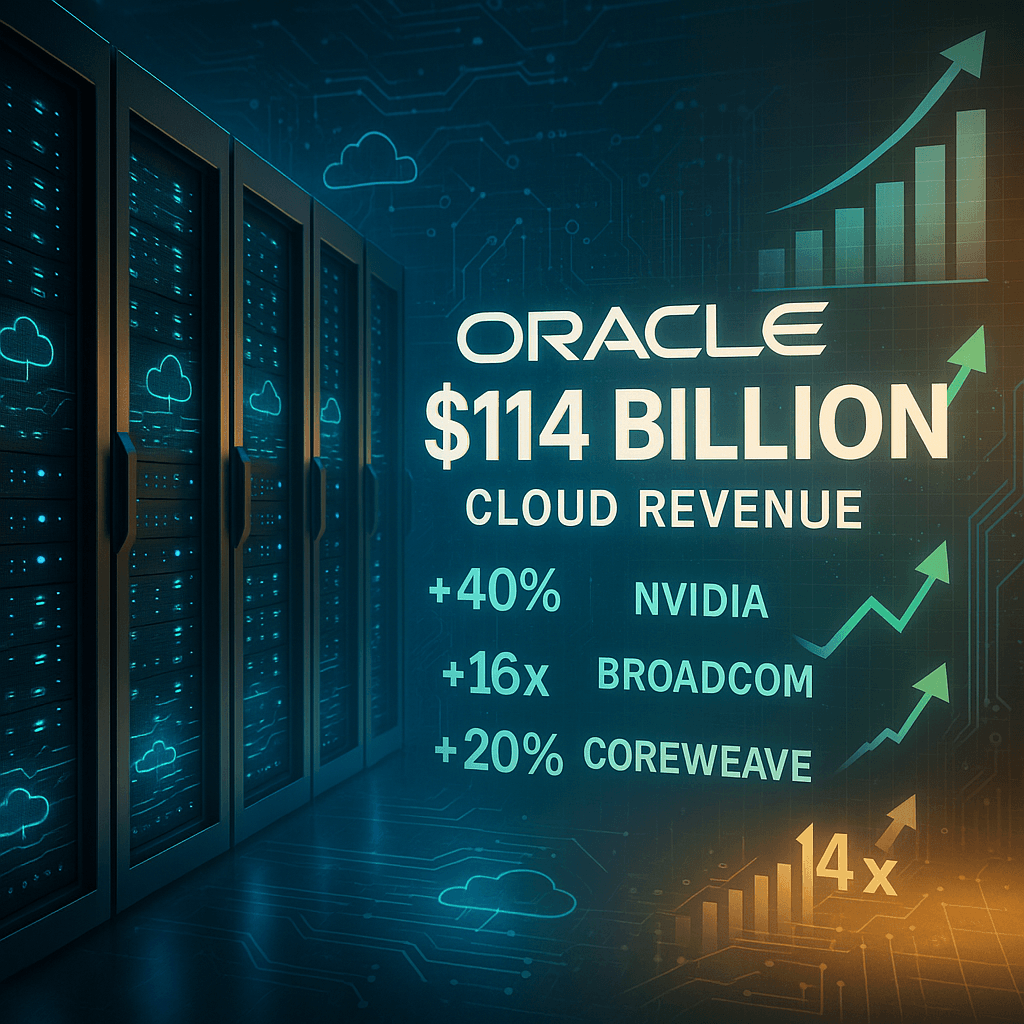

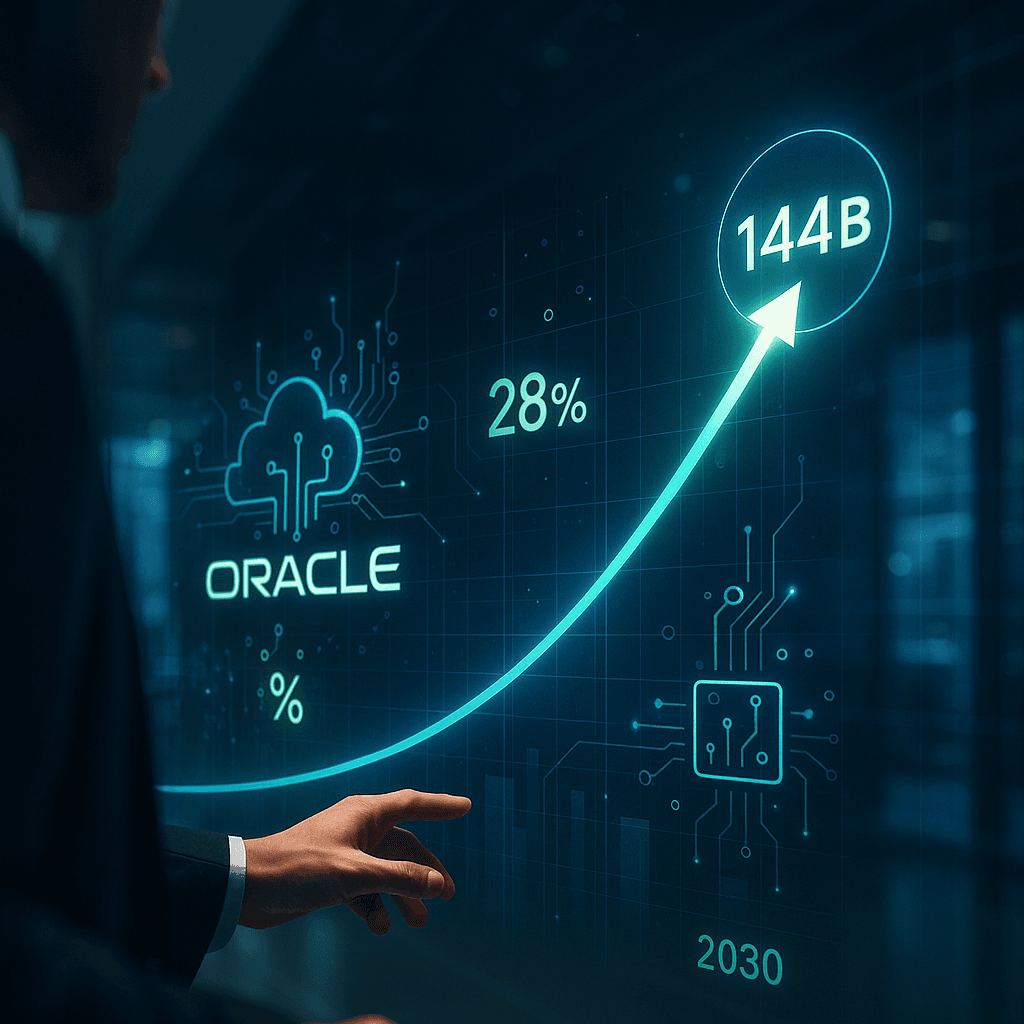

Oracle just dropped a bombshell that's reshaping the entire AI infrastructure landscape. The database giant's projection to hit $114 billion in cloud revenue by fiscal 2029 - a 14x jump - sent shockwaves through Silicon Valley, with everyone from Nvidia to scrappy AI cloud competitors like CoreWeave seeing their stocks explode on Wednesday.

Oracle just turned the AI infrastructure market upside down, and the ripple effects are massive. The enterprise software giant's stunning forecast to reach $114 billion in cloud revenue by fiscal 2029 - essentially a 14x increase from current levels - has triggered one of the biggest sector-wide rallies we've seen all year.

The numbers tell the story of an industry transformation happening in real time. Oracle shares rocketed 40% higher on Wednesday alone, but that was just the beginning. Nvidia, which dominates about 70% of AI data center budgets according to company estimates, climbed 4% as investors realized what Oracle's buildout means for chip demand. Broadcom surged 9%, TSMC jumped over 4%, and even AMD - despite holding just a small fraction of the AI chip market - rose 3%.

"The guide for a 14x of Oracle's cloud infra segment in 5 years, mostly from GPU cloud demand, and the guide for capex of $35b in FY26 is bullish Nvidia, other AI hardware suppliers and the eco-system of partners building and financing Oracle's GPU data centers," UBS analyst Karl Keirstead wrote in a Wednesday note that perfectly captured the market's excitement.

But here's where it gets really interesting - the biggest winner wasn't even Oracle itself. CoreWeave, one of the so-called "neo-cloud" providers that compete directly with Oracle by offering specialized AI infrastructure, saw its shares explode 20% higher. That's a telling sign that investors believe Oracle's massive projections validate the entire AI cloud ecosystem, not just Oracle's piece of it.

The numbers Oracle's throwing around are staggering. Chief Financial Officer Safra Catz made it clear during Tuesday's earnings call that this isn't just talk: "The vast majority of our CapEx investments are for revenue-generating equipment that is going into the data centers." With $35 billion in planned capital expenditure for fiscal 2026 alone, Oracle's essentially betting the farm on AI demand staying red-hot for years to come.

This infrastructure boom is lifting every player in the AI supply chain. reported 34% sales growth in August, perfectly timed with Oracle's announcement. Memory maker jumped 4% as investors connected the dots between AI chip demand and the high-bandwidth memory these systems require. Even the server builders - and - each gained 4% on expectations they'll be packaging all these components into complete systems.