Newsletter

Beyond TechThe Future of Tech

News & Insights

IN PARTNERSHIP WITH

Hyundai Staria, Lucid Hands-Free Highway, Samsung AI Earrings, xAI's Avatars

Feature: The StubHub of Travel: The $32B Travel Waste Crisis Roomer Resales

Latest food and dining and food technology news

Arts and culture news, intersection of tech and entertainment

The latest sports news and sports tech

Futurism, the latest in future concepts and cutting edge deep tech

Latest news in wellness and wellbeing tech, biotech, medtech and more

Hyundai Staria

Hyundai Staria — The Staria EV, revealed ahead of 2026 launch, offers a sleek design with anticipated ranges of 350-400 km. Equipped with 76 kWh or 84 kWh battery options.

Hands-Free Highway — Lucid Motors next software update on July 30 will unlock hands-free highway driving in its Air sedans with a $2,500 Dream Drive Pro package on compatible highways, with driver attentiveness necessary.

Samsung's AI Accessories — Samsung is developing AI-powered wearable devices like earrings and necklaces to enhance smartphone functionality, following the popularity of smart glasses and other AI gadgets.

Prime Day Surge — Prime Day generated over $24B in U.S. e-commerce sales up 30.3% y-o-y, with a 3,300% traffic boost from AI tools. Influencers drove ~20% of sales, as appliances and office supplies saw big growth.

Google Discover — On the Android and iOS search app, instead of seeing publisher headlines, users will now see multiple news publishers’ logos in the top-left corner, with an AI-generated summary citing the sources.

xAI's Animated Avatars — xAI unveils AI companions for SuperGrok users, featuring real-time interactive avatars. Gamification unlocks extra features, but the early examples are pretty edgy and have unsurprisingly raised safety concerns.

The INBOUND 2025 agenda is here!

Connect with AI pioneer Dario Amodei, tech reviewer Marques Brownlee, and creative powerhouse Amy Poehler at San Francisco's epicenter of tech advancement this September.

INBOUND 2025 brings you directly into the global headquarters of AI innovation for one time only, where you'll discover actionable frameworks for building authentic brands and scaling operations.

Registration for limited-capacity sessions begin in August - don't miss this opportunity to secure your ticket in advance, start favoriting your must-sees, and be ready when reservations open.

Explore the lineup and secure your spot.

Every year, travelers book millions of hotel rooms and flights they never use. Plans shift. Trips fall through. Life happens. But the transactions remain — paid in full, nonrefundable, and largely unrecoverable.

Globally, about $32B in unused bookings vanishes annually. That includes $10B in abandoned hotel rooms, $7B in flights, and $10B in unused U.S. airline vouchers. Corporate travel alone contributes another $5B, as companies routinely eat the cost of employee cancellations. In a world where people resell sneakers, concert tickets, and digital art, the idea of letting prepaid travel go to waste feels a bit 90s to us.

A growing wave of startups is trying to capture this inefficiency by turning travel cancellations into liquid assets. Their model is simple: connect those stuck with nonrefundable reservations to bargain hunters willing to pick them up for less. The result is a secondary travel marketplace, a loosely connected set of platforms and services that could eventually function as a resale layer on top of the $1.6 trillion global travel industry.

At the center of this emerging economy are two-sided marketplaces—StubHub-like platforms for hotel nights, flights, and full vacation packages. Users list reservations they can’t use; buyers shop for deals.

The appeal is clear. A user recently scored an all-inclusive trip to Thailand for $1,200—originally booked for $4,700. On the seller side, recovering even half of a booking cost is a meaningful win compared to losing the entire value.

Among the most active platforms is SpareFare, a UK-based site founded in 2016. It operates on a 12% commission, handling flight, hotel, and package resales. But SpareFare’s global presence hasn’t translated into U.S. dominance. That role belongs to Roomer, a New York-based platform that specializes in hotel reservations.

Founded in 2011, Roomer quietly leads the U.S. secondary travel space. With $12.9M in annual revenue, $7M raised, and a team of 34, it’s become the default destination for travelers trying to salvage unused hotel bookings. Its process is surprisingly efficient: users forward confirmation emails, and Roomer’s support team coordinates with hotels to handle the transfer. Funds are held in escrow and released after checkout, creating a layer of trust often missing from informal resale.

Still, the market remains fragmented and deeply underpenetrated. Despite tens of billions in stranded value, total resale volume across all platforms sits at $1.8 billion, with projected growth to $8.5 billion by 2030. That gap signals opportunity.

There are obvious challenges. Most major U.S. airlines still don’t allow name changes on nonrefundable tickets, making flight resale rare and complex. Hotels vary widely in their willingness to transfer bookings. And there’s a regulatory gray zone when it comes to who’s liable if something goes wrong — especially in cases where a platform isn’t officially partnered with the travel provider.

