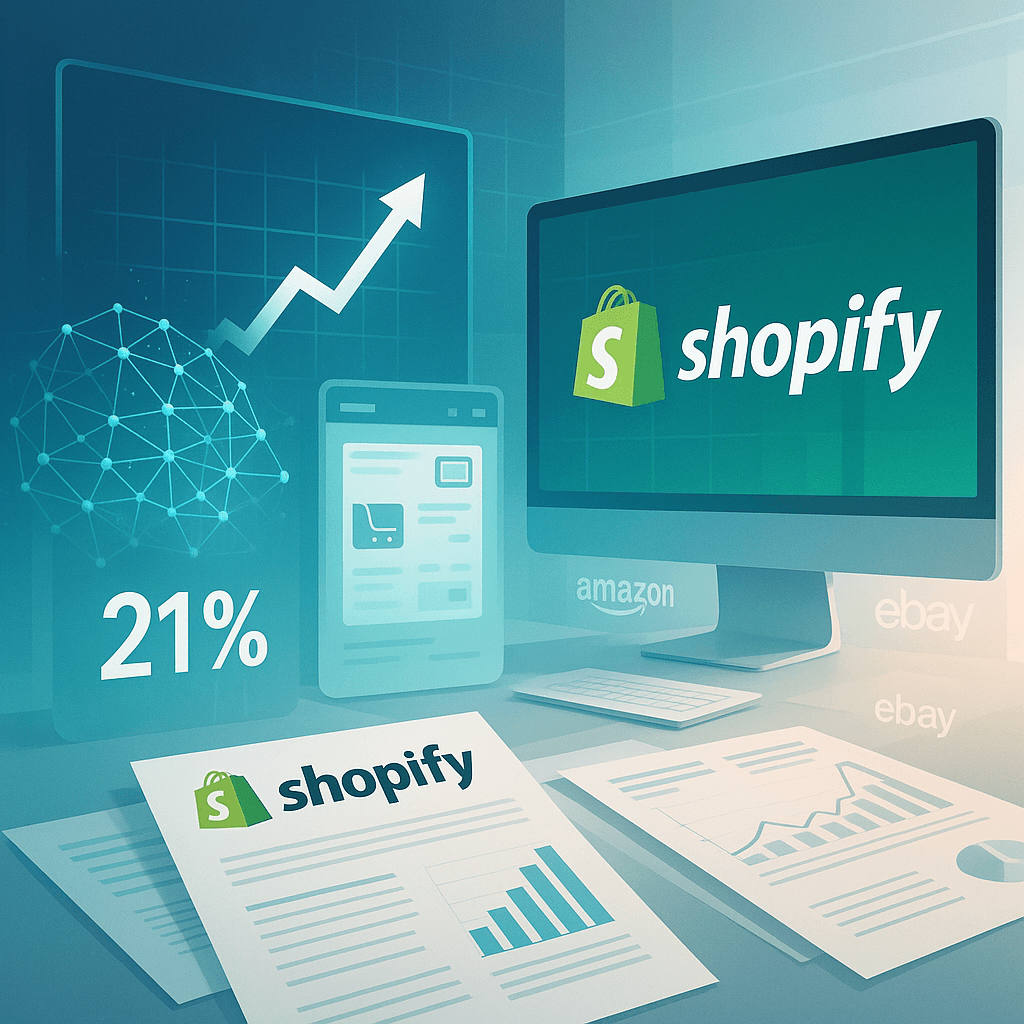

- - Shopify's stock jumped 20% due to strong Q2 performance

- - Q2 revenue hit $2.68B, surpassing the $2.55B consensus

- - AI integration enhances Shopify's e-commerce offerings

- - Strategic investments in AI promise long-term growth potential

Shopify’s stock has soared by 20%, reflecting investor confidence fuelled by upbeat earnings and promising forward guidance. With e-commerce playing an increasingly vital role, understanding Shopify's strategies and market maneuvers can provide a competitive edge.

Opening Analysis

Shopify’s embrace of innovative technology and strategic investment is reflected in its stellar Q2 performance. The e-commerce giant reported second-quarter sales of $2.68 billion, a 31% year-on-year surge, outpacing analysts' expectations of $2.55 billion. This assertive growth not only highlights Shopify's resilience amidst macroeconomic challenges but also underscores its emergence as a formidable player in the SaaS domain.

Market Dynamics

In the current competitive landscape, Shopify has not only outperformed market estimations but has also successfully insulated itself from potential tariff impacts under Trump's administration. Notably, while other retail peers like Amazon Amazon and eBay eBay also reported solid earnings, Shopify's agility in maneuvering economic adversities is especially commendable. CFO Jeff Hoffmeister emphasized that anticipated tariff impacts were factored into guidance but did not manifest, a testament to Shopify's strategic foresight.

Technical Innovation

Shopify's forward-looking technological advancements, especially in artificial intelligence, are setting new industry benchmarks. The roll-out of AI-driven tools, such as the 'AI store builder,' enhances Shopify’s value proposition by fostering an efficient and scalable e-commerce ecosystem. These efforts are not simply about maintaining parity with competitors but positioning Shopify at the forefront of AI commerce evolution.

Financial Analysis

Financially, Shopify’s net income leaped to $906 million, translating to 69 cents per share, compared to $171 million, or 13 cents per share, the previous year. Impressive gross merchandise sales (GMS) of $87.8 billion further exceeded Wall Street’s projections. These metrics reflect not only effective cost management strategies but also the effectiveness of Shopify's vast array of tools enabling merchant success.