TL;DR

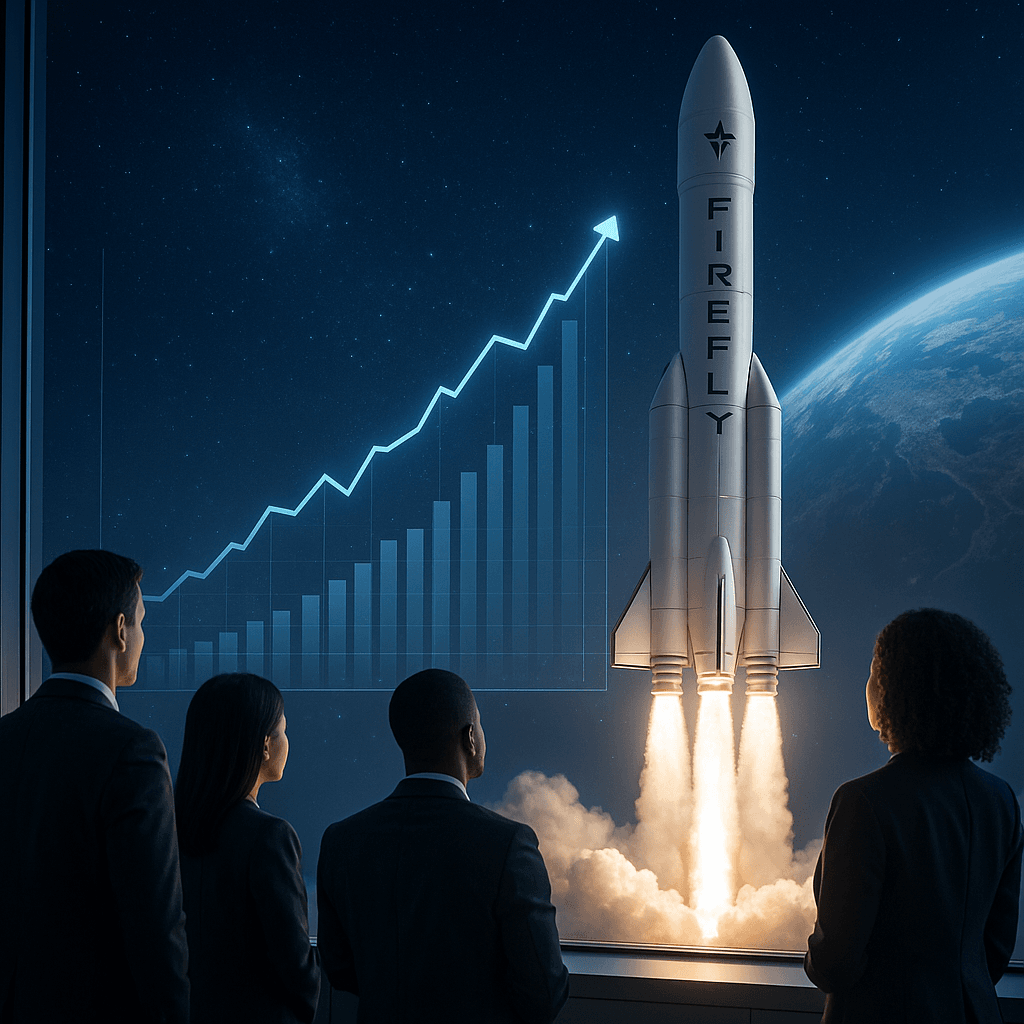

- - Firefly Aerospace's stock surged 50% in Nasdaq debut.

- - IPO valued Firefly around $10 billion; raised $868 million.

- - Growing interest in spacetech as sector reliability increases.

- - Investment thesis: Space tech poised for substantial growth.

Firefly Aerospace made headlines with its Nasdaq debut, where its stock surged over 50% on opening. This move is significant in an era when space technology is attracting increasing financial interest from institutional investors. Firefly's IPO not only underscores its position as a competitive player in the space industry but also signals broader market confidence in spacetech's growth potential. For stakeholders and financiers, this development opens strategic avenues for deeper engagement in space investments.

Opening Analysis

Firefly Aerospace, in its Nasdaq debut, saw its stock price soar by more than 50%, opening at $70 under the ticker symbol FLY and positioning its market cap just shy of $10 billion. The timing is propitious—coming at a crescendo of renewed space investment interest, marked by recent public offerings of peers Voyager Technology and Karman Holdings. The immense interest from investors underscores the surging demand for advancements in space technology, a sector that Firefly is poised to influence significantly.

Market Dynamics

The competitive landscape for space companies like Firefly has shifted dramatically. As companies vie for lucrative government contracts and private sector partnerships, those capable of maintaining a robust pipeline of deals with large corporations such as Lockheed Martin and L3Harris gain a competitive edge. Firefly's $177 million contract with NASA underlines its capacity to secure high-value collaborations pivotal for sustainable growth.

Technical Innovation

Firefly's offerings, including its well-regarded Alpha rocket and the successful deployment of its Blue Ghost lunar lander, cement its reputation as a reliable player in the aerospace arena. The demand for dedicated one-ton launches, particularly from government bodies and defense contractors, reflects Firefly's strategic focus on niche but high-demand segments of aerospace launches. This innovation focus ensures Firefly is not just reactive but a proactive leader in tech advancement.

Financial Analysis

Recent financial disclosures reveal Firefly's impressive revenue growth, reporting a sixfold increase to $55.9 million in the last quarter, underscoring its robust business model. However, the rise in its profitability also comes with increased operational costs, with net losses climbing to $60.1 million. This balance of growth and expenditure underscores the critical need for strategic cost management as Firefly matures as a public company.