TL;DR

- - Figma's IPO is setting the bar at a $19.3B valuation

- - 40x oversubscription indicates robust market confidence

- - Suggests high demand for design-oriented collaboration tools

- - Strategic positioning critical as traditional buyers like Adobe re-evaluate

Figma has launched its much-anticipated IPO at an astonishing $19.3 billion valuation, surpassing prior estimates due to intense market demand. This event is pivotal, positioning Figma as a formidable player in the tech industry, and offers valuable insights into IPO strategies for businesses and investors.

Opening Analysis

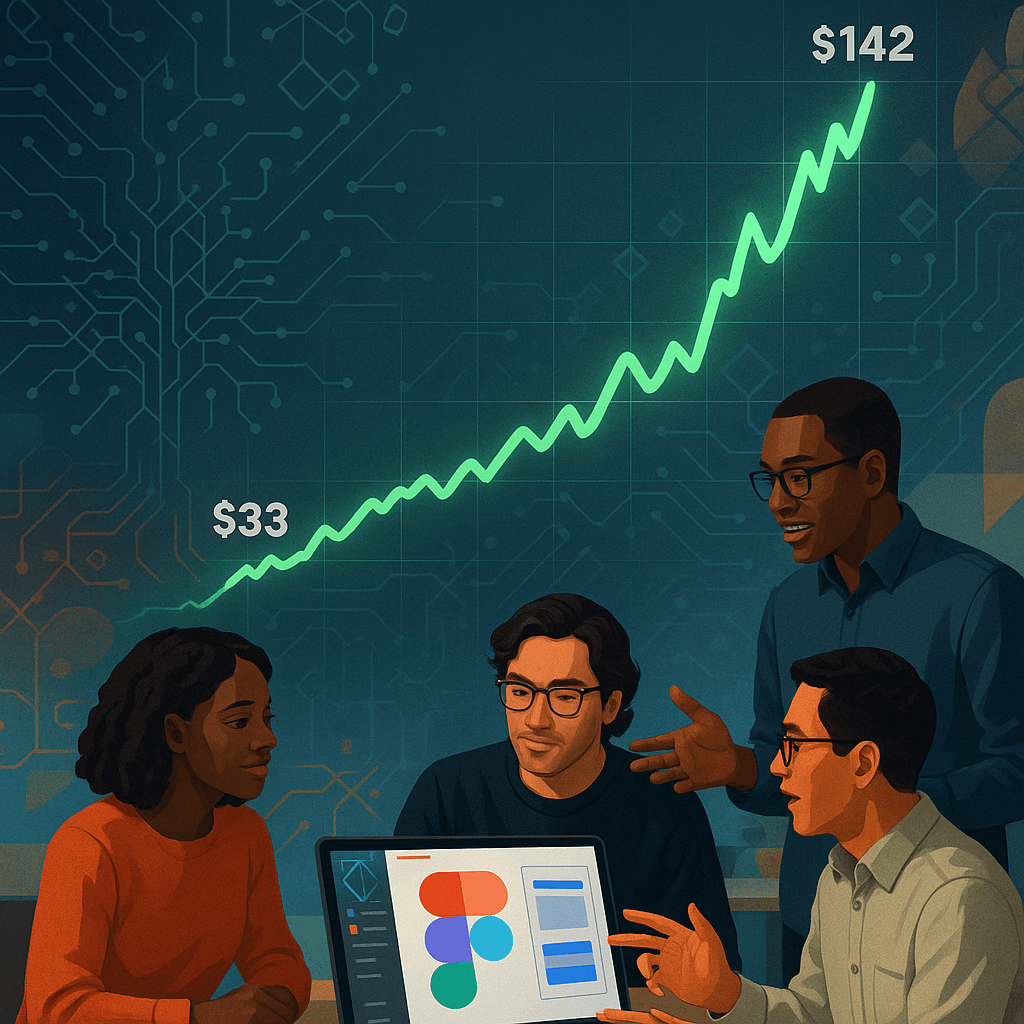

Figma has officially entered public markets with a $19.3 billion valuation, significantly above its anticipated price range. Originally expected to price between $25 and $28 per share, the IPO ultimately priced at $33 each. This indicates a fierce demand estimated to be 40 times oversubscribed, a testament to Figma's innovative position as a design software provider, integral to modern digital creation and collaboration.

The IPO reflects a strategic triumph, transforming potential regulatory setbacks, such as the failed Adobe acquisition, into a cornerstone for independent elevation. Investor appetite highlights a market shift, aligning significant valuation potentials with companies prioritizing user-centric, cloud-native solutions.

Market Dynamics

The competitive landscape for design tools is rapidly evolving. With Figma expanding its market share, larger incumbents like Adobe are compelled to reformulate strategies, especially after halting its Figma acquisition. This IPO pushes Figma into a direct competition league with established entities, leveraging user experience to attract a new generation of designers.

Technical Innovation

Figma's platform distinguishes itself with real-time collaborative capabilities, a major selling point during times heightened for remote work and decentralized teams. By allowing simultaneous editing and seamless feedback integration, the platform has transcended traditional design tool limitations, thus creating a niche difficult for competitors to replicate without substantial R&D investments.

Financial Analysis

The IPO's $1.2 billion raise, mostly directed to existing shareholders, underlines strong investor confidence in Figma's growth trajectory. The raised funds will primarily enable broader innovation and potential acquisition pursuits to cement its market stance. Figma's valuation places it on a robust growth path, providing a war chest for strategic enhancements and geographic expansion.