TL;DR

- - Brex gains direct EU licensing to offer spend management.

- - Projected $500M revenue this year highlights strong financials.

- - UK market expansion could diversify European footprint.

- - Potential IPO uplift with reduced cash burn anticipated.

Brex, an emerging force in fintech, just secured the green light to operate directly within all 30 EU countries without any restrictive conditions. This immediate expansion empowers its European strategy and significantly strengthens its IPO aspirations. As investors weigh this milestone, Brex’s strategic future in Europe suggests substantial growth and potential returns.

Opening Analysis

Brex's recent expansion into the European Union marks a critical advancement, allowing the fintech giant to offer spend management solutions across all 30 EU countries—an opportunity previously blocked by regulatory hurdles. CEO Pedro Franceschi emphasizes this as a seamless transition to bring Brex’s renowned financial management products to a broader audience. With this move, Brex is positioned to significantly impact the European fintech landscape and move closer to its IPO ambitions.

Market Dynamics

In the competitive arena of fintech, Brex’s expansion into the EU not only circumvents prior distribution challenges but also positions it ahead of U.S. rivals like Ramp and Mercury, who are actively scaling through massive VC raises. While Ramp’s valuation hits $22.5 billion, Brex is steadily expanding its market without recent equity funding rounds.

Technical Innovation

With the launch of novel spend management tools tailored for the EU market, Brex is expected to enhance its service offerings—though initial banking solutions remain delayed. By diversifying its product suite with embedded payments, Brex aims to further embed itself in European startups’ operational frameworks.

Financial Analysis

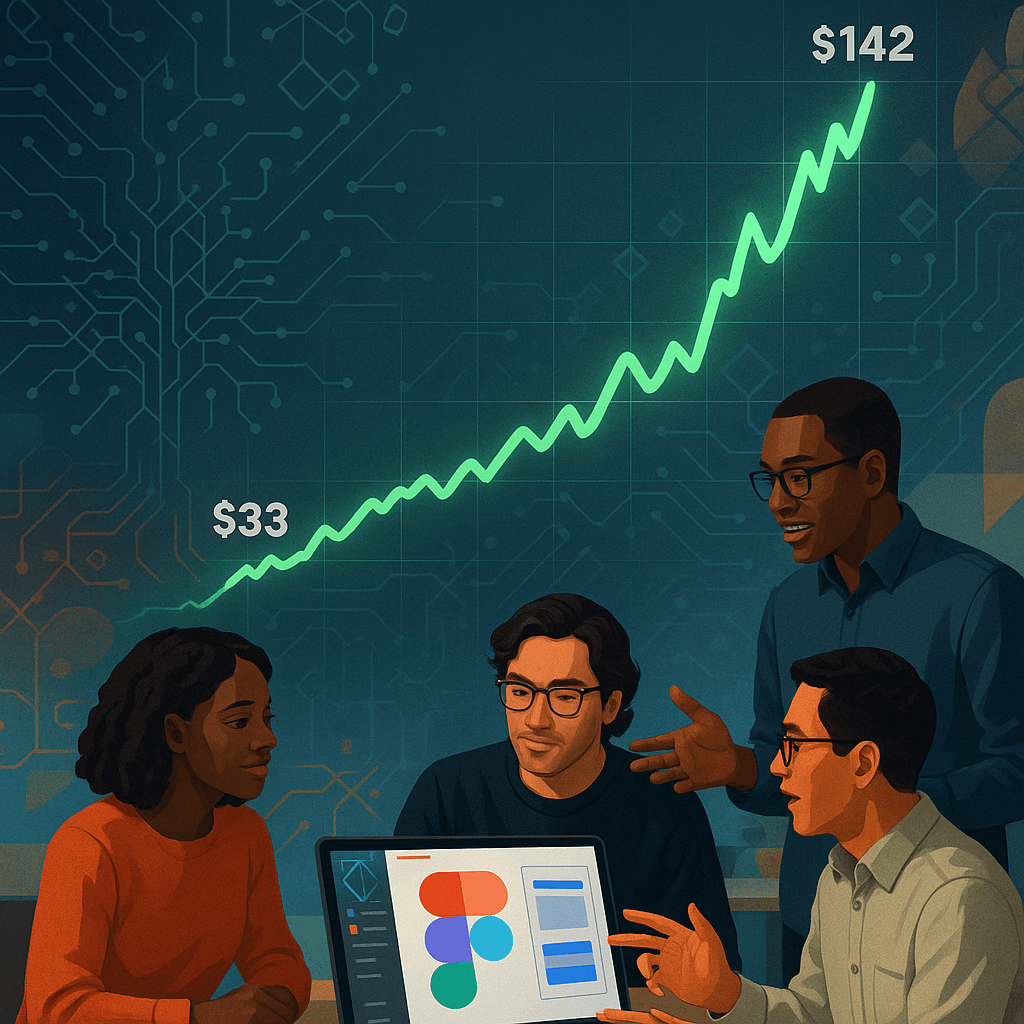

The financial health of Brex is underscored by its projection of $500 million in revenue this year—a substantial recovery given its $12.3 billion valuation following a 2022 funding round. Despite not securing new equity funding post-2022, Brex’s strategic debt acquisition provided necessary liquidity without diluting ownership.

Strategic Outlook Brex’s success hinges on capitalizing the newly accessible EU markets while preparing for a UK expansion. By focusing on scaling its operations and potential IPO timeline, Brex provides a glimpse of burgeoning growth potential, especially in strategically underserved markets.