Saudi Arabia just declared war on the global AI oligopoly. The kingdom's sovereign wealth fund-backed champion Humain is targeting third place worldwide behind only the US and China, armed with $33 billion in committed capital and strategic partnerships with Nvidia, AMD, and rising AI chipmaker Groq. The audacious plan transforms oil wealth into data center dominance across the Middle East's energy-rich landscape.

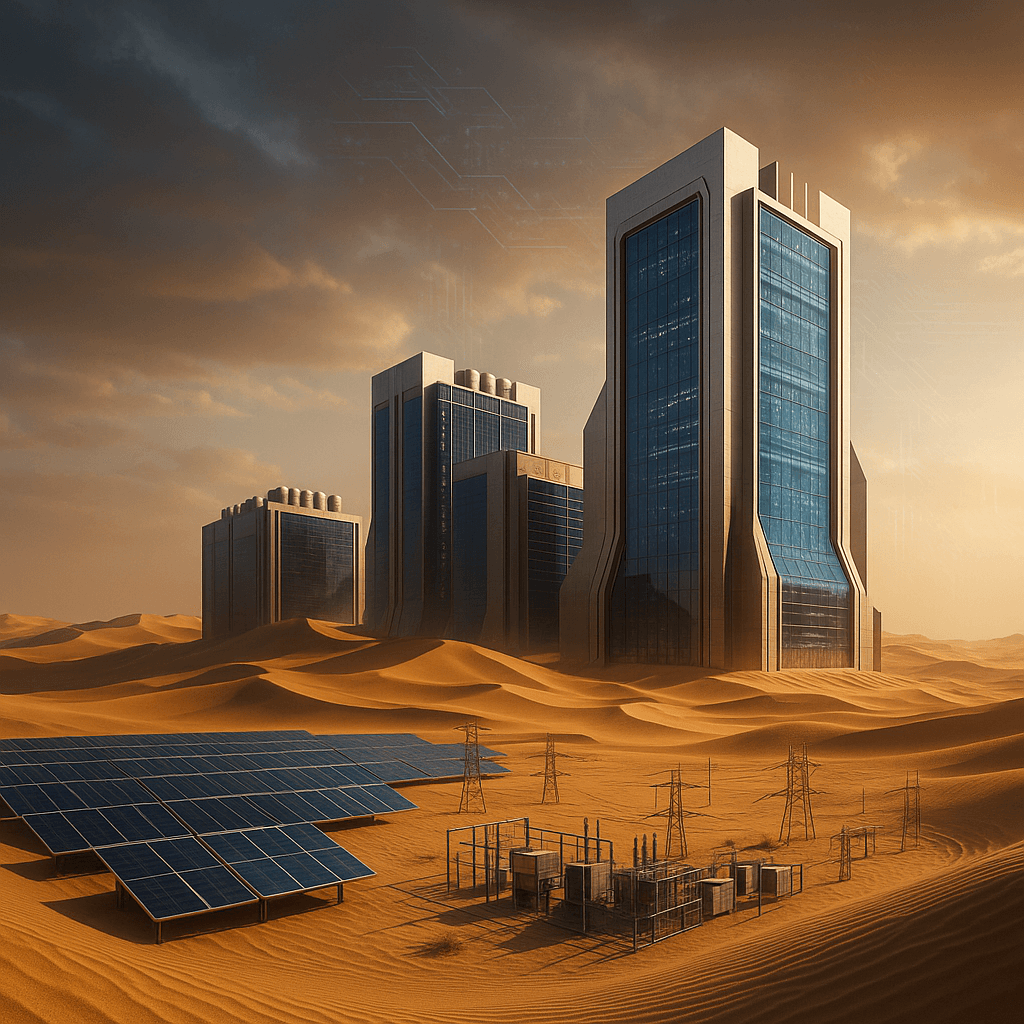

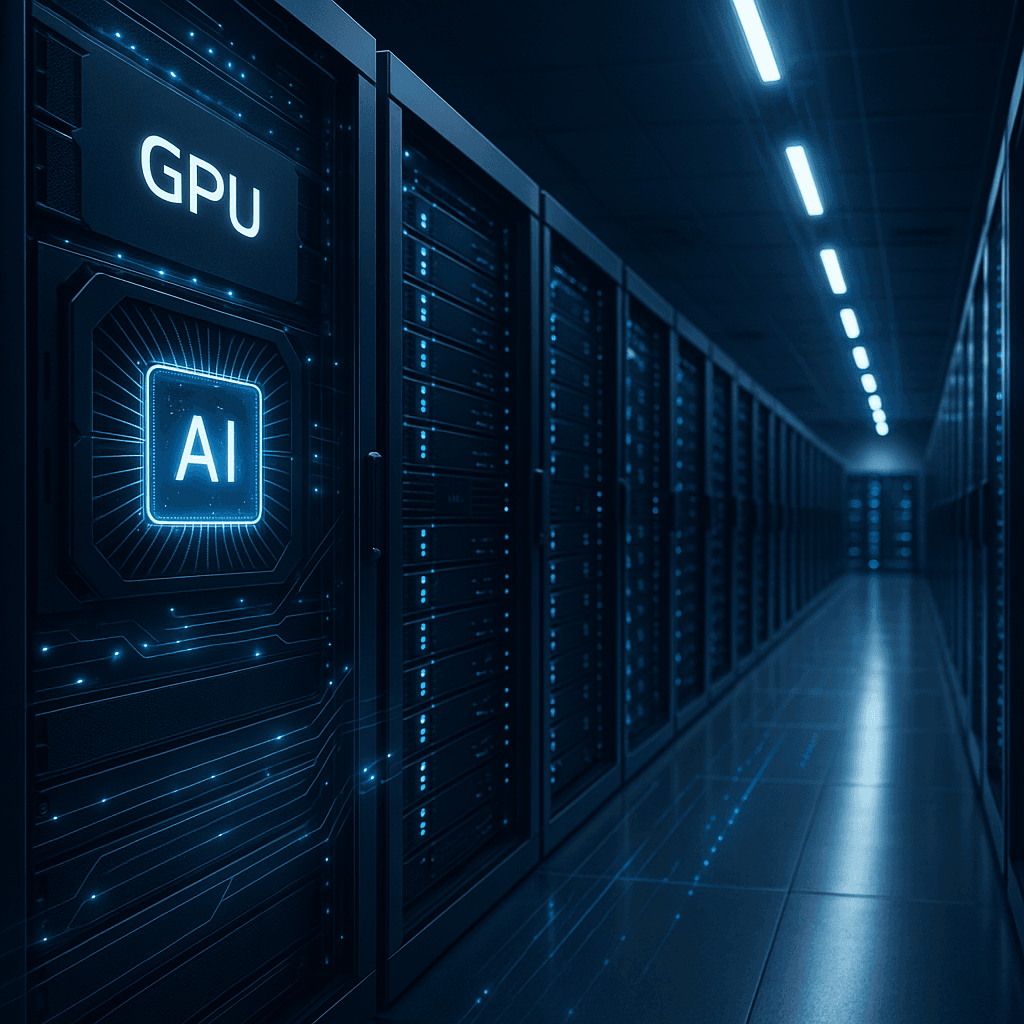

The global AI arms race just gained a new heavyweight contender. Saudi Arabia's Humain, the kingdom's flagship artificial intelligence company backed by the nearly $1 trillion Public Investment Fund, is making an audacious play for third place in the worldwide AI hierarchy. "Our ambition is very clear. We want to be the third-largest AI provider in the world, behind the United States and China," Humain CEO Tareq Amin told CNBC on Tuesday. The declaration marks Saudi Arabia's most aggressive pivot yet from oil dependence to data dominance, leveraging the kingdom's abundant land and energy resources to challenge established tech superpowers. Launched just five months ago during President Trump's visit to Riyadh, Humain has already secured $33 billion in committed capital—$23 billion for strategic technology partnerships and a $10 billion venture fund targeting AI startups. The company is moving fast to capitalize on what it sees as a historic opportunity to reshape global AI infrastructure. The timing couldn't be more critical. With oil prices under pressure and mega-projects like the futuristic Neom city burning through billions, Saudi Arabia desperately needs new revenue streams that can generate cash for decades. Data centers represent that golden opportunity, especially as global AI compute demand explodes and companies scramble for processing power outside the traditional US-China nexus. Nvidia and AMD have already signed on as key chip suppliers, while California-based AI inference specialist Groq secured a massive $1.5 billion commitment from the kingdom. The Groq partnership illustrates Saudi Arabia's strategic approach—in December, the