TL;DR

- - High operational costs threaten profitability.

- - Festering competition with established players increases pressure.

- - Potential for in-house models to alleviate costs but involve significant risks.

- - Investment in unique offerings or efficiency could sustain growth despite challenges.

AI coding startups face profitability obstacles due to high costs and fierce competition. Insights from TechCrunch reveal struggles even successful companies like Windsurf face to stay afloat. Why does this matter now? Decoding these dynamics allows investors and tech leaders to strategize for future resilience and growth.

In an industry popping with innovation like AI coding assistants, profitability remains a hefty challenge. Recent insights from TechCrunch detail how startups like Windsurf struggle with substantial operational costs and razor-thin margins. The reality is, despite the allure, these ventures have profoundly negative gross margins, suggesting operational costs outstrip revenues.

Market Dynamics:

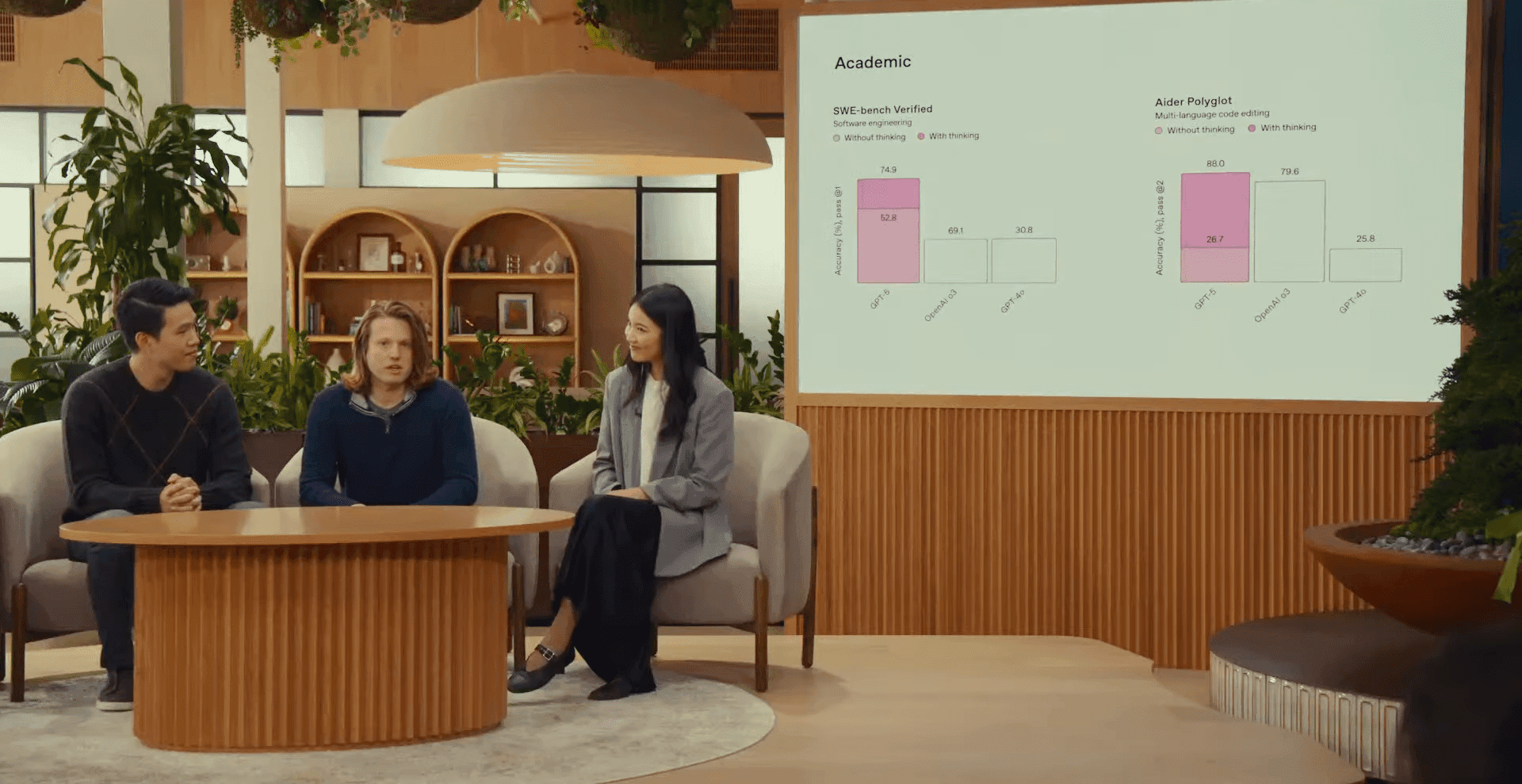

The journey of Windsurf underscores a broader industry battle against mounting LLM (Large Language Model) costs. Fierce competitors such as Anysphere's Cursor and GitHub Copilot have pushed incumbents and newcomers alike toward building proprietary models. While effective, it's financially formidable.

