Former TED curator Chris Anderson is launching a $300 million fund to tackle climate tech's notorious "valley of death" financing gap. The All Aboard Coalition brings together 16 major VCs to bridge the critical $100-200 million funding void that's been strangling promising clean energy startups just as they're ready to scale.

The climate tech sector just got a potential game-changer. Chris Anderson, the visionary who transformed TED from a niche conference into a global ideas platform, is now applying his network-building expertise to one of clean energy's most persistent problems: the "valley of death" funding gap that's been killing promising startups.

The All Aboard Coalition aims to raise $300 million by October specifically to write $100-200 million checks for climate companies ready to build their first commercial-scale projects. Unlike traditional project finance approaches, this fund will focus purely on equity and convertible equity investments, placing it squarely in the venture capital arena where Anderson believes it can have maximum impact.

"The hope is that the new fund will serve as a 'Sequoia-like' signal in the sector," according to sources familiar with the fund. When All Aboard invests, the theory goes, other experienced funds will follow suit—creating the kind of momentum that's been missing in later-stage climate investing.

The coalition reads like a who's who of climate and energy investing: Khosla Ventures, Breakthrough Energy Ventures, DCVC, Clean Energy Ventures, Congruent Ventures, and eleven other firms have signed on. Some partners at these firms are investing personally, though participation isn't mandatory for coalition membership.

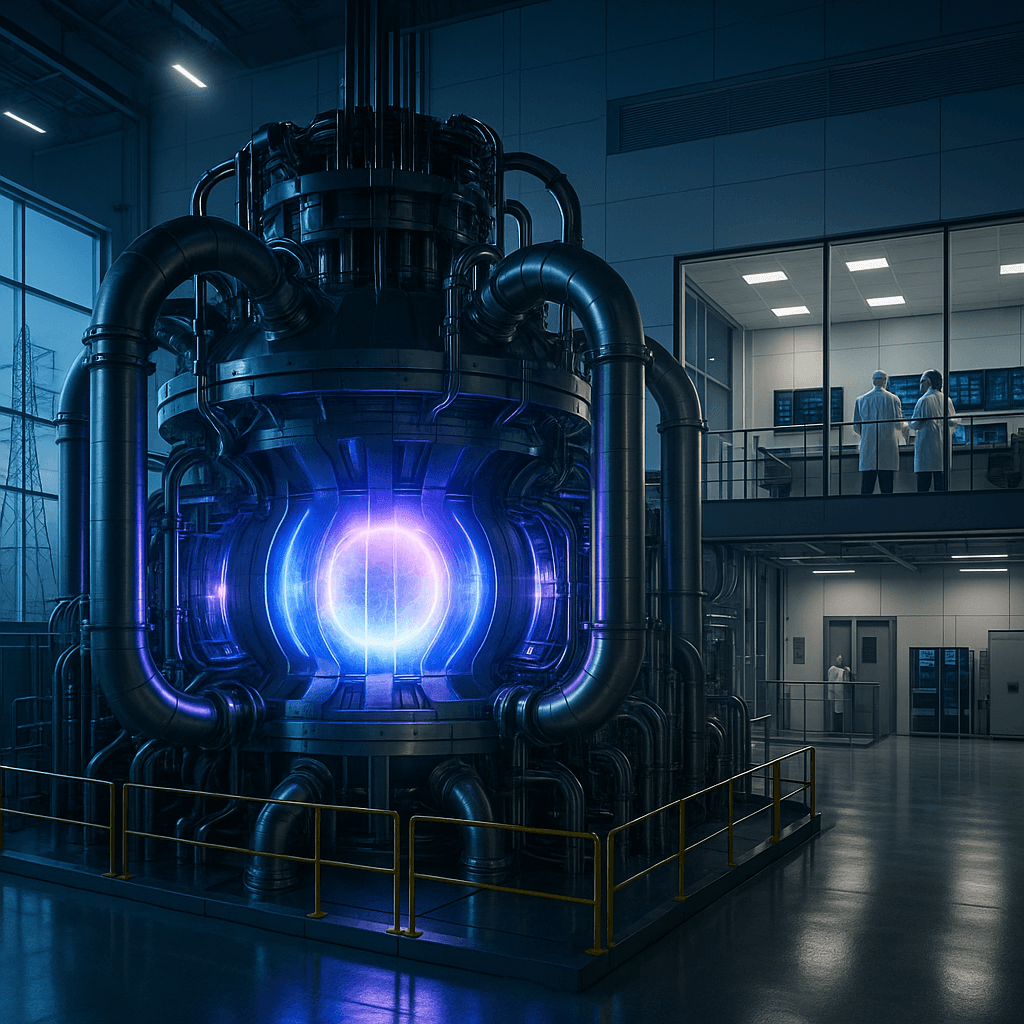

The timing couldn't be more critical. Climate hardware startups face a uniquely challenging scaling problem—unlike software companies that can grow with relatively modest capital increases, clean energy technologies often require tens or hundreds of millions to build their first commercial facility. A breakthrough battery technology might need a $150 million factory. A revolutionary carbon capture system could require a $200 million demonstration plant.

This "missing middle" has become a graveyard for promising technologies. Companies successfully navigate seed and Series A rounds, prove their technology works at pilot scale, then hit a brick wall when trying to raise the massive capital needed for commercial deployment. Traditional VCs balk at the size and risk, while infrastructure investors want proven revenue streams.