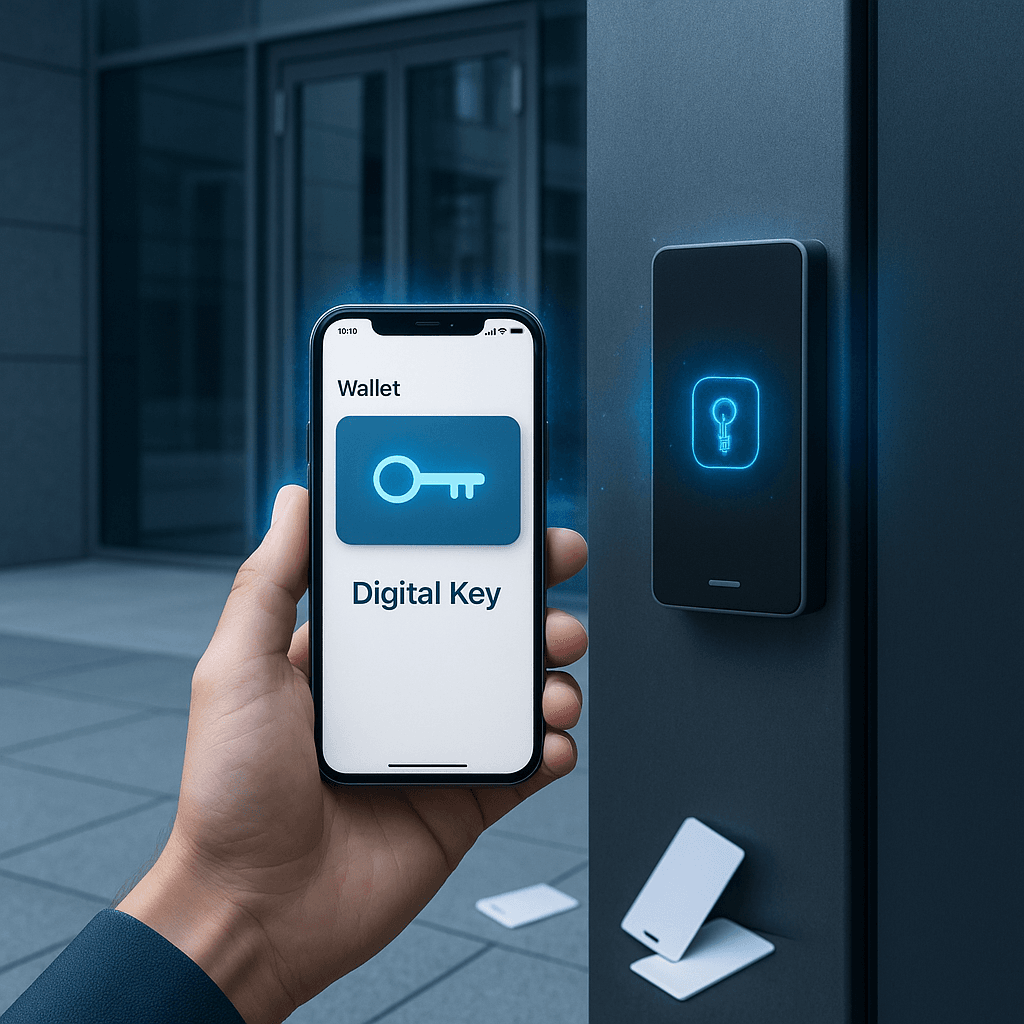

AccessGrid just closed a $4.4 million seed round to modernize an industry stuck in the 1990s. The startup's API platform lets companies turn smartphones into secure digital key fobs that work directly through Apple and Google wallet apps, eliminating physical cards and outdated access control systems that plague most buildings today.

AccessGrid just scored $4.4 million to kill the plastic key card once and for all. The startup announced its seed round Tuesday, led by Harlem Capital, with a simple but ambitious mission: turn every smartphone into an unbreachable digital key that works even when your phone dies.

Founder Auston Bunsen knows a thing or two about building developer platforms. His previous company QuickNode raised around $60 million as a blockchain infrastructure play before he stepped away last October. But it was a conversation with Apple that sparked his next venture. "I eventually met with some folks at Apple and they decided to make a bet that I could help further their goals to enable every company to bring the power of Apple Wallet to their door," Bunsen told TechCrunch.

The timing couldn't be better. Most access control systems are embarrassingly outdated - think unencrypted communications, easily cloned ID cards, and on-premises infrastructure that can't talk to the cloud. "The access control industry is stuck in the late 1990s," Bunsen explained. His API platform changes that by issuing what he calls "uncloneable credentials using encrypted payloads that can be instantly revoked via the cloud."

Here's where it gets interesting: the digital keys work when your iPhone is locked, automatically sync to your Apple Watch, and in a neat trick that physical cards can't match, they'll still unlock doors even if your phone battery dies. Google Wallet users get similar functionality through AccessGrid's cross-platform approach.

The security infrastructure runs deep. Bunsen says they're using "military-grade" encryption with dual-encryption layers, multi-factor authentication for all server access, and other enterprise-grade cybersecurity practices. That's crucial when you're essentially replacing every building's front door security.

Bunsen's going solo this time, unlike his QuickNode days with three co-founders. He calls fundraising a "distraction" from serving customers, but connected with Harlem Capital's Henri Pierre-Jacques through Miami connections. Other investors include familiar faces from his QuickNode network: Marell Evans from Exceptional Capital and Maya Bakhai from Spice Capital. The HF0 accelerator provided AccessGrid's first check.