TL;DR

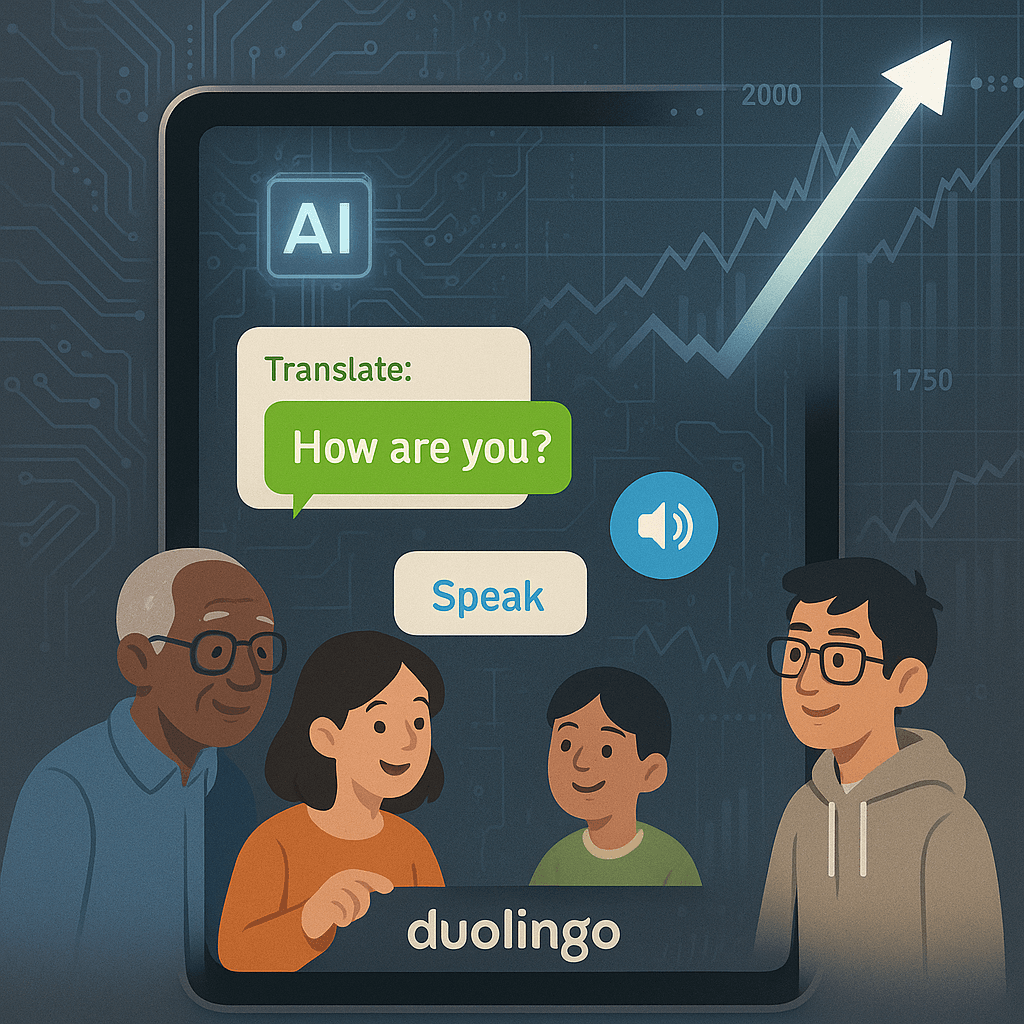

- - Duolingo's AI tools drive 40% increase in daily active users.

- - Projected 2025 revenues raised to $1.01–$1.02 billion due to strong user metrics.

- - Anticipated further integration of AI to enhance learning platforms.

- - Investing in AI-driven education platforms is a strategic opportunity.

As tech giants explore AI innovations, Duolingo’s 14% stock surge highlights a significant market trend. AI-driven tools not only advance learning efficacy but significantly impact fiscal forecasts, necessitating investor attention. For tech leaders and investors, understanding these dynamics can guide strategic investment decisions.

Opening Analysis

Duolingo's recent stock surge, a remarkable 14%, signifies the transformative power of artificial intelligence in education technology. This boost comes on the heels of increased guidance for the fiscal year, set between $1.01 billion and $1.02 billion, showcasing the potent combination of technological innovation with market strategy. Under CEO Luis von Ahn, Duolingo has expanded its user base significantly, with daily active users jumping 40% to nearly 48 million.

Market Dynamics

Amidst a competitive EdTech landscape, Duolingo distinguishes itself through strategic AI integrations. These enhancements cater to personalized learning experiences, a growing demand in the digital education sphere. With competitors like Babbel and Rosetta Stone vying for user engagement, Duolingo’s AI-driven initiatives, such as conversational video-call practices, provide it with an edge.

