TL;DR

- - Firefly's IPO surge reflects robust space-tech demand.

- - Valuation at $10 billion signals confident market entry.

- - Rising interest in space tech offers lucrative opportunities.

- - Strategic positioning in defense contracts enhances investment potential.

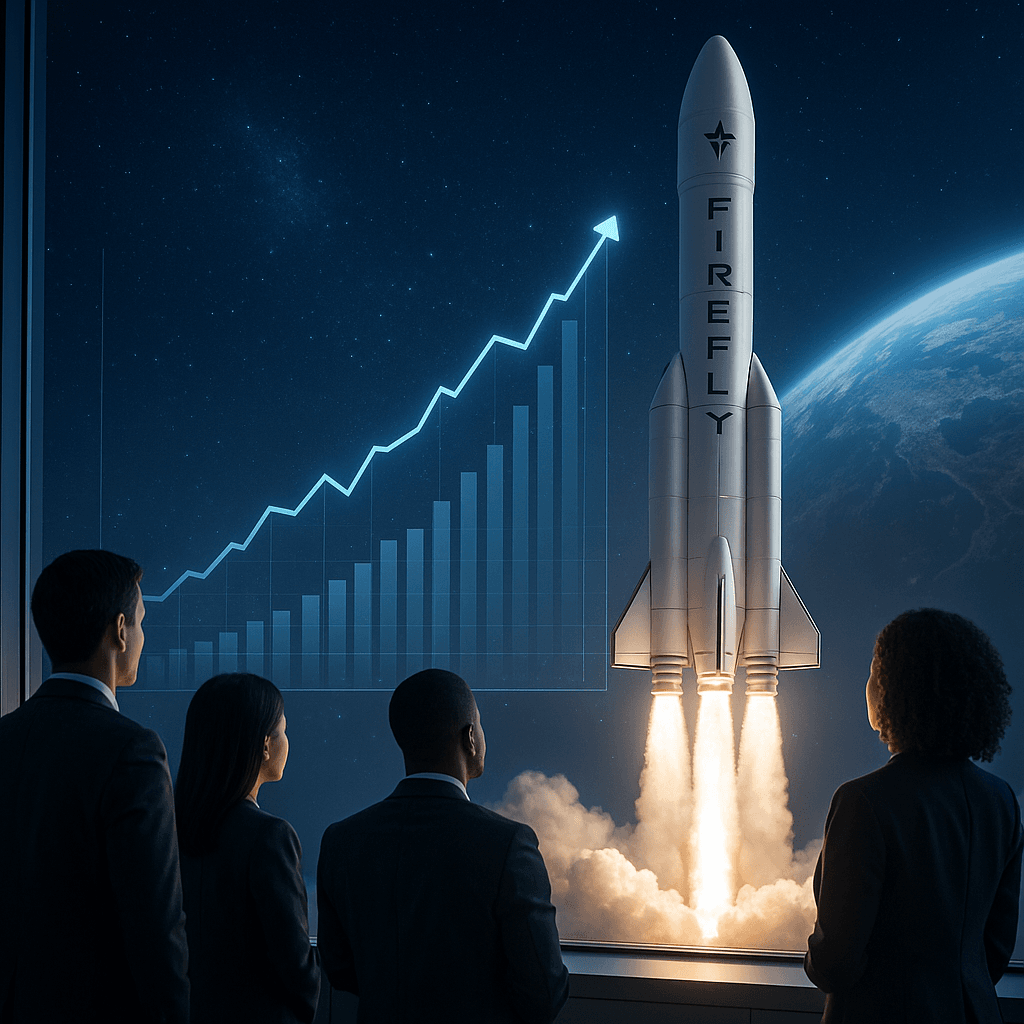

Firefly Aerospace soared over 50% above its initial stock price during its Nasdaq debut, highlighting significant investor enthusiasm and positioning the company as a formidable player in space technology innovation. This IPO comes amidst a heated tech IPO market, fueled by growing demand for efficient launch solutions for national security, commercial, and hypersonic applications.

Opening Analysis

Firefly Aerospace's debut on the Nasdaq has generated attention with a remarkable 50% surge, reflecting investor confidence in its strategic initiatives and technological capabilities. Priced at $70 per share, this marks a substantial leap above its initial range, setting the company's valuation at a commanding $10 billion. This move places Firefly among the elite trio of space companies going public this year, alongside Voyager Technologies and Karman Holdings. With strong investor demand, Firefly has capitalized on the burgeoning space technology segment, highlighting its pivotal role in advancing aerospace innovation.

