TL;DR

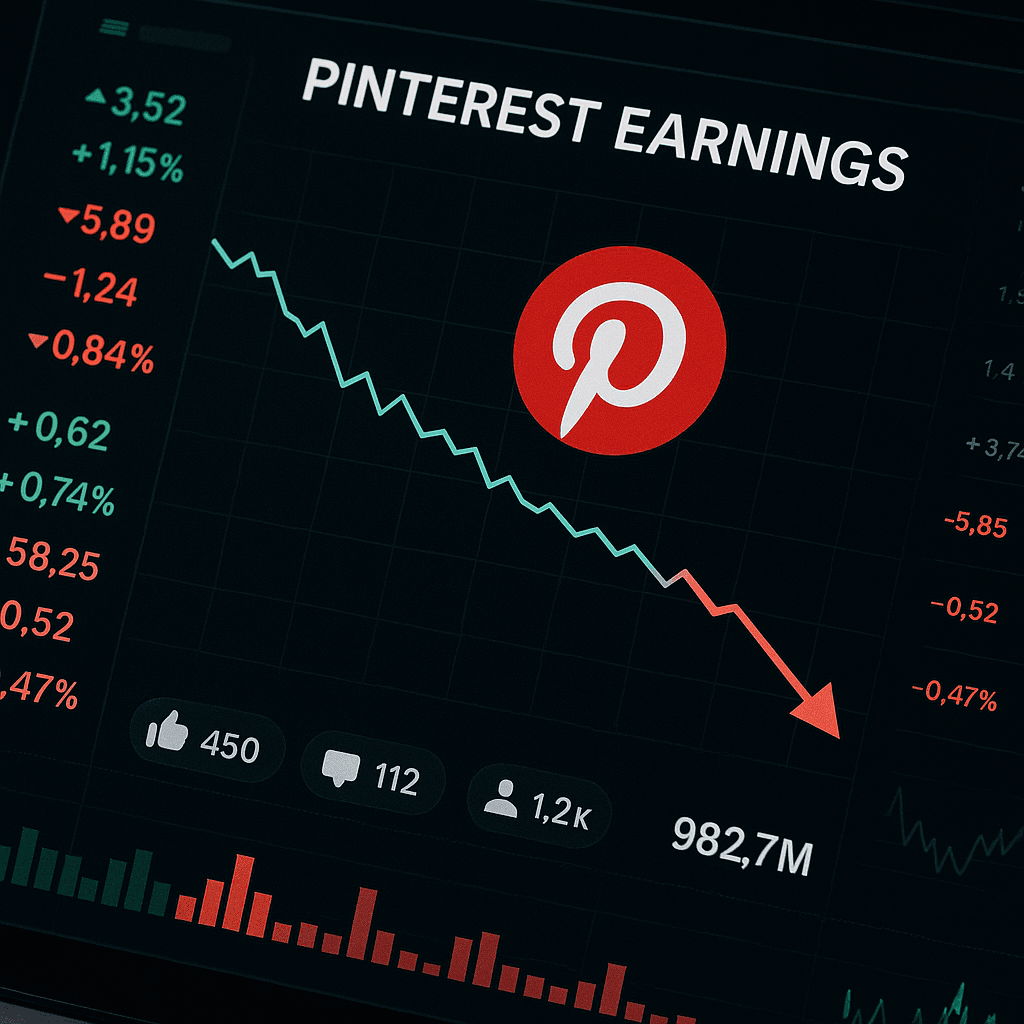

- - Analyze the impact of Pinterest's Q2 earnings miss on stock.

- - Revenue exceeded expectations but did not prevent a 10% stock drop.

- - Investors must weigh short-term volatility against potential growth.

- - Strategic investment may focus on user growth and ad revenue.

Pinterest recently reported its Q2 earnings, recording a 10% drop in stock value following a miss on expected earnings per share, despite exceeding revenue projections. This discrepancy highlights investor sensitivity to earnings performance and the broader impact of fiscal metrics on market confidence, offering critical considerations for stakeholders assessing Pinterest's financial trajectory.

Opening Analysis

Pinterest's recent earnings report revealed a complex financial picture. Despite a robust revenue performance, earnings per share fell short of market estimates — leading to a 10% drop in stock value. This decline reflects investors' heightened expectations and the pressure companies face to deliver on all financial fronts. The report suggests a dual narrative: a company achieving significant user growth and revenue increases, yet struggling to convert these into expected profit margins.

Market Dynamics

In the competitive social media landscape, Pinterest's challenges contrast with peers who are navigating similar earnings pressures differently. As Snap's shocking 15% stock drop illustrates, disappointing earnings aren't unique to Pinterest. Pinterest, however, managed to increase its global monthly active users by a noteworthy margin, suggesting underlying resilience despite fluctuating market sentiments.

Technical Innovation

Strategically, Pinterest continues to emphasize its growing Gen Z user base. This demographic could drive future revenue, given its susceptibility to trendy, image-based content. The technology and features Pinterest deploys to captivate this audience is crucial — they’re banking on these enhancements to translate engagement into monetization effectively.

Financial Analysis

The financial standout was a revenue increase to $998 million, surpassing forecasts despite lingering challenges from advertising uncertainties and tariff-induced market hesibilities. Pinterest's EBITDA also soared past expectations, highlighting robust operational health. However, profitability metrics, specifically earnings per share, fell short, indicative of ongoing internal balancing acts.

Looking ahead, Pinterest's possession of a steadily growing user base, especially among Gen Z, offers future monetization pathways. However, they must strategically navigate fiscal uncertainties and advertising market dynamics, possibly leveraging their user engagement strengths to stabilize earnings. Risks include continued pressure from global economic factors and competitive rival platforms like Snap and Meta.