Technical Innovation:

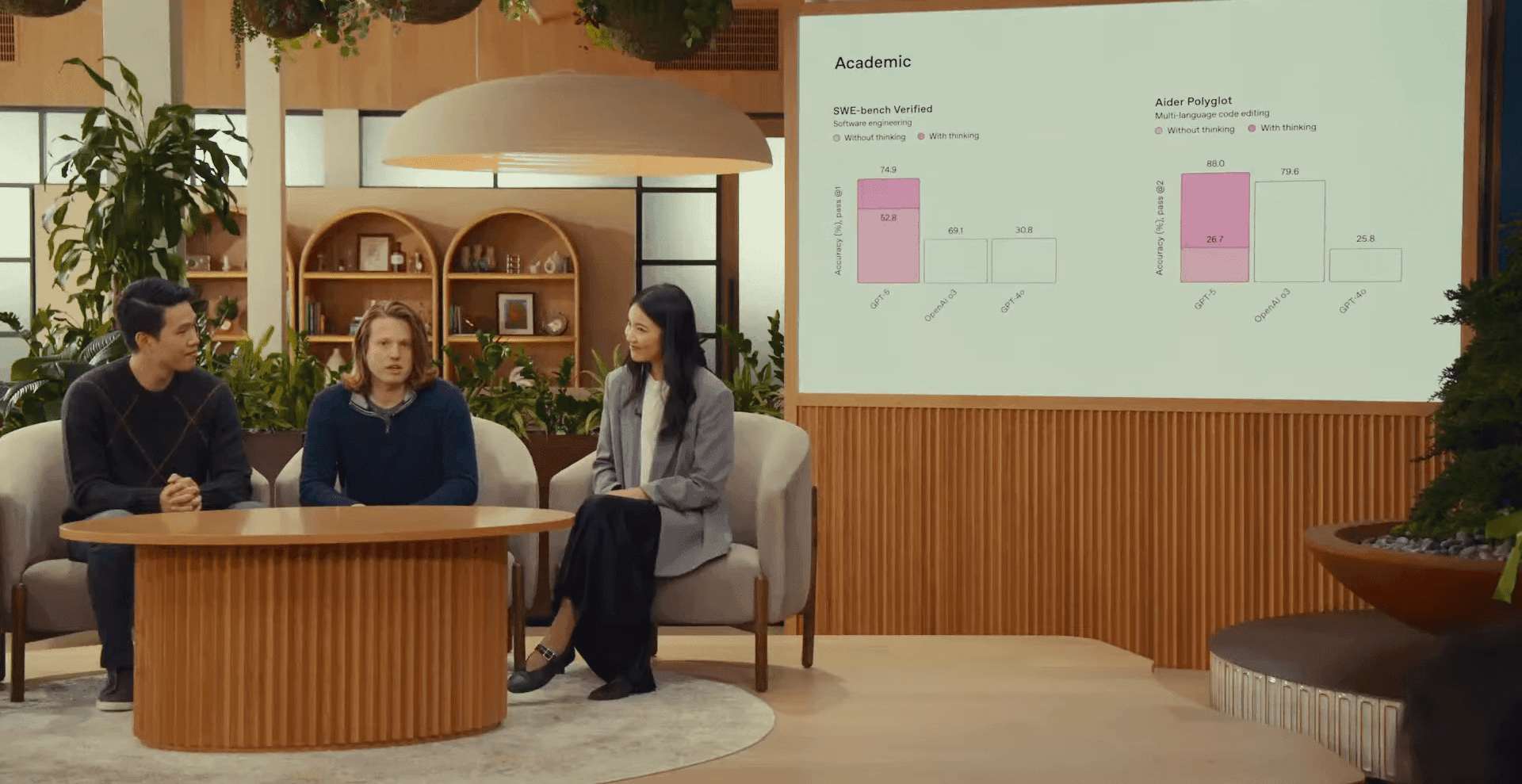

The agility required to constantly upgrade to newer, more potent LLMs is non-negotiable for maintaining competitive parity. However, with each innovation comes an increased strain on budgets as the cost of more advanced computing resources swells.