Market Dynamics

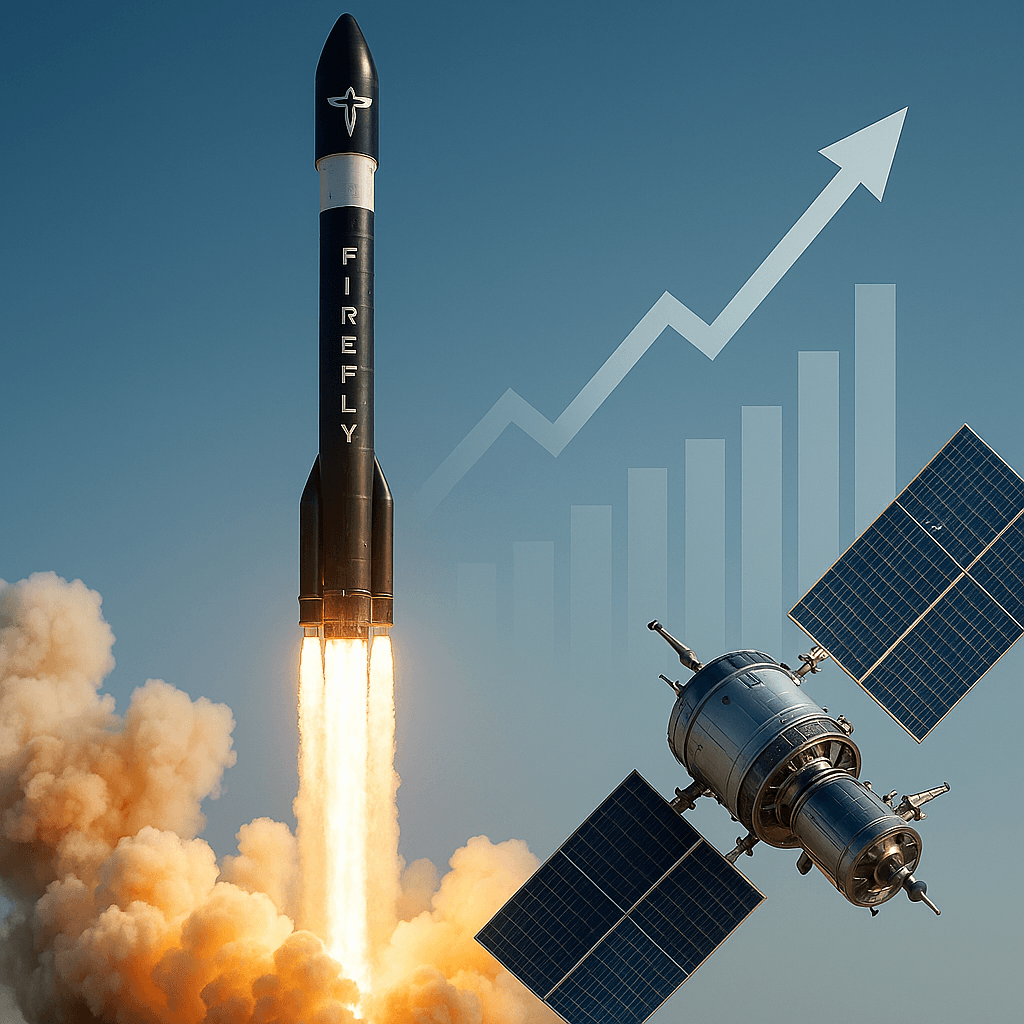

The competitive landscape of space technology has evolved rapidly as private companies, including SpaceX and Firefly, secure hefty government contracts and diversify into commercial sectors. Firefly's successful pursuits with defense giants Lockheed Martin and L3Harris underscore its strategic positioning. Their ability to form high-value contracts, such as a recent $177 million agreement with NASA, positions them strongly against competitors.

Technical Innovation

Firefly's technological advancements, particularly in launch vehicles like the Alpha rocket, provide a specific capability for one-ton launches that meet the demands of national security and commercial needs. This specialization aligns well with increasing governmental interest in swift, reliable launch solutions, particularly for missile testing and satellite deployments.

Financial Analysis

Despite reporting a net loss of $60.1 million, Firefly's revenue jumped sixfold to $55.9 million, showcasing its potential for growth in new revenue streams. The company's financial trajectory is supported by a $50 million investment from Northrop Grumman, further solidifying its financial backing and strategic investments.