TL;DR

- - Understand key timing for exits

- - Current exit option complexities

- - Strategic preparations for future opportunities

- - Invest wisely with expert guidance

Amidst a landscape fraught with uncertainty, startups face a plethora of exit options today. This reality underscores the importance of mastering exit strategies, which will be unpacked at TechCrunch Disrupt 2025. Participants gain insider knowledge from seasoned VCs like Jai Das and Roseanne Wincek on how to be strategically positioned for future liquidity events.

Opening Analysis

The startup ecosystem is continuously evolving, and a pivotal component of this is understanding exit strategies. A staggering 60% of startups are navigating exit decisions earlier than expected, according to a recent industry survey. As the economic climate fluctuates, being informed and prepared is crucial. TechCrunch Disrupt 2025 provides a platform for founders to glean insights from top venture capitalists on how to navigate this pressing aspect effectively.

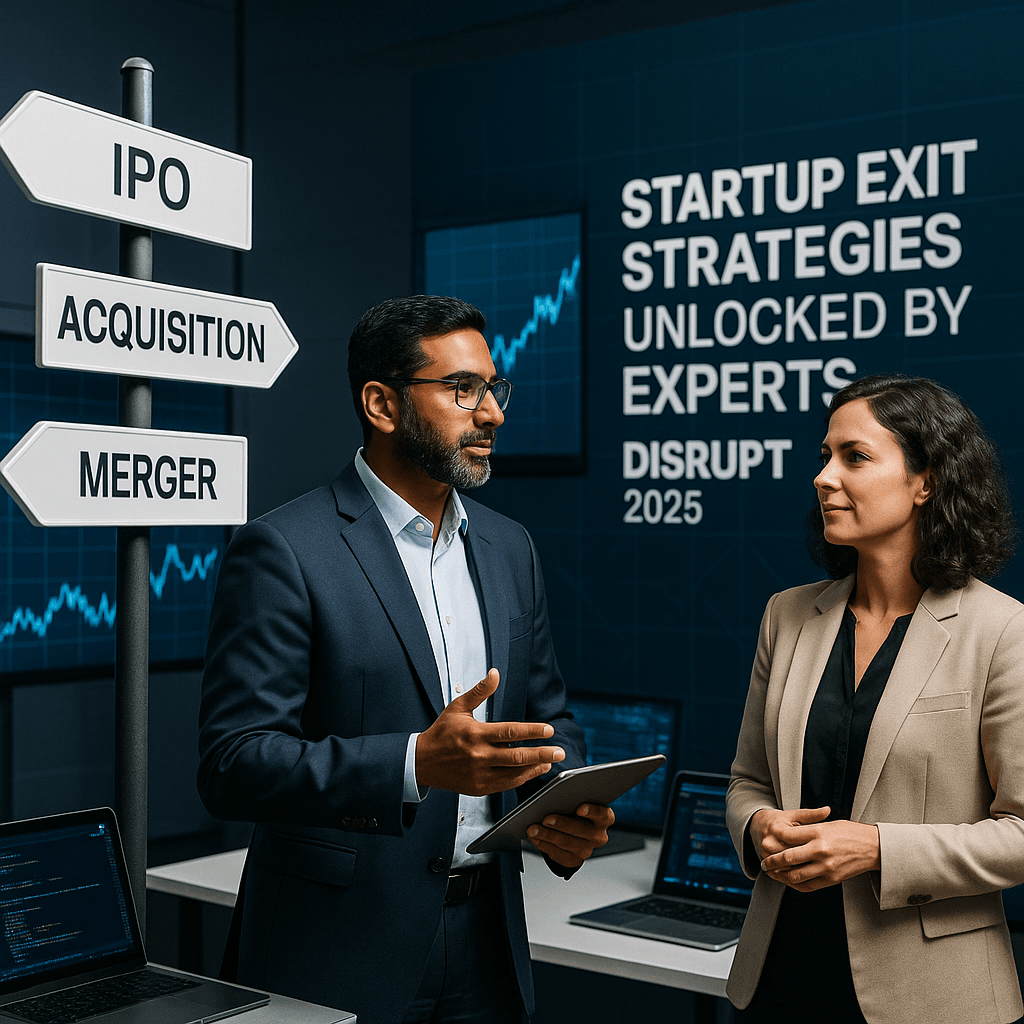

Market Dynamics

According to market experts, the current landscape offers multiple exit routes—from IPOs to acquisitions—but also introduces layers of complexity. The tightening of capital markets means that founders need to be more discerning about when and how to exit. As Jai Das of Sapphire Ventures points out, current valuations and investor expectations have shifted, and founders must be ready to act promptly when opportunities arise.

Technical Innovation

Navigating these waters also requires grasping technical innovations that can impact exits. Advisors will delve into AI and SaaS solutions that provide competitive advantages in these scenarios. Roseanne Wincek, a co-founder at Renegade Partners, highlights, the increasing importance of technological readiness in securing favorable outcomes during exit strategies.

Financial Analysis

Financial metrics play a crucial role in strategic decision-making for exits. A study indicates that startups focusing on robust financial health and strategic partnerships tend to secure more favorable exit terms. Understanding the leanings of investors towards AI-driven metrics can provide a predictive edge for founders.

Strategic Outlook

Ultimately, the sessions at TechCrunch Disrupt 2025 will equip startups with a strategic outlook that synthesizes market conditions, technical readiness, and financial positioning. Experts like Jai Das emphasize the need to be forward-thinking, preparing for an exit two to five years down the line. This strategic foresight can distinguish a successful exit from a missed opportunity.