TL;DR

- - Figma's IPO highlights strategic role of design in tech.

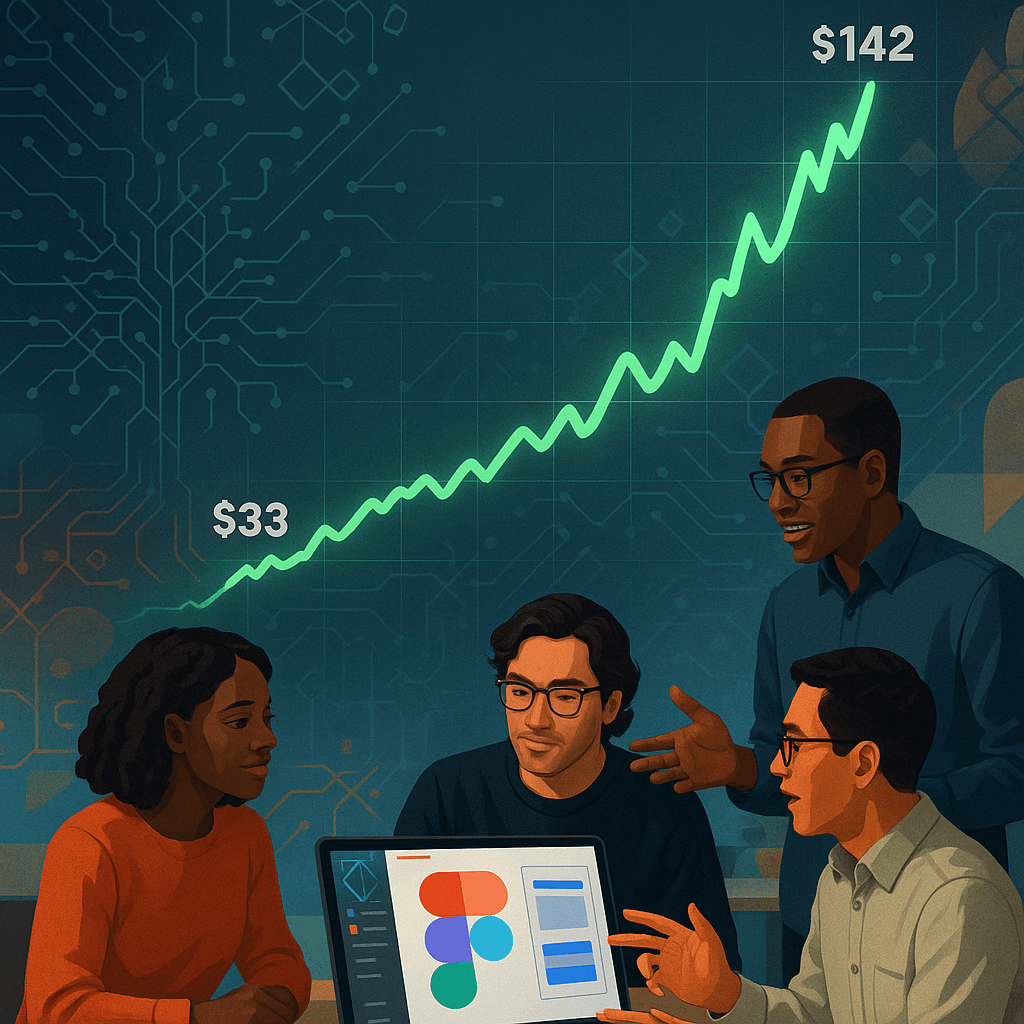

- - $33 to $142 IPO surge indicates strong market interest and volatility.

- - AI's role crucial in elevating design capabilities and market reach.

- - Figma's design-centric approach offers expansive growth and differentiation potential.

Figma's IPO, launched by founder Dylan Field, bucked trends with a meteoric debut. His true focus, however, lies beyond the numbers—it's the heralding of design prominence and its strategic intertwining with AI. This blend not only shapes Figma's trajectory but sets a precedent in how design will drive future innovations. Understanding this shift can unlock new investment avenues and strategic pivots for tech leaders.

Opening Analysis

Figma, under Dylan Field's visionary leadership, recently executed one of the most dynamic IPOs in tech history. It wasn't just about the financial fireworks—the stock surged from an opening price of $33 to $142 before stabilizing near $90. This IPO marks a significant shift in recognizing design's centrality in tech, dovetailing with AI to chart a new course not only for Figma but for industry-wide applications. The implications for tech leaders and investors are profound, as investing in design-driven technologies promises to redefine competitive advantages.

Market Dynamics

Figma's entrance into the public market signifies a pivotal moment in the tech industry's competitive landscape. With a post-IPO valuation over $40 billion, surpassing Adobe's once-proposed $20 billion acquisition offer, Figma exhibits the magnetic appeal of design-forward technology. As design transitions from aesthetic enhancement to a core strategic component, the market responds with heightened interest. This trend underscores an opportunity for startups and established enterprises alike to integrate design more deeply into their innovation ecosystems.

Technical Innovation

At the heart of Figma's value proposition is its commitment to leveraging AI to democratize design. By empowering non-design specialists to engage in professional-grade design work, Figma showcases how AI can lower barriers, enabling widespread participation in design innovation. This approach aligns with broader sector movements where AI is pivotal in expanding capabilities beyond traditional expertise bounds, suggesting a model where collaboration between AI and human creativity becomes the norm rather than the exception.

Financial Analysis

Figma's IPO not only affirmed its market viability but illustrated the readiness of investors to back design-centric companies. Initial surges revealed both interest and volatility, reflecting confidence tempered by realistic assessments of emerging risks. As AI becomes more advanced, Figma’s pursuits present both a lucrative investment and a complex challenge, balancing growth potential with the unpredictabilities of technological advancements that could reshape competitive dynamics.