TL;DR

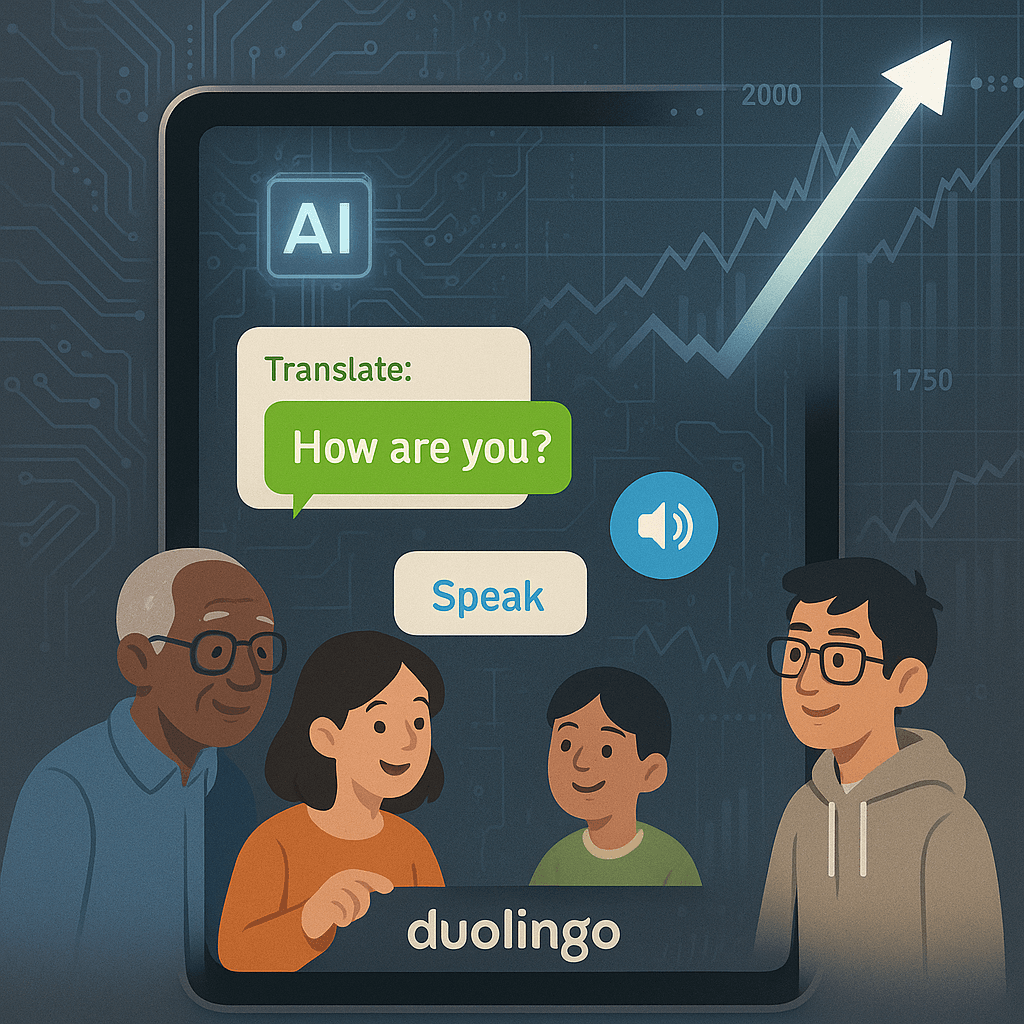

- - Duolingo's stock rose nearly 14% from AI-driven user growth

- - Raised guidance to $1.01-$1.02 billion annual revenue

- - AI tools like video-call practice attract paying subscribers

- - Investment thesis: Continued AI integration could maintain growth

Duolingo's stock surged nearly 14% as AI enhancements spurred user growth, prompting the language-learning platform to raise its annual guidance. This growth underscores the transformative power of AI in user engagement and revenue generation.

Opening Analysis

Duolingo's stock recently experienced a significant 14% increase following the company’s announcement of heightened annual revenue guidance, pegged between $1.01 billion and $1.02 billion, up from previous estimates of $987 million to $996 million. This upward revision is largely attributed to strong user growth fueled by the integration of artificial intelligence (AI) tools into its platform. As a language-learning app, Duolingo continues to leverage technological advancements to enhance user experience and engagement.

Market Dynamics

AI's influence in driving Duolingo's user base cannot be understated. Daily active users soared by 40% year-over-year, reaching 48 million. This remarkable user engagement is a direct result of new features like AI-powered video-call conversation practice, specifically targeting premium subscribers. Through strategic implementation of AI, Duolingo has positioned itself competitively against other edtech firms vying for market share through technological differentiation.

Technical Innovation

The company's deployment of AI features exemplifies its commitment to robust technological innovation. These features not only cater to traditional language learning but have expanded into diverse course offerings such as chess. This diversification strategy indicates how Duolingo is leveraging AI to broaden its service portfolio, potentially attracting a wider demographic of users.

Financial Analysis

Duolingo's revenue climbed 41% year-over-year, reaching $252 million, surpassing Wall Street predictions. This substantial financial performance aligns with the company's enhanced guidance and is supported by an 84% increase in net income to $45 million, reflecting sound fiscal management and growth potential driven by user engagement.

Strategic Outlook

Duolingo's strategic acquisitions, like the recent purchase of music gaming startup NextBeat, demonstrate a forward-thinking approach to expanding its educational footprint. Continued investments in AI-powered tools are projected to maintain Duolingo's growth trajectory. In the next 3-6 months, we may see further stock appreciation as user engagement grows. Over the next 1-2 years, Duolingo could solidify its market position, leveraging AI to explore additional educational content avenues.