company built what it claims is the region's largest AI inference cluster, now serving "nearly four billion people regionally adjacent to the KSA," according to Groq's statement. The infrastructure buildout is staggering in scope. Humain has broken ground on two massive campuses housing 11 data centers, each with 200-megawatt capacity. The company plans 50 megawatts online by Q4 2025, then an additional 50 megawatts every quarter through 2026. By 2030, the target jumps to 1.9 gigawatts, scaling to six gigawatts by 2034—enough to power millions of AI workloads across the Middle East and beyond. But Saudi Arabia faces serious headwinds in its AI ambitions. The kingdom's data center market, while growing rapidly from , remains dwarfed by the US market's $200+ billion valuation. More critically, talent acquisition poses a massive challenge. AI-related roles in Saudi Arabia show a 50% hiring gap, according to Minister Ahmed Al-Rajhi, forcing heavy reliance on expensive foreign professionals who often don't stay long-term. The kingdom also faces stiff regional competition from the UAE, which just landed the massive Stargate Project—a $500 billion AI-focused investment vehicle from , Abu Dhabi's MGX, and Japan's . The UAE's more established tech ecosystem and consistent execution track record gives it significant advantages in attracting and retaining AI talent. "I think the bottom up version of Saudi is extremely concentrated at the top, but there is a kind of lag at the middle management and how the vision is being communicated and translated on the ground," Baghdad Gherras, a UAE-based venture partner at Antler, told CNBC. Environmental concerns also loom large—running and cooling massive data centers in desert temperatures will require enormous energy inputs, potentially undermining Saudi Arabia's sustainability commitments. Still, Amin remains bullish on the kingdom's prospects, emphasizing strategic investments in "joint IP creation, localization, and workload consumption in Saudi." The approach suggests Saudi Arabia isn't just building data centers—it's trying to create an entire AI ecosystem that keeps value and innovation within its borders.