Perplexity just landed $200 million at a staggering $20 billion valuation, jumping $2 billion in just two months as the AI search startup positions itself as Google's most serious challenger yet. The fresh capital comes as the company approaches $200 million in annual revenue while making bold moves like its recent $34.5 billion Chrome acquisition offer.

Perplexity just closed one of the year's hottest AI funding rounds, securing $200 million at a $20 billion valuation that puts serious pressure on Google's search monopoly. The deal, first reported by The Information, caps a meteoric rise for the three-year-old startup that's now valued higher than many Fortune 500 companies.

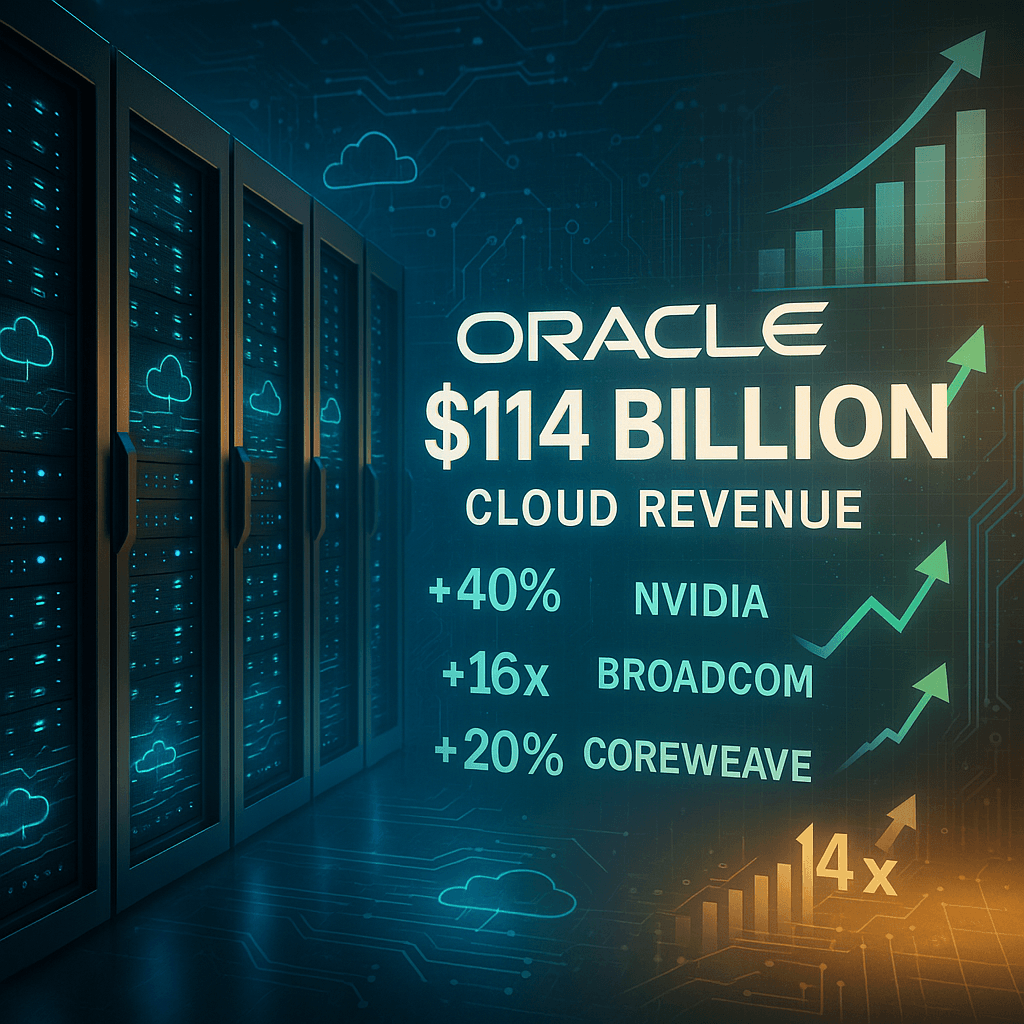

The numbers tell a stunning growth story. Just two months ago, Perplexity raised $100 million at an $18 billion valuation according to Bloomberg's July report. That means investors just handed the company a $2 billion valuation bump in 60 days - the kind of premium that signals serious FOMO in Silicon Valley's AI arms race.

Since launching in 2021, Perplexity has now raised $1.5 billion total according to PitchBook data, with Accel leading its previous $500 million round at a $14 billion valuation earlier this year. The latest round's lead investor remains undisclosed, but sources familiar with the company tell us Perplexity's annual recurring revenue is approaching $200 million - up from $150 million just last month according to Business Insider.

That revenue trajectory explains investor enthusiasm. While traditional search relies on blue links and ads, Perplexity's conversational AI delivers direct answers with citations - a user experience that's making Google's 25-year-old search model look increasingly dated. The startup's growth comes as Google faces its biggest competitive threat since Microsoft launched Bing with OpenAI's ChatGPT integration.

Perplexity isn't just raising money - it's making aggressive moves that signal serious Google competition. In August, the startup shocked Silicon Valley by offering to buy Google's Chrome browser for $34.5 billion, capitalizing on the Justice Department's antitrust pressure. The bold move came after federal regulators proposed forcing to to break up its search monopoly.