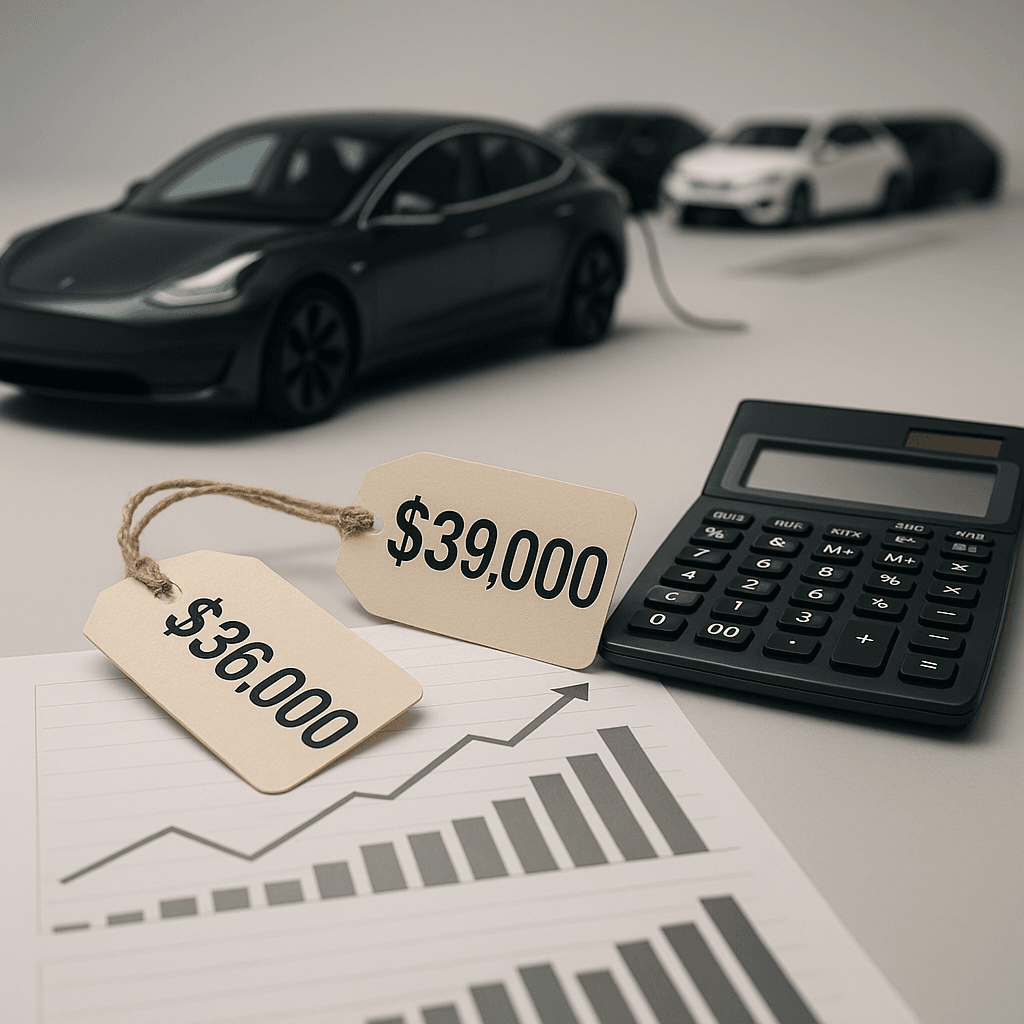

Tesla just crossed a critical pricing threshold that could reshape the EV market. The company quietly launched standard variants of its Model Y SUV priced just below $40,000 and Model 3 sedan starting at $37,000, marking the first time Tesla's most popular vehicles have dipped into mass-market territory. This move comes as the automaker battles a multi-quarter sales slump and faces mounting pressure from cheaper competitors.

Tesla just made its biggest play for mainstream adoption since the Model 3 launch. The company's surprise Tuesday announcement brings its popular Model Y SUV below the crucial $40,000 psychological barrier for the first time, with the standard variant now listed at $39,990 on Tesla's website. The Model 3 standard follows at around $37,000.

The timing couldn't be more critical for Tesla. After climbing 5% Monday on speculation about what Elon Musk's weekend teaser videos might reveal, shares dropped 3% Tuesday as investors realized this wasn't the long-promised next-generation Roadster or Cybercab updates they were hoping for.

But the pricing move represents something potentially more significant - Tesla's first real answer to the affordability challenge that's been plaguing EV adoption. "Tesla debuted more affordable versions of its popular Model Y SUV and Model 3 sedan," according to the CNBC report, alongside a new version of Full Self-Driving (Supervised) released early Tuesday.

The announcement caps a weekend of classic Musk showmanship. Tesla posted cryptic teaser clips on X, including one featuring a spinning, logo-emblazoned component and another showing vehicle headlight outlines in darkness. Both ended with "10/7," building anticipation that ultimately delivered something more practical than flashy.

This pricing strategy comes as Tesla grapples with what analysts are calling a multi-quarter auto sales slump. The company hasn't released a genuinely new model since the Cybertruck began shipping in late 2023, and that angular steel pickup has struggled with popularity and recalls - eight voluntary ones in the U.S. so far.

The sales challenges stem from multiple factors beyond just product lineup fatigue. There's been a measurable consumer backlash against Musk personally, particularly his endorsements of far-right political figures and increasingly incendiary political rhetoric. But equally important is the intensifying competition from established automakers like Volkswagen and rising Chinese manufacturers like BYD, who are flooding the market with more affordable alternatives.