TL;DR

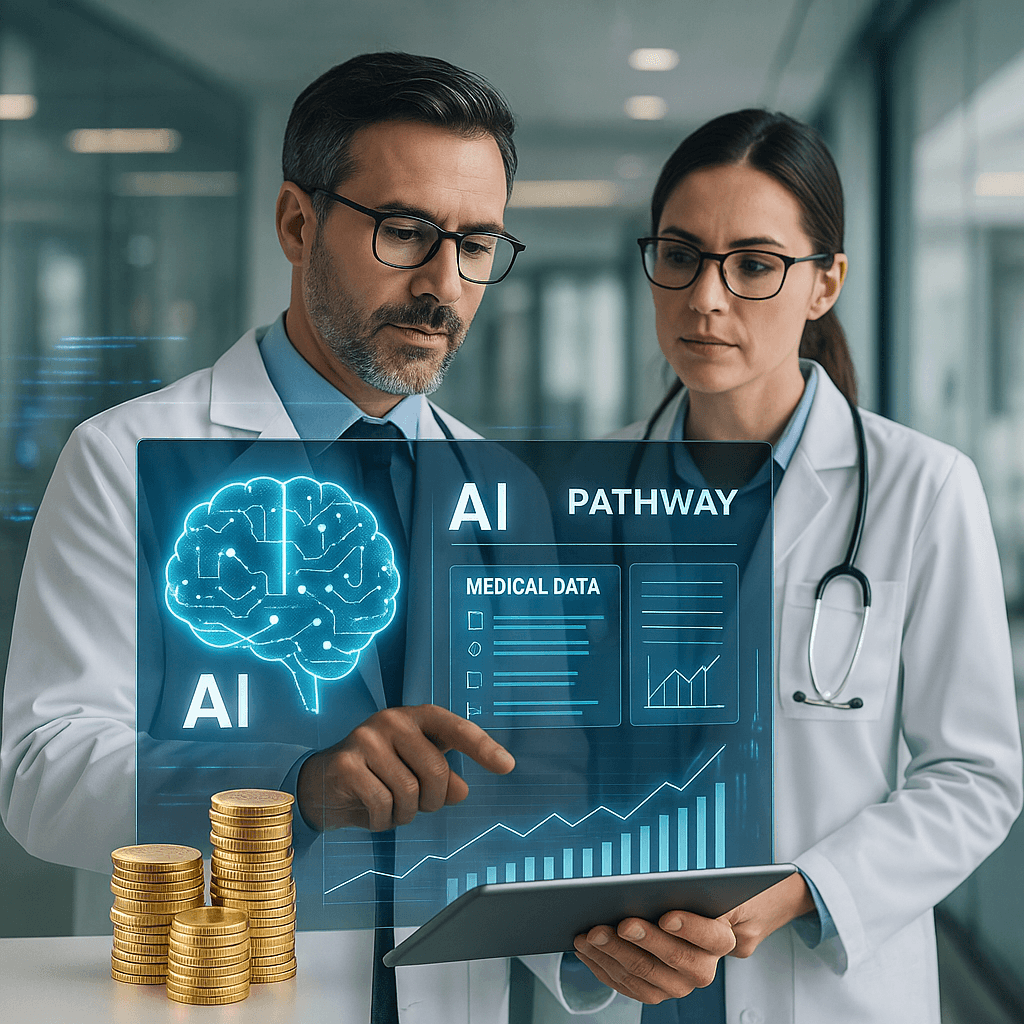

- - Doximity buys Pathway for $63M to boost AI-powered solutions.

- - Pathway's tool excels in providing medical knowledge.

- - Anticipate improved clinical efficiency and care.

- - Investment in AI is key to Doximity's growth strategy.

Doximity's $63 million acquisition of AI startup Pathway Medical brings a strategic leap in AI-powered medical assistance. By integrating Pathway's vast clinical datasets, Doximity aims to transform its platform into an invaluable tool for healthcare professionals seeking quick, accurate clinical insights. This move comes as AI's role in healthcare grows, signaling opportunities for improved doctor-patient interactions.

Opening Analysis

Doximity's acquisition of Pathway Medical for $63 million marks a significant step in the realm of AI-driven healthcare, reflecting the growing importance of technology in improving clinical decision-making. By acquiring Pathway Medical, known for its AI-powered tool that aids doctors with clinical questions regarding guidelines, drugs, and trials, Doximity aims to enhance its platform, often dubbed 'LinkedIn for doctors,' by offering more comprehensive insights at the point of care.

Market Dynamics

The acquisition positions Doximity uniquely in a competitive landscape where AI is increasingly sought after in healthcare. According to recent reports (source), healthcare AI tools are becoming essential as doctors face a growing volume of information and complex patient needs. Pathway's integration provides Doximity with a competitive edge, leveraging one of medicine’s largest structured datasets.

Technical Innovation

Pathway Medical's AI model, which scored a remarkable 96% on the U.S. Medical Licensing Examination benchmark, demonstrates its capability in synthesizing vast amounts of medical literature into actionable insights, providing doctors with reliable and up-to-date information. This level of accuracy is crucial, given the shift towards digital solutions in patient care.

Financial Analysis

Doximity's financial health underscores its capacity to make strategic acquisitions. The company saw a 6% boost in its shares post-acquisition, reflecting investor confidence. Their fiscal first-quarter results exceeded expectations with a revenue leap of 15%, underpinning the financial viability of integrating Pathway's innovative solutions (source).