Discover 10 up-and-coming crypto companies positioned to thrive under the CLARITY Act. From RWA tokenization to AI agents, here's what founders and investors should track.

The crypto industry is entering a new chapter. With the GENIUS Act signed into law in July 2025 and the CLARITY Act passed by the House, regulatory clarity is finally arriving. For the first time, companies know which agency oversees what. The CFTC will regulate "digital commodities" on spot markets. The SEC keeps authority over securities and initial offerings.

This shift changes everything. Companies that built compliance into their DNA from the start now have a major advantage. The projects on this list share common traits: strong teams, real traction, thoughtful technology, and a regulatory posture that positions them to thrive as rules become clearer. We selected these based on regulatory readiness, institutional backing, technological innovation, and growth potential in 2026.

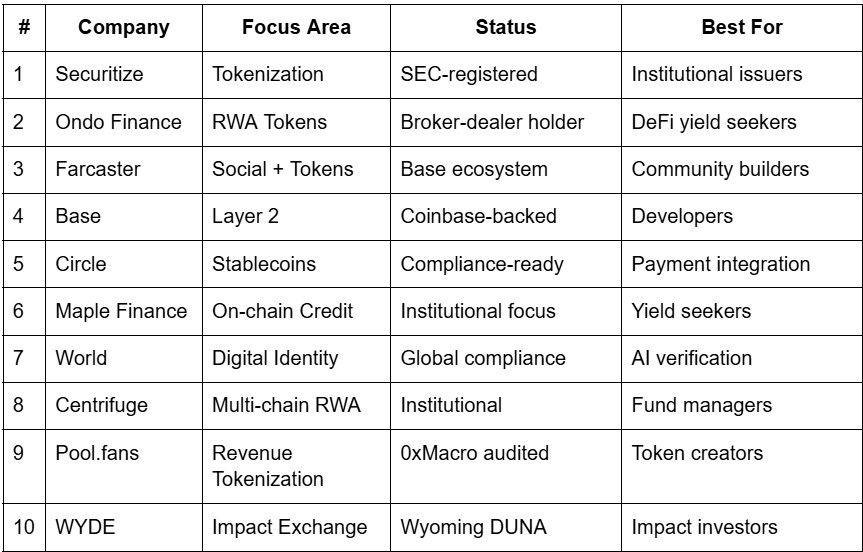

Quick Answer: The top crypto companies to watch in 2026 include Securitize, Ondo Finance, Farcaster, Base (Coinbase), Circle, Maple Finance, Tools for Humanity (World), Centrifuge, Legion, and WYDE Impact Exchange.

⚠️ DISCLAIMER: This list is for educational purposes only and is NOT financial or investment advice. Company performance depends on many factors including regulatory outcomes, market conditions, and execution. Always conduct your own research (DYOR) and consult qualified advisors before making any decisions.

Selection Criteria

We evaluated companies on five dimensions:

-

CLARITY Act Alignment: Does the company's structure benefit from clear SEC/CFTC jurisdiction boundaries?

-

Traction: Does the company have real users, revenue, or assets under management?

-

Team: Do founders have relevant experience and a track record of execution?

-

Technology: Is the underlying tech differentiated and defensible?

-

Regulatory Posture: Has the company proactively engaged with compliance rather than avoiding it?

1. Securitize - The Tokenization Standard-Setter

What It Is: Securitize is an SEC-registered broker-dealer and transfer agent that powers tokenized securities. It operates the infrastructure behind BlackRock's BUIDL fund, the largest tokenized Treasury product with over $2.4 billion in assets.

Why It Makes the List: The CLARITY Act creates a clear pathway for tokenized securities to operate under SEC oversight. Securitize already holds the licenses needed to issue, transfer, and custody digital securities. When stablecoin applications open in July 2026 under the GENIUS Act, Securitize's infrastructure will be ready.