Financial Analysis:

Windsurf's decision to seek acquisition, even in the face of doubled valuations, stems from strategic shifts to exit the financially tightening noose created by rival pressures and sustainable model building. Anysphere's attempt to bypass supplier dependency showcases an alternative yet costly strategy to improve its financial positioning.

Strategic Outlook:

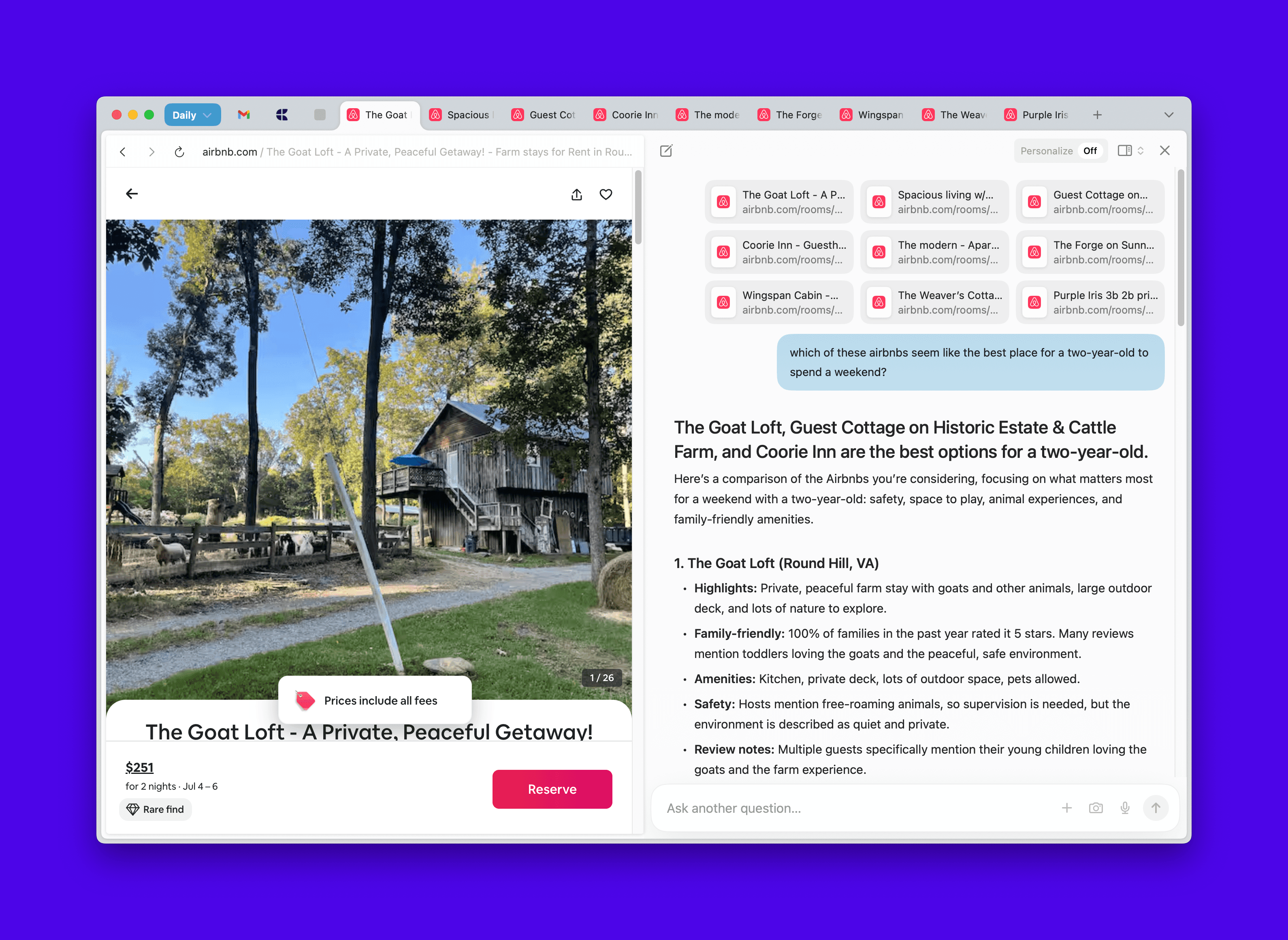

With innovation as a cornerstone, the potential to develop in-house solutions remains tantalizing despite the barriers. Companies that crack the code of efficiency—investing in proprietary tech or optimizing existing frameworks—could secure stronger market positions long-term. Amidst this, investors should eye startups experimenting with crafting niche differentiators or enhancing cost-efficiency in operations.