But complexity alone doesn’t explain why no major player has stepped in. Legacy travel giants like Expedia and Booking Holdings have the infrastructure, customer base, and hotel partnerships to dominate resale. Startups like Hopper and Airbnb have the design chops and mobile reach to make secondary booking mainstream. Yet none have built a full-fledged resale feature, let alone a platform. For now, Roomer has the U.S. field mostly to itself. That won’t last.

The commission math is too attractive to ignore. With 10–15% fees across a multi-billion-dollar pool of unused bookings, the addressable revenue from resale commissions alone exceeds $3B per year. That doesn’t even include potential upsells, subscription tiers, or B2B offerings.

Startups like Fairlyne in Paris are already building “Resale-as-a-Service” tools for airlines — white-label platforms that plug into existing booking systems. The model lets carriers offer resale directly to customers, with built-in fraud protection and analytics. This shift toward embedded resale is likely to accelerate, especially as large travel companies look to unlock new margin in a slowing macro environment.

AI could push things further. Algorithms trained on resale history could price unused bookings in real time, match buyers and sellers more effectively, and even predict booking abandonment before it happens.

Meanwhile, consumer sentiment is shifting. Younger travelers—digital natives raised on marketplaces—expect flexibility, liquidity, and minimal friction. The notion that you should be stuck with a $600 hotel charge because you missed a check-in window is losing cultural traction.

As more bookings move online and cancellation policies grow stricter, the need for resale will grow. A fragmented cottage industry could soon evolve into a foundational layer of the travel economy that creates value for sellers, access for buyers, and data for platforms.

The infrastructure is slowly being built. The market signals are clear. What’s missing is the heavyweight travel platform that decides this market is too valuable to ignore. Until then, unused trips remain one of the most obvious inefficiencies in consumer travel. Not because it’s a super hard problem to solve, but because too few have tried.

Hate to get conspiratorial here, but it feels like there are some vested interests in the airline/travel sector that are happy for things to stay as they are, as they essentially get to double sell reservations and still fill up flights, hotels due to high demand.

$400 Musk Melon

Hamptons $400 Melons — Gourmet grocery prices in the Hamptons are soaring, with a $400 musk melon and $100 lobster salad highlighting the area's affluence.

Autonomous Burritos — Travis Kalanick's Cloud Kitchens is set to disrupt the food industry with automated kitchens using AI, promising efficient, personalized meal delivery, challenging traditional grocery and restaurant models.

MAHA vs Dyes — The FDA approves a new blue food dye from gardenia fruit to replace synthetic dyes. Dozens of U.S. ice cream manufacturers aim to eliminate artificial dyes by 2027, opting for natural alternatives.

Graphene Sensor — An AI-powered Artificial tongue mimics human taste with 98.5% accuracy, using machine learning.

Shift to Online — Online grocery sales are rapidly surpassing in-store shopping, as consumers increasingly opt for Walmart and other discount chains for their purchases.

Tariffs Hit Food Brands — Food brand operators grapple with tariff uncertainties and new food safety regulations, with 52% struggling to track changes and 70% of consumers worried about safety, driving up prices and inflation.

HBO’s New "Harry Potter"

Emmy Nominations — HBO dominates with 142 Emmy nominations, surpassing Netflix and Apple TV+, which received 120 and 79 respectively. Owen Cooper, at just 15, becomes the youngest best supporting actor nominee.

Lionsgate Acquisition — Legendary Entertainment is exploring a potential acquisition of Lionsgate Studios, boosting the latter's stock amid market speculation.

"Harry Potter" — HBO has started filming a new "Harry Potter" series with a fresh cast, adapting all seven books into individual seasons with a 2027 premiere scheduled.

Bad Bunny in Residence — Bad Bunny's residency in his native Puerto Rico is projected to bring nearly $200M in economic impact, boosting tourism in a slump.

Fyre Rights Sold on eBay — Billy McFarland sold the Fyre Festival brand rights on eBay for $245,300 “to help with restitution”, but given he owes $26M it won’t go too far.

AI Influencer Videos — AI Filmmaker Lu Huang used Google's Veo 3 and Higgsfield's Soul ID to create realistic influencer videos with fully editable elements, showcasing advancements in AI-generated content.

Runway Unveils Act-Two — Runway launched Act-Two, an AI model enhancing motion capture fidelity and versatility from a single video without specialized tools.

