TL;DR

- - Founders need a proactive exit strategy.

- - Disrupt 2025 addresses startup exit preparation.

- - Market signals and timing are crucial for success.

- - Investing in understanding exits enhances long-term positioning.

In 2025, startups encounter an unprecedented variety of exit strategies, yet venture into more uncertain territory than ever. This volatility makes understanding these options crucial now. At TechCrunch Disrupt 2025, industry leaders Jai Das of Sapphire Ventures and Roseanne Wincek of Renegade Partners will illuminate actionable pathways for founders poised to choose their best exit strategy. Attendees will gain insights into market signals, structural preparation, and timing, equipping themselves with a playbook to navigate this complex landscape.

Opening Analysis

Startups today are faced with an intricate web of potential exit strategies, ranging from IPOs to acquisitions, each offering its own set of challenges and opportunities. As market conditions grow increasingly volatile, founders must become strategic thinkers about these exits earlier in their journey. TechCrunch Disrupt 2025 aims to cut through this complexity by convening industry titans to offer founders clear, actionable advice on preparing for and optimizing their exit moves.

Competitive Market Dynamics

Startups encounter a landscape where investor expectations and capital availability are shifting dramatically. Roseanne Wincek and Jai Das bring their frontline experiences to this conversation, discussing how to craft a strategy that meets today’s rigorous investor criteria. Founders must harness these insights to remain competitive as exit environments grow more sophisticated.

Technical Innovation in Strategy

For technology-driven startups, being technically prepared for an exit is as important as financial readiness. The speakers will cover how technical and operational excellence play into valuation and attractiveness to potential buyers or the public market. This is essential as AI and enterprise-ready tech dominate investor focus.

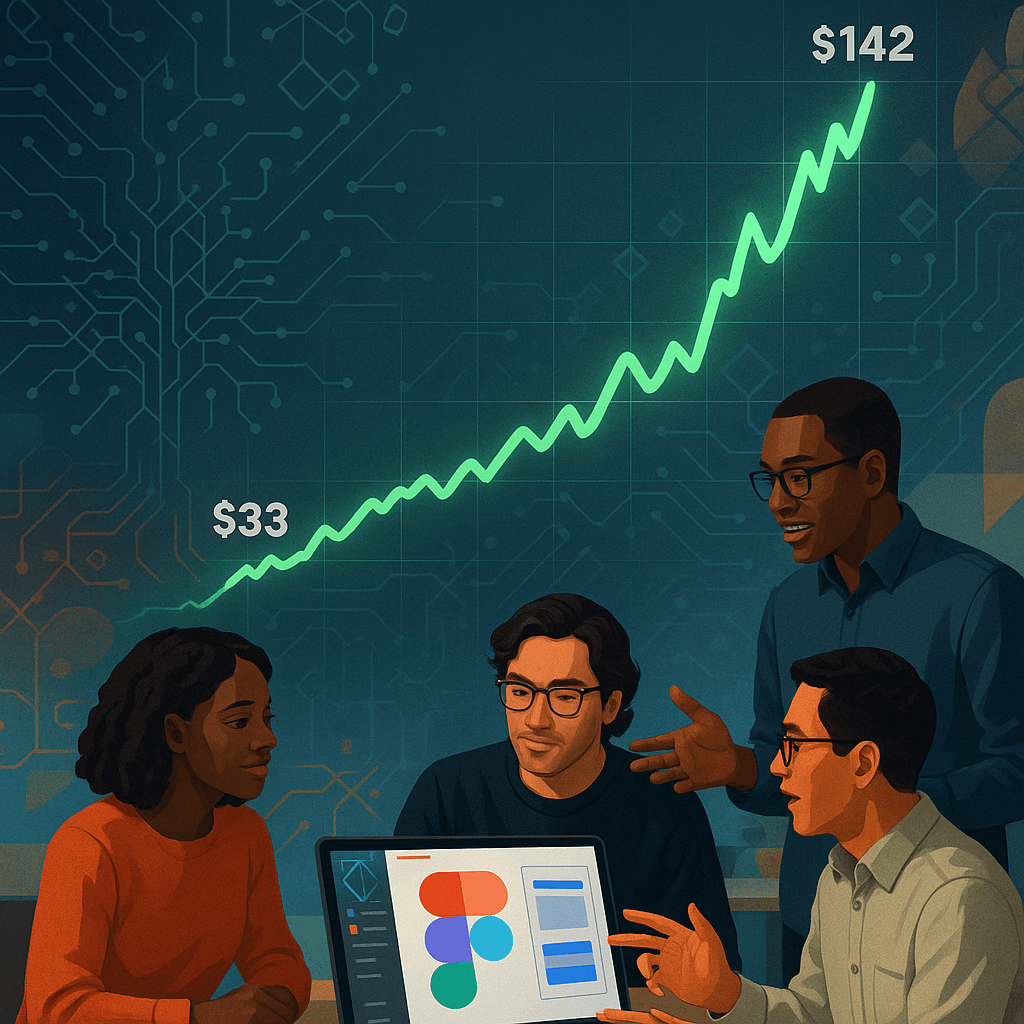

Financial and Valuation Analysis

Evaluations and value creation sit at the heart of exit readiness. Managing the financial aspects of a startup with a view toward potential exits requires founders to be meticulous about their financial story. Key insights from Das and Wincek will cover how startups can command favorable valuations and align financial storytelling with market demand.

Strategic Outlook for Founders

The overarching theme is about setting the groundwork now to ":maximize strategic optionality:" Whether considering a path toward IPO or acquisition, understanding the trade-offs and recognizing when to pivot is vital. This session looks to empower startups to craft a future-proof exit strategy.