Swedish autonomous trucking startup Einride just closed a $100 million funding round, marking a major vote of confidence in self-driving freight technology. The raise comes five months after founder Robert Falck stepped down as CEO, signaling the company's push from development to commercial scale with its unusual pod-like autonomous trucks.

Einride is betting big on a freight revolution that's just getting started. The Swedish startup announced Wednesday it secured $100 million in fresh funding, with lead investor EQT Ventures doubling down on their belief that autonomous trucking is ready for prime time.

The timing couldn't be more telling. This funding round comes exactly five months after co-founder Robert Falck stepped down as CEO and moved into the executive chairman role, handing the reins to former CFO Roozbeh Charli. The transition signals Einride's evolution from a visionary startup to a scaling operation.

"We believe Einride is building the most complete and forward-looking freight ecosystem on the market today," Ted Persson, partner at EQT Ventures, told TechCrunch. "Nordic tech has a habit of being underestimated, until it quietly rewires an entire industry."

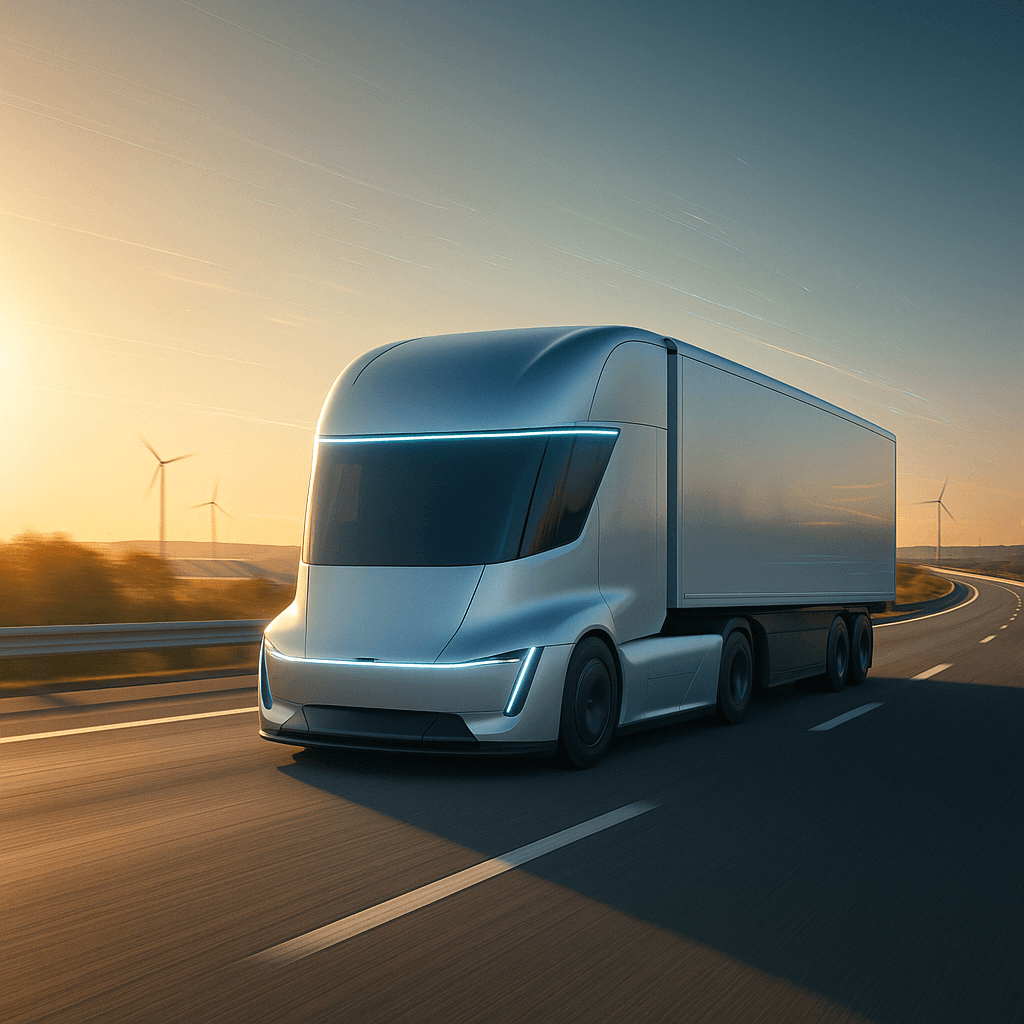

What makes Einride unique isn't just their technology - it's their three-pronged approach. The company operates traditional electric big rigs for major clients like PepsiCo, Carlsberg Sweden, and DP World across Europe, North America, and the UAE. But their real differentiator lies in those futuristic autonomous pods that look like something from a sci-fi movie.

These purpose-built vehicles have no steering wheel, no pedals, and no driver cabin. They're designed exclusively for self-driving on fixed routes, and they're already moving freight for Swedish pharmacy chain Apotea and GE Appliances in the United States. The third piece is their planning software that helps shippers optimize routes and operations.

The funding round included an undisclosed strategic investment from quantum computing company IonQ, though neither Einride nor its investors revealed the post-money valuation. This follows the company's massive $500 million Series C round in 2022, which combined $200 million in equity with $300 million in debt financing led by Barclays Europe.