TL;DR

- - Brex can now offer financial services in the EU

- - Licensing allows direct selling sans "workarounds"

- - UK expansion is on the roadmap

- - EU growth enhances IPO potential

Brex has secured a critical authorization to offer its financial products across the European Union, a significant step as it plans further expansion. This move positions Brex to capitalize on the EU market's lucrative potential, providing startups with tailored expense solutions while setting a foundation for growth in the UK.

Opening Analysis

Brex's recent approval to sell spend management products in the European Union marks a strategic milestone. By securing this authorization, Brex can now directly engage with startups and enterprises across all 30 EU countries. This development eliminates the previous necessity of having a U.S. presence, unlocking a significant market for Brex’s solutions.

After broadly supporting multiple currencies worldwide but facing limitations without an EU license, Brex has now elevated its competitive positioning in the fintech space. With no need for financial intermediaries or workarounds, Brex offers a more seamless and direct access to its services.

Market Dynamics

The European market is ripe with startups hungry for streamlined financial management solutions. Brex's entry brings competition to a region dominated by traditional banking structures. This could drive innovation as startups now have more options beyond conventional banks which often demand stringent conditions for partnerships.

However, Brex faces challenges too; the initial absence of integrated banking and bill pay services may impede comprehensive adoption by the smallest startups.

Technical Innovation

Brex’s ability to offer products such as corporate cards and embedded payment solutions positions it strategically ahead in the innovation curve. The platform’s adaptability and focus on enhancing user experience can foster strong, long-term relationships with its European clientele.

Financial Analysis

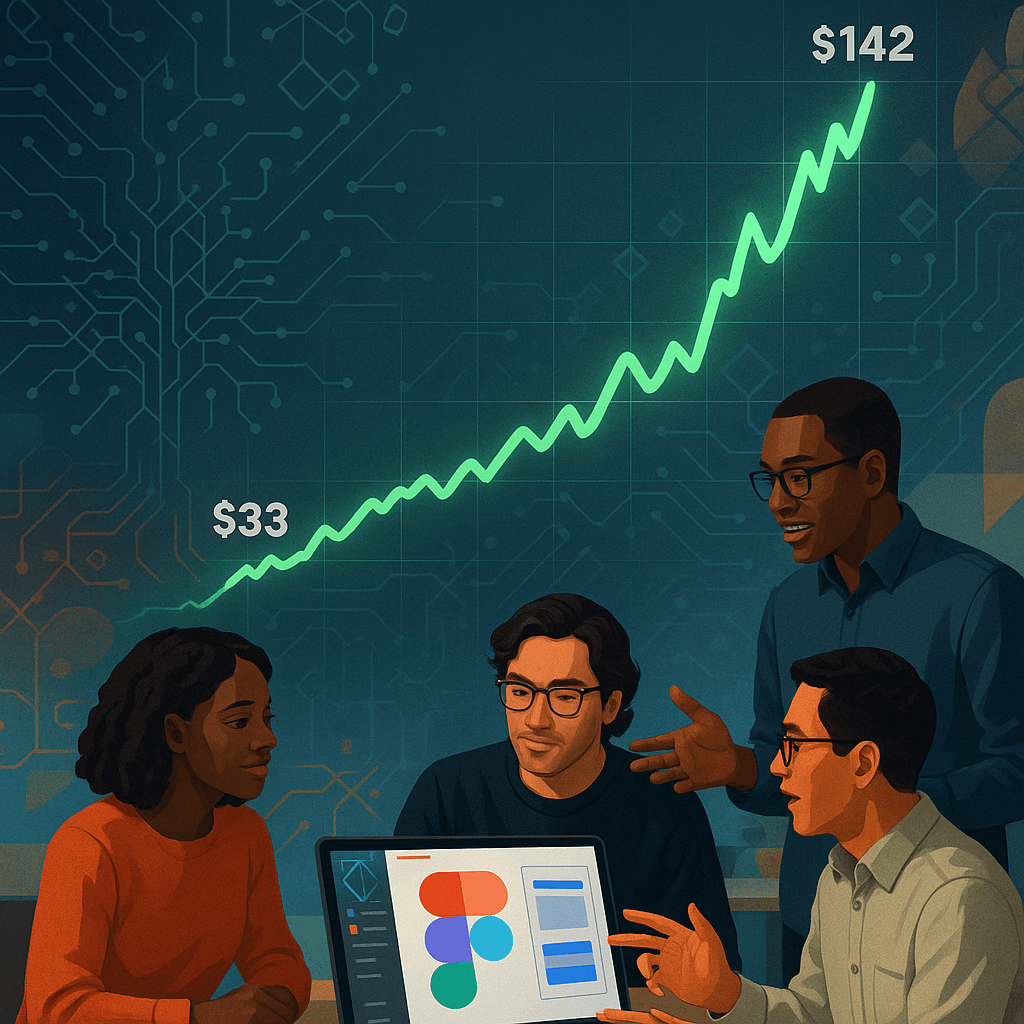

Financial data indicates a positive trajectory for Brex. With $500 million expected in revenue this year, Brex demonstrates a robust recovery following major financial adjustments in 2023. This financial strengthening underpins its expansion ambitions and supports its path towards an IPO.

Strategic Outlook

Strategically, Brex is setting the stage for a broader European play, with the UK singled out for next phase expansion. This methodical build-out aligns with reports of Brex preparing to become cash flow positive in 2025, a crucial preparatory step for its anticipated IPO.