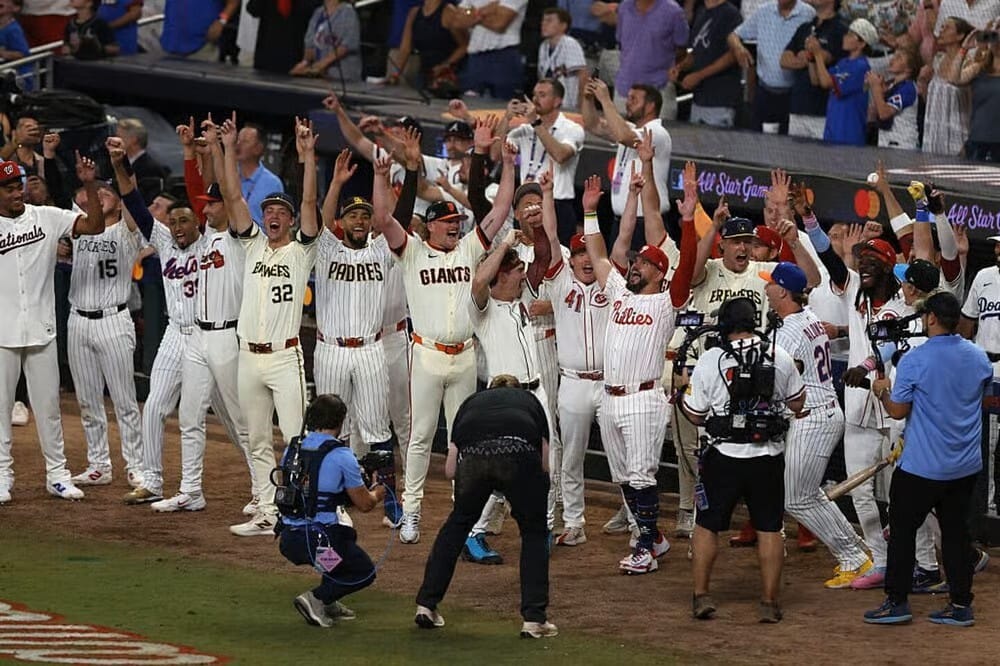

MLB All-Star Game

MLB All-Star Game — The National League defeated the American League 4-3 in a thrilling home run swing off after a 6-6 tie; Phillies slugger Kyle Schwarber rallied the NL from a 3-1 deficit with three homers.

Wimbledon — Jannik Sinner beat Carlos Alcaraz in four sets, the first Italian Wimbledon champ, and his third Grand Slam in four events. Iga Swiatek claimed her first Wimbledon title with a decisive 57 min victory over the US’ Amanda Anisimova.

Apple F1 Deal — Apple is set to secure US streaming rights for Formula 1 with a $150M annual bid, surpassing ESPN. This move follows Apple's F1 movie success and rising US interest from Netflix's "Drive to Survive."

Sony Scores NFL Deal — Sony will become the NFL's official headset provider in 2025, replacing Bose with advanced noise-canceling headsets with ANC technology for optimal stadium performance.

Flutter x FanDuel — Flutter Entertainment acquired the final 5% of FanDuel from Boyd Gaming for $1.76 billion, valuing FanDuel at $31 billion. FanDuel leads US sports betting with a 43% market share.

Movetru's Funding Win — The Irish SportsTech startup, raised a £1.2M pre-seed to launch its AI-powered wearable for movement analysis and injury prevention, backed by investors from the UK, Ireland, and USA.

Futurism Reimagined — Futurism risks becoming a tool for corporate agendas rather than societal empowerment. Experts advocate for a shift towards democratizing future thinking to regain control over future narratives.

Magic Mushrooms and Longevity — Psilocybin may extend lifespan by slowing telomere degradation. Studies on human cells and mice reveal potential benefits for aging and disease progression.

Lifelike Lung Lab — UBC researchers have developed a 3D-printed lung tissue model that mimics human complexity potentially advancing personalized medicine for conditions like COPD and lung cancer.

Green Cement — Seabound introduces a carbon capture system on a cement carrier, transforming CO2 emissions into limestone for cement, tackling pollution in shipping and cement industries.

Paradox-Free Time Travel — Mathematicians prove time travel can exist without paradoxes, maintaining determinism and free will.

Sun Day — Jack Dorsey's new app tracks UV exposure and vitamin D intake with location-based UV Index, sunrise/sunset times, and personalized recommendations. O/S and available on iOS via TestFlight.

Eye on Early Detection — Skleo Health raises €3M to enhance AI-driven eye screenings in Germany, improving early detection of eye diseases.

AI Chatbot Therapy Concerns — AI therapy chatbots show bias and lack empathy, making inappropriate comments about mental health conditions like alcoholism and schizophrenia.

Sorcero MedTech Revolution — Sorcero acquires Axiom Health, launching Sorcero MedTech, an AI-driven platform for enhanced decision-making and market intelligence in life sciences and medical devices.

APOE Variant's Wider Impact — APOE ε4 gene variant not only raises Alzheimer’s risk but also links to broader brain disorders through chronic inflammation, as shown in a study using a large proteomics database.

| Get the daily newsletter that helps you understand the tech ecosystem sent to your inbox weekly.

More Newsletter Posts

Newsletter

Beyond Tech

Newsletter

SignalPulse: