TL;DR

- - The Trade Desk's shares dropped 40% after CFO exit

- - Amazon's ad rev increase poses significant threat

- - Trade tensions may further impact ad spend

- - Strategic navigation imperative amid competition

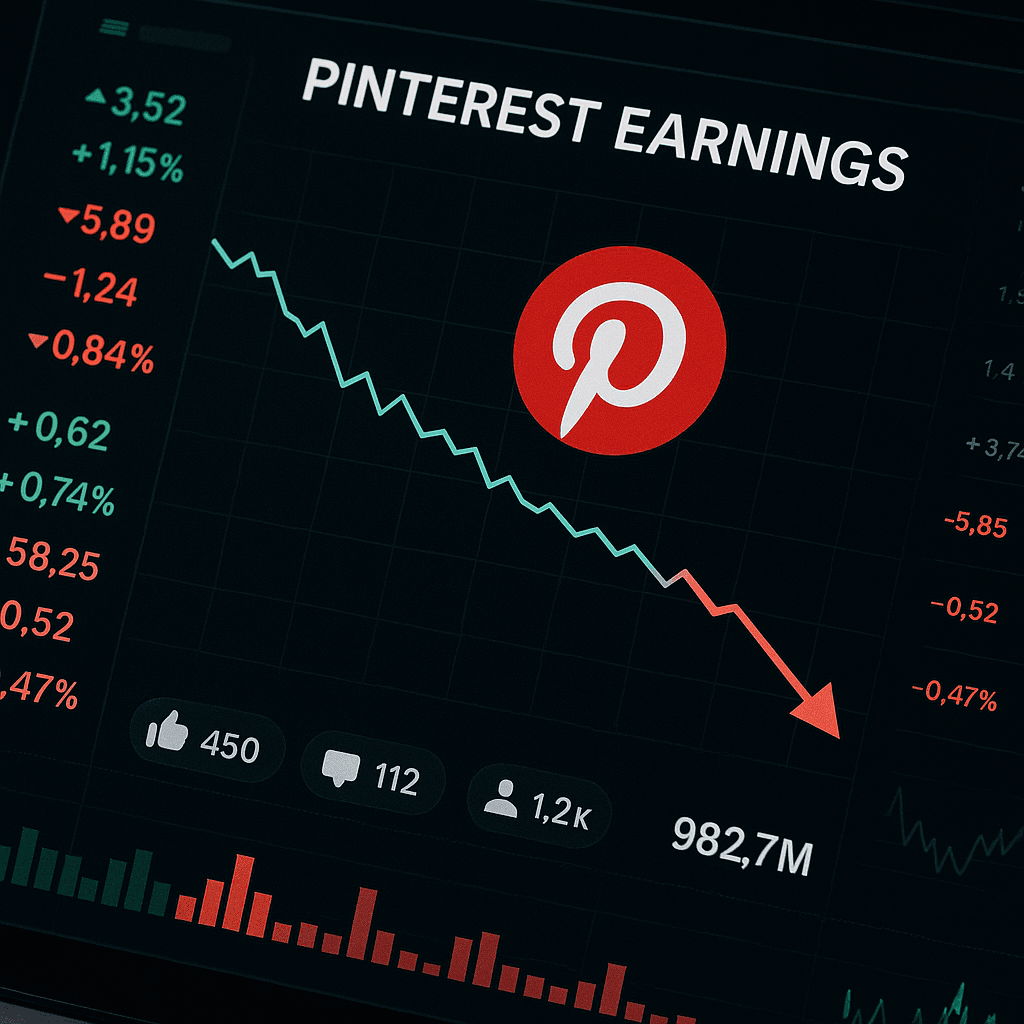

Shares of The Trade Desk fell nearly 40%, marking its worst trading day in history. Despite beating Q2 earnings expectations, investors fear rising competition from Amazon and the unexpected departure of CFO Laura Schenkein. Understanding these factors is critical for stakeholders as they navigate potential changes in the ad-tech landscape.

Opening Analysis

Shares of The Trade Desk experienced a record drop, plummeting nearly 40% chiefly due to an unexpected CFO departure and intensified competition from Amazon. The Trade Desk, despite surpassing earnings and revenue forecasts, faces daunting challenges as Amazon's influence grows in ad-tech.

Market Dynamics

Amazon's increasing foothold in the digital advertising space is a crucial concern for The Trade Desk. Recently, Amazon reported a 23% surge in ad revenue, reaching $15.7 billion. This growth has placed Amazon as a formidable competitor, trailing only behind Google and Meta. This rise signifies a shift in the ad-tech hierarchy, highlighting Amazon's capacity to capture significant market share, potentially diminishing The Trade Desk's appeal.

Technical Innovation

Amazon's strategic advancement into 'premium' ad inventory via its demand-side platform (DSP) represents a cutting-edge development. By unlocking access to exclusive ad spaces, Amazon enhances its DSP's potency. Such innovation pressures The Trade Desk to reassess and potentially revamp its strategic positioning to preserve its unique selling proposition.

Financial Analysis

In Q2, The Trade Desk showcased a 19% revenue increase, amounting to $694 million, slightly topping estimates. Despite these promising metrics, the stock's reaction reflects deeper investor anxieties about competitive pressures and macroeconomic uncertainties, including trade tariffs imposed under President Trump's administration, potentially impacting spending on advertisements.

Strategic Outlook

Given The Trade Desk's current predicament, strategic foresight is paramount. The company must now focus on differentiating its service offerings and leveraging its status as a scaled independent DSP to counterbalance Amazon's dominance. Additionally, maintaining investor confidence through stability in executive ranks and transparent communication will be crucial moving forward.