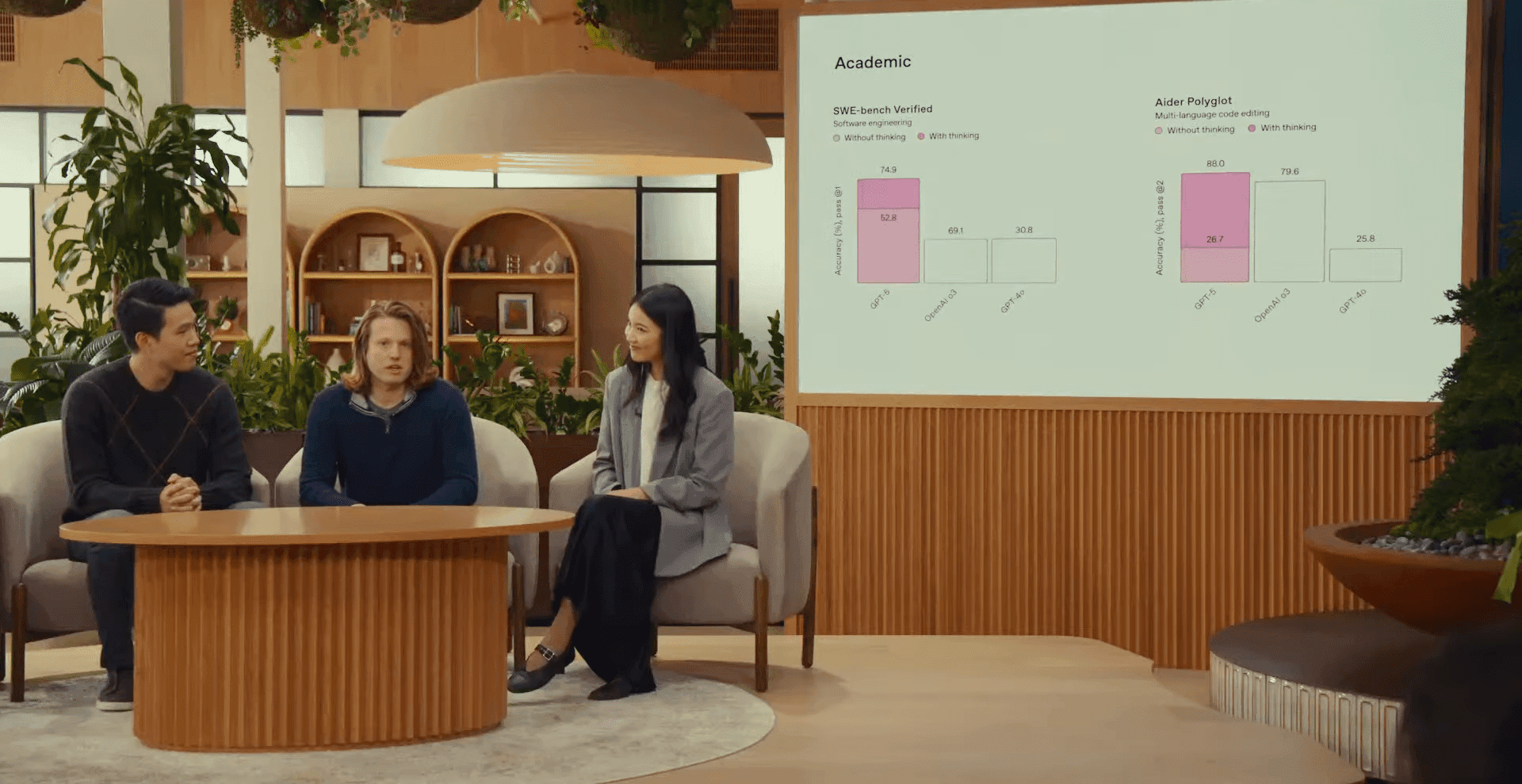

Technical Innovation

Duolingo's AI applications, from adaptive learning algorithms to automated conversational tools, enhance user engagement and learning efficacy. As AI further integrates into Duolingo’s platform, it broadens lesson applicability beyond traditional language courses, illustrated by their introduction of chess and music modules.

Financial Analysis

After announcing substantial revenue growth of 41% year-over-year, reaching $252 million, Duolingo’s fiscal forward momentum is clear. This trajectory eclipses Wall Street expectations, underscoring robust financial health and strategic foresight. Net income soaring by 84% year-over-year to $45 million notably fortifies investor confidence.

Strategic Outlook

Positioned at the intersection of AI and education, Duolingo offers dynamic growth potential and educational impact. The acquisition of NextBeat further anticipates emerging trends in hybrid educational models. Investors and tech leaders should monitor Duolingo’s strategic integrations as they could redefine digital learning spaces in the coming years.